October 21, 2024

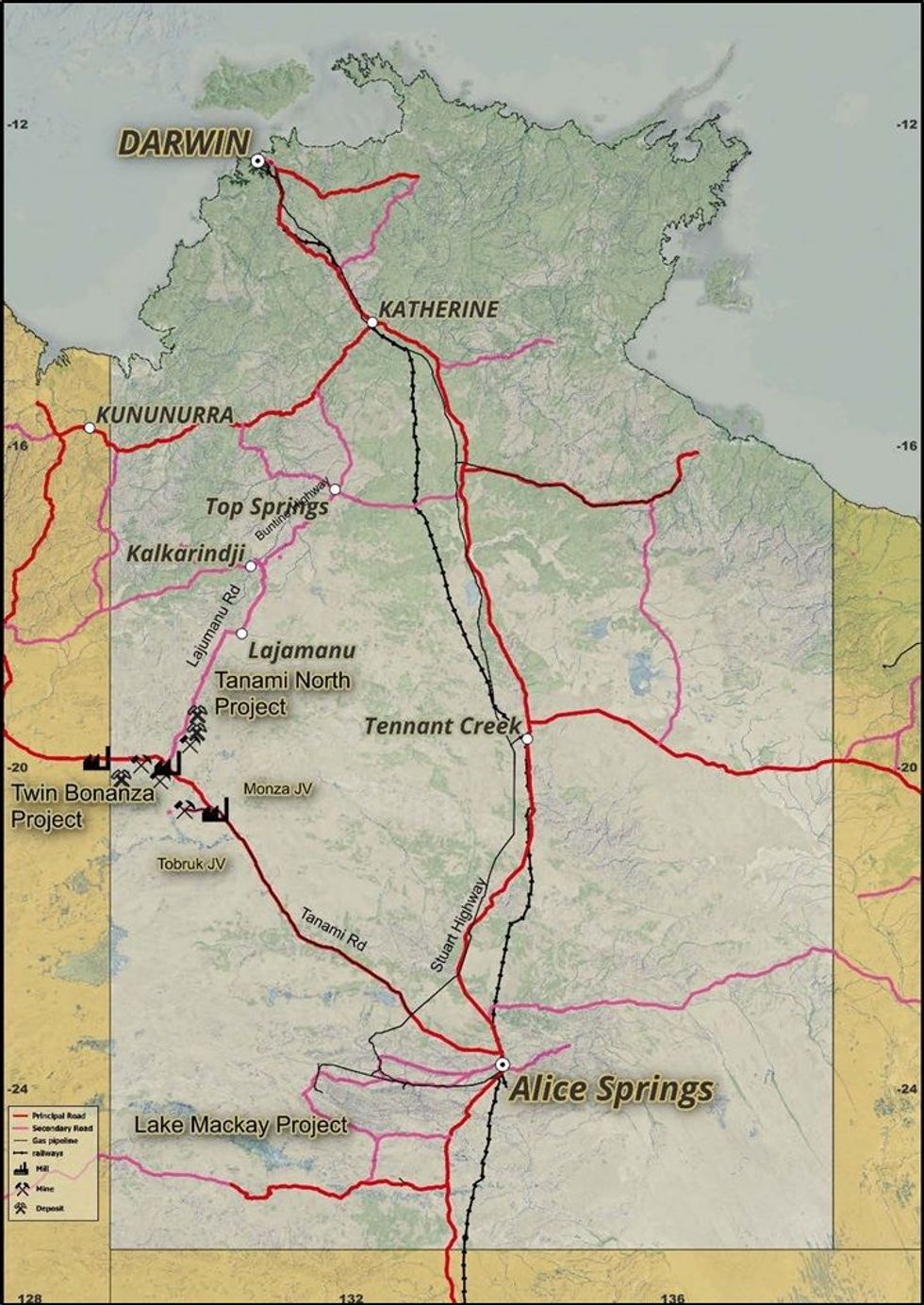

Prodigy Gold NL (ASX: PRX) (“Prodigy Gold” or the “Company”) is excited to announce the receipt of all results for the Reverse Circulation (“RC”) drilling program completed during September at the Hyperion Gold Deposit (“Hyperion”), which forms part of the Company’s strategically important Tanami North Project in the Northern Territory (Figure 1).

HIGHLIGHTS

- Exceptional results returned from the Reverse Circulation drilling campaign completed at the Hyperion Gold Deposit.

