May 30, 2024

Summary

Tempest Minerals Ltd (TEM) is pleased to provide information on progress at the FiveWheels Project. TEMhas finalised heritage and land access agreements for all granted tenure at the project with the Traditionalowner corporation, Mungarlu Ngurrarankatja Rirraunkaja Aboriginal Corporation RNTBC (MNR).TEM has also completed a strategy planning session for the project and finalised an exploration plan for thenext financial year 2024-25 that includes: geochemistry, geophysics and target generation.

Key Points

- Heritage agreements for all granted tenure completed

- Collaborative exploration plan for FY 2024-25 completed

- Upcoming exploration plans include geochemistry, geophysics and drill target generation

FiveWheels Project

Background

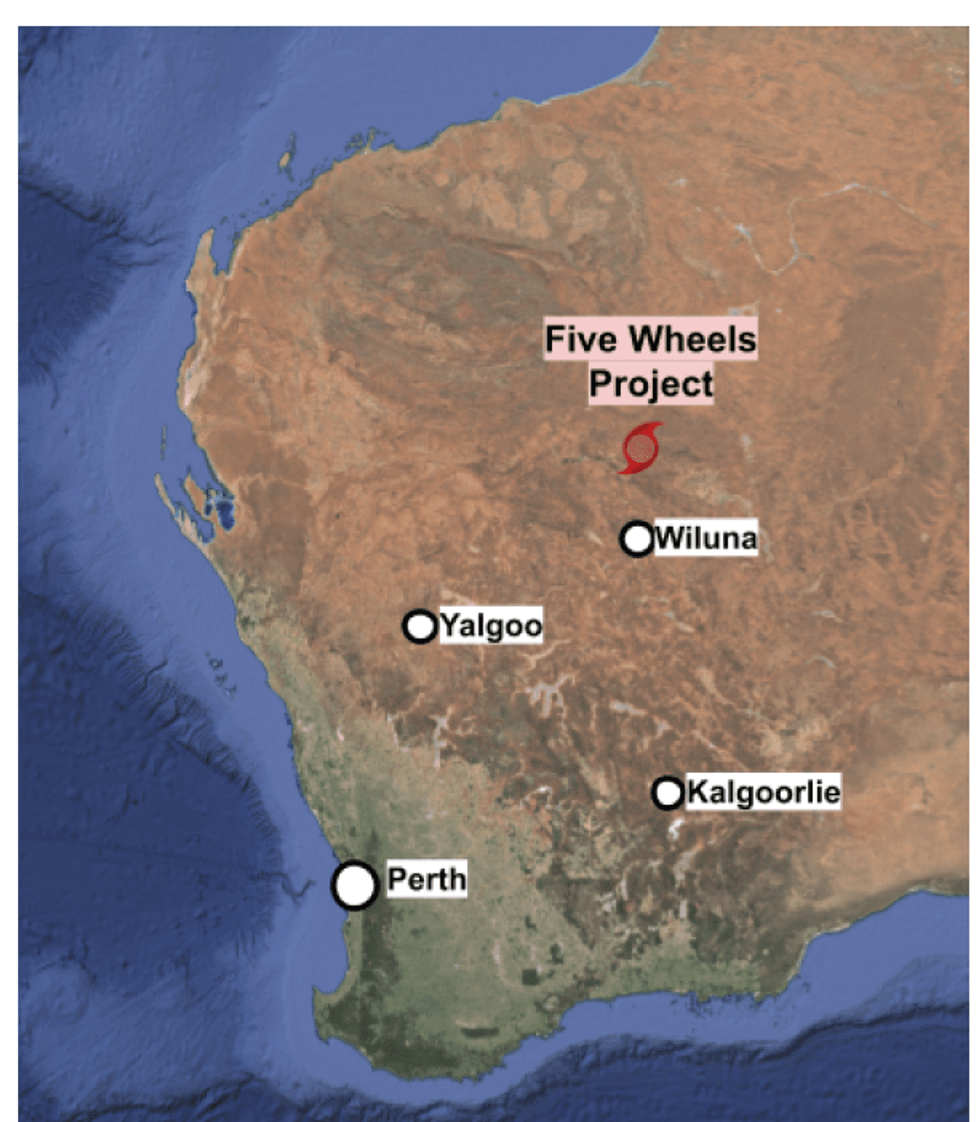

In July 2023, Tempest announced theacquisition of the FiveWheels Project.

