- WORLD EDITIONAustraliaNorth AmericaWorld

November 20, 2023

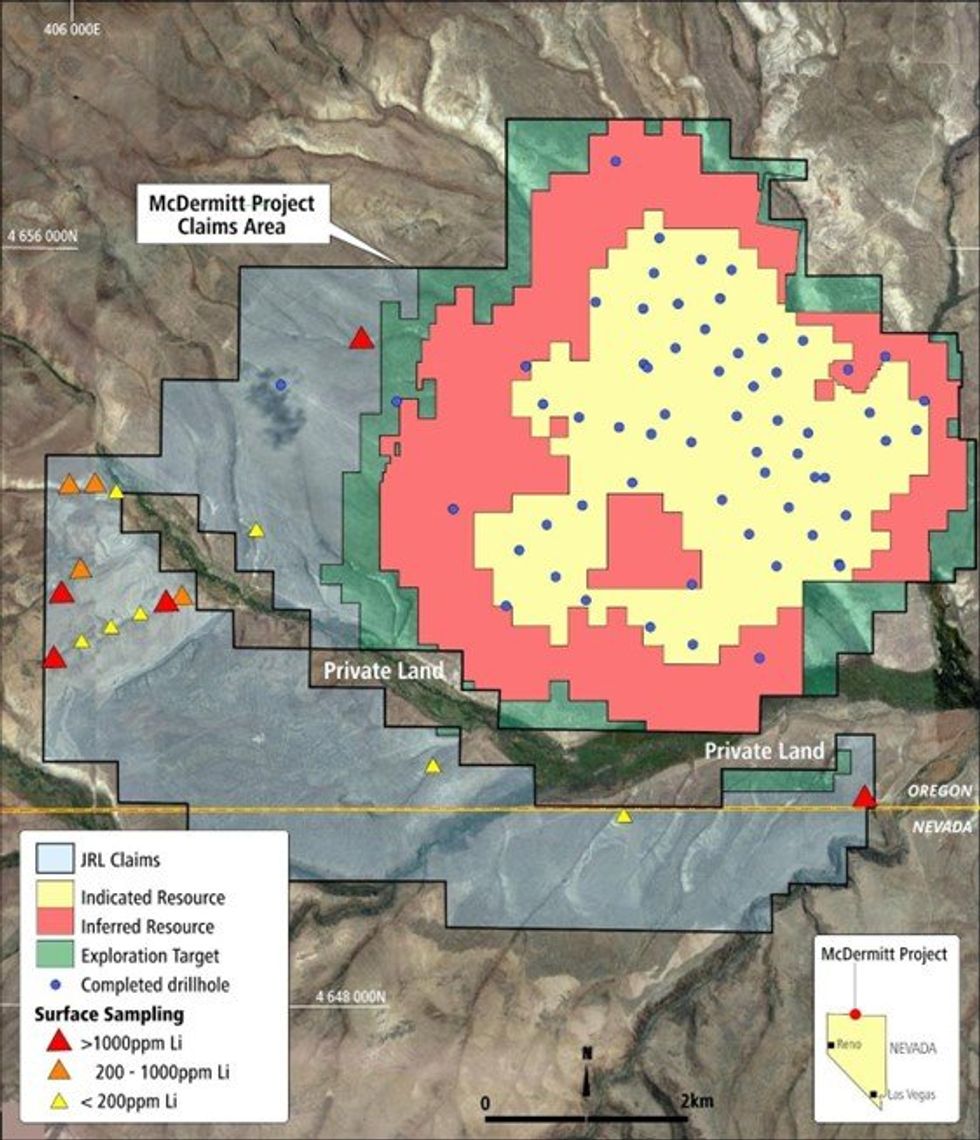

Jindalee Resources Limited (to be renamed “Jindalee Lithium Limited”) (Jindalee, the Company) announced an updated Mineral Resource Estimate (MRE) at Jindalee’s 100% owned McDermitt Lithium Project (US) (Figure 1)1.

- Exploration Target confirms excellent potential for further resource growth

- The Exploration Target is in addition to the Mineral Resource Estimate announced February 20231

- Anomalous lithium assays from surface sampling highlight further potential at McDermitt

The 2023 MRE for McDermitt contains a combined Indicated and Inferred Mineral Resource Inventory of 3.0 Billion tonnes at 1,340ppm Li for a total of 21.5 Million tonnes Lithium Carbonate Equivalent (LCE) at 1,000 ppm cut-off grade. At 21.5 Mt LCE, McDermitt is the largest lithium deposit in the US by contained lithium in Mineral Resource, and a globally significant resource (Table 3), with the deposit remaining open to the west and south (Figure 1).

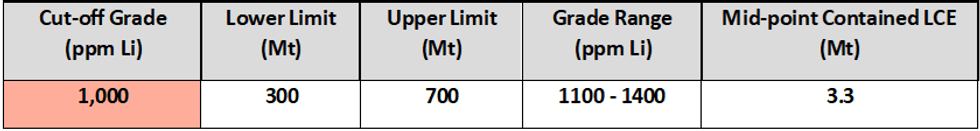

Jindalee is also pleased to announce an independently estimated Exploration Target Range (ETR) at McDermitt. The ETR of 300 – 700 Million tonnes at 1,100 – 1,400ppm Li (at 1,000ppm Li cut-off) is extrapolated from drilling completed at the Project (Table 1, Figure 1).

Recent relogging of McDermitt drilling, combined with regional mapping and sampling, has recognised up to 12 distinctive and laterally continuous stratigraphic units which can be tracked across the Project area. The Exploration Target surrounds and abuts the 2023 MRE and is extrapolated from 62 holes drilled at McDermitt from 2018 to 2022. Material for the MRE extends to a maximum distance of 1,200m from the nearest hole, with the ETR extending to a maximum of 1,500m from the nearest hole (Figure 1).

In August 2022 Jindalee submitted an Exploration Plan of Operations (EPO) to the Bureau of Land Management (BLM), with the EPO deemed complete by the BLM in May 20232. Once approved, the EPO will allow Jindalee to significantly increase on-site activity, including up to 160 holes designed to both infill the 2023 MRE and test areas currently covered by the Exploration Target. Jindalee expects the EPO to be approved 2H 2024, with drilling to commence soon after.

Furthermore, sampling of weathered sediments exposed in drainages west and south of the Mineral Resource and Exploration Target areas has returned strongly anomalous lithium values, indicating excellent potential to locate additional lithium mineralisation in these areas (Figure 1, Table 2).

Methodology

The methodology used for the ETR was identical to that used for the 2023 MRE1. A total of 62 drillholes and 97 density measurements were used for the estimation of both the 2023 MRE and the ETR, with lithium estimated by Ordinary Kriging. The block size for estimation was 200mE by 200mN by 5mRL, with sub-celling permitted to 40mE by 40mN by 1mRL.

The ETR estimates were guided by stratigraphy, which is the major control on the continuity of both lithium grade and geology, with material for the ETR limited to within 1,500m of the nearest hole. The entire mineralisation inventory (2023 MRE and ETR) occurs within 215m of surface.

A summary of all drill data included in both the 2023 MRE and the ETR is included in Annexure A. All other details pertaining to the reporting of exploration results and the 2023 MRE and the ETR are detailed in Annexure B.

Click here for the full ASX Release

This article includes content from Jindalee Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

JRL:AU

The Conversation (0)

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00