April 26, 2024

Falco Resources (TSXV:FPC) focuses on developing gold and base metal projects in the Rouyn-Noranda region of Quebec, an established mining camp with a long history of exploration and development. The camp has historically produced 19 million ounces (Moz) of gold and 2.9 billion pounds (Blbs) of copper, and yet it is still under-explored for gold.

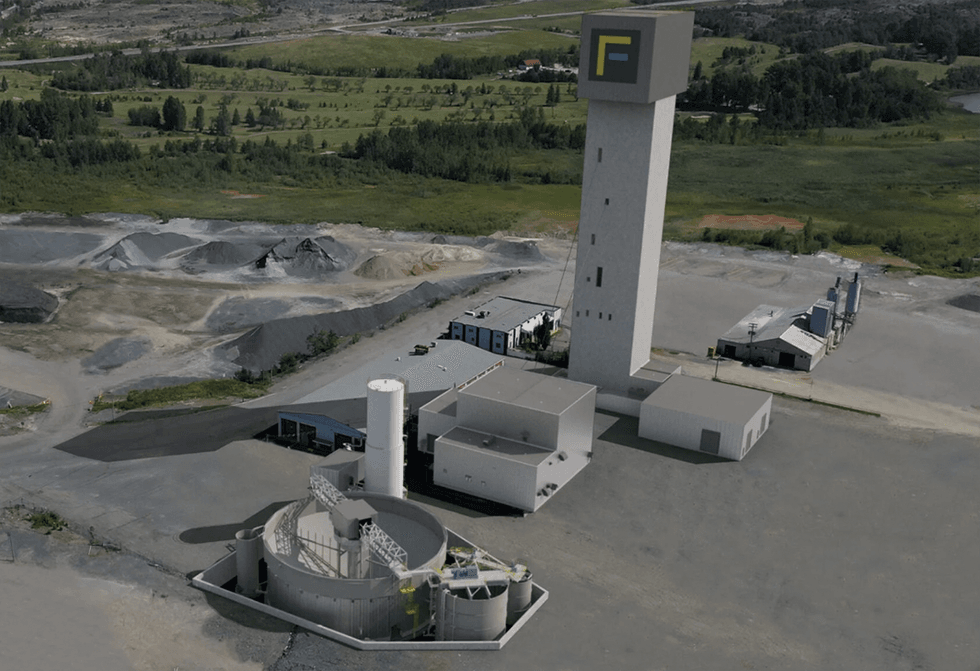

Falcon’s principal property, Horne 5 project, holds 67,000 acres or nearly 67 percent of the total area of the entire mining camp and is located under the former Horne mine which produced 11.6 Moz of gold and 2.5 Blbs of copper. The 2021 feasibility study on the Horne 5 project suggests strong project economics with a total mine life of 15 years, after-tax NPV at 5 percent of US$761 million, and a payback period of 4.8 years, assuming gold prices at $1,600/oz. At the current gold prices of over $2,300/oz, the project economics will be even better.

Falco Resources operating license and indemnity agreement (OLIA) with Glencore Canada will enable Falco to utilize a portion of Glencore's lands. The agreement entails establishing a technical committee comprising two representatives from Glencore and two from Falco, tasked with safeguarding the uninterrupted operations of Glencore’s Horne copper smelter. Additionally, a parallel strategic committee will be formed. Glencore will nominate one representative to join Falco's board of directors.

The successful completion of the OLIA, coupled with life-of-mine copper-zinc concentrate offtake agreements with Glencore, positions Falco to advance its Horne 5 project towards construction. The company is advancing with the permitting and financing processes for the project.

Company Highlights

- Falco Resources is a Canadian explorer of base and precious metals focused on developing its mineral properties in the Rouyn-Noranda region in Quebec, Canada.

- The company holds 67,000 acres of mining claims in the Rouyn-Noranda mining camp, accounting for nearly 67 percent of the entire mining camp.

- Rouyn-Noranda has a long history of mining and exploration. The area has established infrastructure and has been host to 50 former producers, including 20 base metal mines and 30 gold mines.

- Falco’s principal asset is the Horne 5 project which is a gold project with significant base metal by-products. It is located under the former Horne Mine which produced 11.6 Moz of gold and 2.5 billion pounds of copper.

- The Horne 5 is a world-class deposit containing 7.6 Moz gold equivalent in measured and indicated resources and 1.7 Moz gold equivalent in inferred resources.

- The Horne 5 project represents a robust, high-margin, 15-year underground mining project with attractive economics. The 2021 feasibility study indicates after-tax NPV at 5 percent of US$761 million and after-tax IRR of 18.9 percent.

- The operating lease and indemnity agreement (OLIA) with Glencore coupled with EIA admissibility receipt from the government body positions Falco to advance its Horne 5 project towards construction.

This Falco Resources profile is part of a paid investor education campaign.*

Click here to connect with Falco Resources (TSXV:FPC) to receive an Investor Presentation

FPC:CC

The Conversation (0)

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00