- Intercepts received include highlights:

- Hyperion Lode

- 25m @ 2.2g/t Au from 66m in hole HYRC24001

- 33m @ 2.6g/t Au from 49m in hole HYRC24017A

- Tethys Lode

- 10m @ 15.9g/t Au from 177m in hole HYRC24004

- 30m @ 2.9g/t Au from 31m in hole HYRC24006

- 13m @ 4.1g/t Au from 26m in hole HYRC24013

- Suess Lode

- 4m @ 7.7g/t Au from 87m in hole HYRC24004

- Hyperion Lode

- Two holes drilled down dip for metallurgical testwork, yielded intercepts:

- 99m @ 2.7g/t Au from 33m in hole HYRC24005 from the Hyperion Lode

- 53m @ 2.9g/t Au from 49m in hole HYRC24009 from the Tethys Lode

The results received are from the 17 hole, 1,770 metre RC program completed at Hyperion1 covering the Hyperion, Tethys and Seuss Lodes, yielding a series of significant intercepts demonstrating a greater than 30 gram metre interval (grade times width) based on a 0.5g/t gold cut-off, including:

- 25 metres @ 2.2g/t Au from 66m in hole HYRC24001 (Estimated True Width – “ETW” 24.1m)

- 15 metres @ 3.1g/t Au from 152m in hole HYRC24003 (ETW 13.2m)

- 15 metres @ 2.1g/t Au from 48m in hole HYRC24004 (ETW 7.9m)

- 4 metres @ 7.7g/t Au from 87m in hole HYRC24004 (ETW 2.8m)

- 10 metres @ 15.9g/t Au from 177m in hole HYRC24004 (ETW 9.4m)

- 30 metres @ 2.9g/t Au from 31m in hole HYRC24006 (ETW 19.0m)

- 17 metres @ 2.9g/t Au from 67m in hole HYRC24011 (ETW 14.4m)

- 15 metres @ 2.2g/t Au from 50m in hole HYRC24012 (ETW 11.7m)

- 13 metres @ 4.1g/t Au from 26m in hole HYRC24013 (ETW 10.9m)

- 26 metres @ 1.6g/t Au from 41m in hole HYRC24016 (ETW 25.4m) and

- 33 metres @ 2.6g/t Au from 49m in hole HYRC24017A (ETW of 29.9m)

The results show that all holes intersected a reportable mineralised interval, with the majority of the reported results at grades above the estimated grade of the recently released Hyperion Mineral Resource. These new results will now be used to update the Hyperion Mineral Resource, which currently comprises an Indicated and Inferred Mineral Resource of 8.64Mt @ 1.5g/t Au for 407,000 ounces at a reporting cut-off grade of 0.6g/t Au2.

Drilling was also completed at the Brokenwood, Pandora and Tregony North Prospects for which the Company is still awaiting results.

Hyperion is located in the highly prospective, but underexplored area situated between the 1.1Moz Groundrush Gold Deposit and the 94Koz Crusade Gold Deposit3, both of which form part of the neighboring Central Tanami Project (Northern Star Resources Ltd (ASX:NST)/Tanami Gold NL (ASX:TAM)). Hyperion is also located around 25kms to the south of Prodigy Gold’s wholly owned 64Koz Tregony Gold Deposit4 (Figure 2). Hyperion and Tregony are key pillars of Prodigy Gold’s project portfolio and the focus of the Company’s current exploration activities.

The objectives of the reported Hyperion RC drilling program were to:

- infill areas of the Hyperion Resource that require closer spaced drilling to improve confidence in the recently updated Mineral Resource estimate for the Deposit

- re-drill several historical Air Core (“AC”) holes so that these results can be used in future resource estimations

- complete two holes drilling down dip of the known mineralisation to provide samples for metallurgical benchscale testwork from other areas of the Hyperion Deposit. Previous metallurgical testing was completed only on samples from the Suess Lode5.

Management Commentary

Prodigy Gold Managing Director, Mark Edwards said:

“The drilling completed in 2024 highlights the reason why Prodigy Gold views Hyperion as one of the key projects for the Company. These results support the current company strategy focusing on our Tanami North project area and remaining committed to expanding our Mineral Resource inventory through organic growth. These new results will also provide the Company with additional technical information, such as the recovery characteristics of the mineralisation of other lodes at Hyperion through further metallurgical testwork.

While two holes drilled targeted mineralisation down dip of the Hyperion and Tethys Lodes to provide samples for metallurgical testwork, they also provided the Company with confidence in the style of mineralisation at Hyperion. The holes have provided information regarding the down dip continuity of mineralisation, which will be used to assist with the updating of the Hyperion resource estimate.

With drilling now complete for the current field season the results will be used to assist with the planning of further drilling for the 2025 field season, which will definitely include follow-up drilling close to hole HYRC24004 that intersected 10m of mineralisation at close to half an ounce of gold per tonne (15.9g/t Au). This is an outstanding result and demonstrates the overall potential of the Hyperion Deposit and the nearby areas.”

Hyperion 2024 RC Resource Drilling Programs

The Hyperion Deposit is located on EL9250, which is 100% owned by Australian Tenement Holdings, a wholly owned subsidiary of Prodigy Gold. The project is approximately 150km southwest of Lajamanu in the Tanami Region of the Northern Territory (Figure 1).

The Hyperion Deposit was actively explored by Zapopan NL between 1989 and 1995 with RAB, RC and DD drilling completed. Further exploration was undertaken by Otter Gold NL in 2002 and then Newmont Exploration between 2003 and 2005 before the project was purchased by Prodigy Gold in 2009. The Company has been active on the project since 2011.

Click here for the full ASX Release

This article includes content from Prodigy Gold NL, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

18h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

19h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00