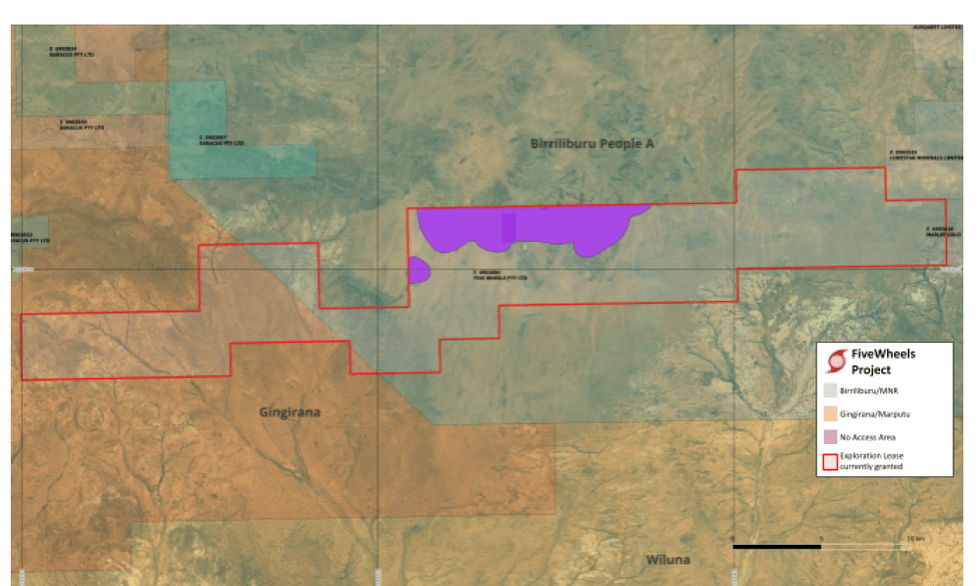

The FiveWheels Project is 266km2 ofgranted tenure on the Earaheedy Basin'snorthern edge. This is located ~146 kmnorth of the Western Australian miningtown of Wiluna.

This region was reinvigorated in 2021 bythe major discovery of base metals byRumble Resources (ASX:RTR) 2 and in2023 with a globally significant inferredMineral Resource Estimate (MRE) of94Mt @ 3.1% Zn + Pb and 4.2g/t Ag (ata 2% Zn + Pb cutoff)] 3. NeighbouringStrickland Resources Ltd (ASX:STK)also announced the discovery of similarmineralisation in 2023.

The FiveWheels Project is approximately36km north of these projects and isconsidered to exhibit similar geology.This is highlighted by historicexploration near the FiveWheels Projectexhibiting soil geochemistry up to 1,130ppm (~0.1%) Copper and 847 ppm Zinc.

Similarly, key geological unitsincluding the Yelma Formation and theFrere Formation have been intersectedin legacy drilling but not assayed 6.

Heritage Agreements

TEM is pleased to announce the signing of a land access for exploration deed of agreement with MNR. Anexisting Land access agreement for exploration and prospecting already exists with the Marputu AboriginalCorporation RNTBC.

This is an excellent outcome as all granted tenure now has heritage agreements. TEM is looking forward toworking together with the traditional owners to progress the exciting exploration potential at the FiveWheelsProject.

Click here for the full ASX Release

This article includes content from Tempest Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

TEM:AU

The Conversation (0)

03 February 2025

Tempest Minerals

A diverse portfolio of projects in Western Australia that are prospective for precious, base and energy metals in addition to iron ore.

A diverse portfolio of projects in Western Australia that are prospective for precious, base and energy metals in addition to iron ore. Keep Reading...

25 June 2025

Completion of Shortfall Offer

Tempest Minerals (TEM:AU) has announced Completion of Shortfall OfferDownload the PDF here. Keep Reading...

15 June 2025

Further Excellent Metallurgical Results From Remorse-Yalgoo

Tempest Minerals (TEM:AU) has announced Further Excellent Metallurgical Results From Remorse-YalgooDownload the PDF here. Keep Reading...

10 June 2025

Entitlement Offer Results

Tempest Minerals (TEM:AU) has announced Entitlement Offer ResultsDownload the PDF here. Keep Reading...

30 May 2025

Geochemical Sampling Extends Sanity Gold Anomalies - amended

Tempest Minerals (TEM:AU) has announced Geochemical Sampling Extends Sanity Gold Anomalies - amendedDownload the PDF here. Keep Reading...

20 May 2025

Yalgoo - Geochemical Sampling Extends Sanity Gold Anomalies

Tempest Minerals (TEM:AU) has announced Yalgoo - Geochemical Sampling Extends Sanity Gold AnomaliesDownload the PDF here. Keep Reading...

19h

Top 5 Canadian Mining Stocks This Week: Belo Sun is Radiant with 109 Percent Gain

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.On Tuesday (February 17) Canadian Prime Minister Mark Carney announced the creation of... Keep Reading...

19h

Gold and Silver Stocks Dominate TSX Venture 50 List

This year's TSX Venture 50 list showcases a major shift in sentiment toward the mining sector. The TSX Venture 50 ranks the top 50 companies on the TSX Venture Exchange based on annual performance using three criteria: one year share price appreciation, market cap growth and Canadian... Keep Reading...

19 February

Ole Hansen: Next Gold Target is US$6,000, What About Silver?

Ole Hansen, head of commodity strategy at Saxo Bank, believes US$6,000 per ounce is in the cards for gold in the next 12 months; however, silver may not enjoy the same price strength. "If gold moves toward US$6,000, I would believe that ... silver at some point will struggle to keep up, and... Keep Reading...

19 February

Kinross’ Great Bear Gold Project Accelerated Under Ontario’s 1P1P Framework

Ontario is moving to accelerate one of Canada’s largest emerging gold projects, cutting permitting timelines in half for Kinross Gold's (TSX:K,NYSE:KGC) Great Bear development in the Red Lake district.The province announced that Great Bear will be designated under its new One Project, One... Keep Reading...

19 February

Massan Indicated Conversion Programme Continues to Deliver

Asara Resources (AS1:AU) has announced Massan indicated conversion programme continues to deliverDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00