July 02, 2024

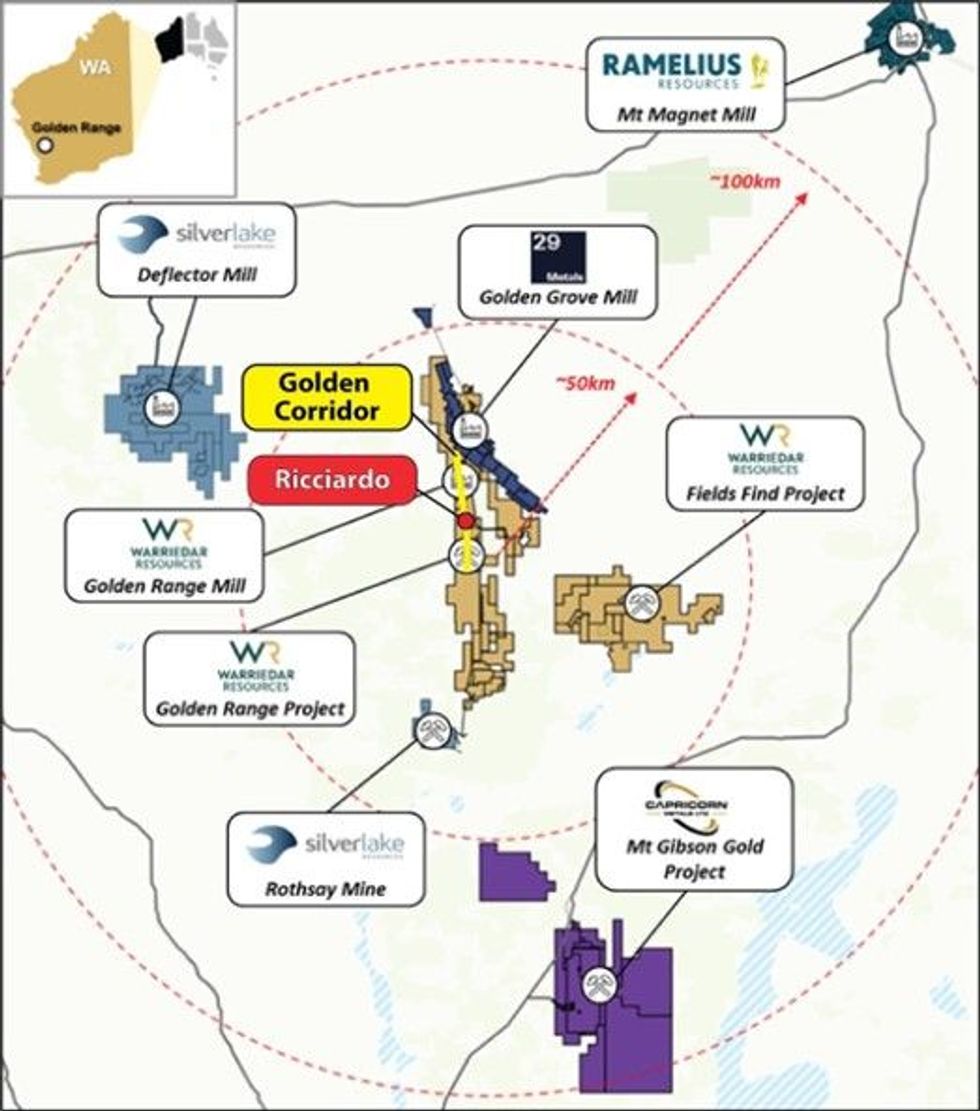

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) is pleased to provide an update on drilling progress and release the first results from diamond drilling undertaken at the Ricciardo deposit within its Golden Range Project, located in the Murchison region of Western Australia (Figure 1).

HIGHLIGHTS:

- Next phase of drilling activities progressing strongly at Ricciardo and M1.

- Approximately 5,030m RC (29 holes) and 1,420m diamond drilling (16 holes) completed to date.

- The first diamond drilling undertaken at the 2.3km long Ricciardo deposit by any operator in ten years.

- Assay results returned for the first four (4) diamond tails (255m) of the program at Ricciardo have seen all holes intersect significant gold intervals, including:

- 19m @ 4.94 g/t Au from 188m (RDRC039 DD) * includes contiguous final RC result of 4m @ 14.49 g/t from 188m

- 12m @ 6.98 g/t Au from 110m (RDRC040 DD) inc. 3m @ 22.12 g/t Au from 112m

- 16m @ 2.30 g/t Au from 243m (RDRC055 DD) inc. 6m @ 3.13 g/t Au from 252m

- 17m @ 2.38 g/t Au from 264m (RDRC055 DD) inc. 8m @ 4.03 g/t Au from 273m

- Delivers further high-grade extensional success to existing Mineral Resource Estimate (MRE) model below the Silverstone North pit (Holes 40, 55) and infill confidence to MRE below northern end of the Ardmore pit (Hole 39).

- These outcomes build on the growth in high-grade deposit margins delivered at Ricciardo from the significant RC program executed earlier this year.

- Ricciardo sits in the middle of the 25km-long ‘Golden Corridor’ at Golden Range, which hosts six discrete deposits (18 historic pits) that are all open at depth and possess immediate growth potential.

- The ‘Golden Corridor’ is Warriedar’s key exploration focus in 2024.

This is the first diamond drill program at Ricciardo since 2014, when just three (3) diamond holes were drilled by the previous operator.

The results reported in this release are for four (4) (255m) of the 16 (1420m) diamond holes drilled to date. Approximately 2,200m of diamond drilling is planned as part of the current phase of combined RC and diamond drilling at Ricciardo and M1.

The results from these initial four diamond holes extend the high-grade shoot below the Silverstone North pit and infill a previous gap in the high-grade zone of the MRE below the northern part of the Ardmore pit (adding confidence and continuity to the MRE in this area).

These outcomes, while stemming from only a small part of the overall current phase of drilling, continues to demonstrate the outstanding MRE growth potential that exists at Ricciardo and along the broader ‘Golden Corridor’ trend.

The Ricciardo gold system (within the Golden Range Project) spans a strike length of approximately 2.3km, with very limited drilling having been undertaken below 100m depth. Ricciardo possesses a current Mineral Resource Estimate (MRE) of 8.7 Mt @ 1.7 g/t Au for 476 koz gold.1 The oxide material at Ricciardo has been mined by previous operators.

Click here for the full ASX Release

This article includes content from Warriedar Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

WA8:AU

The Conversation (0)

09 April 2024

Warriedar Resources

Advanced gold and copper exploration in Western Australia and Nevada

Advanced gold and copper exploration in Western Australia and Nevada Keep Reading...

18 November 2024

Targeted Exploration Focus Delivers an Additional 471koz or 99% Increase in Ounces, and a Higher Grade for Ricciardo

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) is pleased to report on an updated MRE for its flagship Ricciardo Gold Deposit, part of the broader Golden Range Project located in the Murchison region of Western Australia. HIGHLIGHTS:Updated Mineral Resource Estimate (MRE) for... Keep Reading...

30 September 2024

Continued Delivery of High Grade Antimony Mineralisation at Ricciardo

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides an update on its initial review of the antimony (Sb) potential at the Ricciardo deposit, located within its Golden Range Project in the Murchison region of Western Australia. HIGHLIGHTS:Review of the antimony (Sb)... Keep Reading...

29 September 2024

Further Strong Extensional Diamond Drill Results from Ricciardo

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides further assay results from its Golden Range Project, located in the Murchison region of Western Australia. HIGHLIGHTS:All residual assay results received from the recent 2,701m (27 holes) diamond drilling program at... Keep Reading...

26 August 2024

Further Step-Out Gold Success and High-Grade Antimony Discovery

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides further assay results from its Golden Range Project, located in the Murchison region of Western Australia. The results reported in this release are for a further 6 of the 27 diamond holes drilled in the current program at... Keep Reading...

1h

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

4h

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

05 March

Oreterra Metals Fully Financed for Maiden Discovery Drilling at Trek South

Oreterra Metals (TSXV:OTMC) is set to launch its first-ever discovery drill program at the Trek South porphyry copper-gold prospect in BC, Canada, a pivotal moment following a corporate restructuring that culminated in the company emerging under its new name on February 2.Speaking at the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00