Balanced approach to AI sovereignty needed to ensure Europe's competitiveness while protecting data

A new study by Accenture (NYSE: ACN) has found that European organizations are placing greater emphasis on maintaining control over data and infrastructure which is likely to accelerate the demand for sovereign AI.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20251103564089/en/

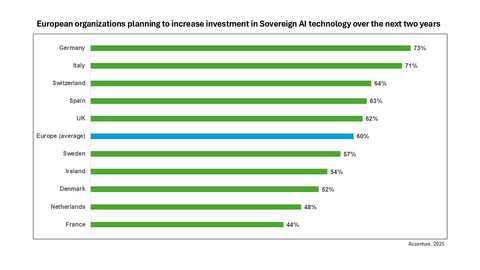

European organizations planning to increase investment in Sovereign AI technology over the next two years.

Sovereign AI refers to the ability of a country to develop and deploy AI using local infrastructure, data, models and talent to protect data from foreign access, bolster competitiveness, and decrease reliance on overseas technology providers.

In Europe, 62% of organizations are seeking sovereign solutions in response to current geopolitical uncertainty, a concern that's heightened among Danish (80%), Irish (72%), and German (72%) organizations. Sectors with regulatory requirements and sensitive data are most likely to lead sovereign AI adoption including banking (76%), public service (69%), and utilities (70%).

This trend is expected to grow over the next two years, as 60% of European organizations plan to increase investments in sovereign AI technology especially those in Germany (73%), Italy (71%) and Switzerland (64%).

Mauro Macchi, Accenture CEO for EMEA commented, "Europe is facing an AI paradox. Its leaders understand the need to accelerate AI adoption to spur innovation and drive growth. But at the same time, because most AI technologies originate from outside the region, it could also be seen as a risk. A sovereign AI approach can help resolve this challenge by enabling European organizations to protect critical operations without hampering innovation and competitiveness. It's with an innovative and thriving economy that we'll be able to invest in strengthening our technology ecosystem, enabling local champions to grow and compete on the global stage."

Balancing data control and access to global innovation

The survey highlights that, on average, just one-third (36%) of AI initiatives and data within European organizations require a sovereign approach due to regulatory requirements or data sensitivity. Capital markets and public services are sectors where such measures apply to a higher share of data.

European organizations are seeking a balance between data control and access to global innovation, with 65% acknowledging that they cannot remain competitive without non-European technology providers. 57% are considering using sovereign solutions from both European and non-European providers.

For its part, Accenture is helping Telia Cygate gain an early lead helping Swedish organizations adopt scalable and secure AI services. Accenture is also working across the ecosystem in Europe, including with AI infrastructure providers like Amsterdam-based Nebius, to provide clients with a foundation for their own sovereign AI factories that enable them to meet data residency requirements. Nebius is an AI cloud platform engineered to support the full lifecycle of AI workloads, integrating custom hardware, proprietary software and energy-efficient data centers located across Europe and the Middle East.

Mauro Capo, Digital Sovereignty lead for Accenture in EMEA said, "A sovereign AI approach is not about holding everything in one place. The goal is to make technology choices according to the degree of control organizations want to exercise over data, AI infrastructure and models, while benefiting from the scale, service breadth and pace of innovation that some non-European providers offer. These choices are decided by the use case and national priorities. Some cases need only local data residency, while others, in defense for instance, call for full sovereignty over the different AI components - local data, infrastructure and model, advanced encryption, or even air-gapped systems when necessary."

Reframing sovereignty, from risk management to competitive advantage

Only 19% of organizations view sovereign AI as a competitive advantage, while 48% cite compliance requirements as their primary motivation for adopting sovereign solutions. Sovereign AI is still perceived as a technical issue within businesses, as only 16% of European companies have made AI sovereignty a CEO or board-level concern.

However, there's a growing recognition of its strategic importance, with 73% of organizations calling for governments and institutions, such as the European Union, to play a key role in enhancing Europe's digital sovereignty, through regulations, subsidies, or public investments. Small and medium enterprises are also seen as critical in this pursuit, with 70% of organizations considering it as important to helping them access sovereign solutions.

Accenture recommends four actions to maximize opportunities from sovereign AI:

- CEO Ownership: Sovereign AI must be a CEO-led priority, aligning AI strategy with enterprise risk, growth, and geopolitical realities for maximum impact.

- Reframe Sovereignty: Organizations should shift from viewing sovereignty as mere risk mitigation to leveraging it as a source of value creation and competitive advantage.

- Expand Your Ecosystem: Companies should build hybrid ecosystems that combine local trust with global innovation, tailoring sovereignty measures to where they matter most.

- Redefine Architecture: Firms need to architect AI across a multi-cloud continuum, embedding sovereignty into every layer - data, infrastructure, models, and applications - for resilience and adaptability.

About the research

This study combines quantitative, qualitative and policy research to examine how governments and enterprises are advancing sovereign AI and sovereign cloud. It is based on a global survey of 1,928 organizations across 28 countries and 18 industries conducted during Jul–Aug 2025. Respondents were senior technology and policy leaders - CIOs, CTOs, chief data, AI and risk officers - from both public and private sectors.

About Accenture

Accenture is a leading solutions and global professional services company that helps the world's leading enterprises reinvent by building their digital core and unleashing the power of AI to create value at speed across the enterprise, bringing together the talent of our approximately 779,000 people, our proprietary assets and platforms, and deep ecosystem relationships. Our strategy is to be the reinvention partner of choice for our clients and to be the most AI-enabled, client-focused, great place to work in the world. Through our Reinvention Services we bring together our capabilities across strategy, consulting, technology, operations, Song and Industry X with our deep industry expertise to create and deliver solutions and services for our clients. Our purpose is to deliver on the promise of technology and human ingenuity, and we measure our success by the 360° value we create for all our stakeholders. Visit us at accenture.com .

Copyright © 2025 Accenture. All rights reserved. Accenture and its logo are registered trademarks of Accenture.

View source version on businesswire.com: https://www.businesswire.com/news/home/20251103564089/en/

Andy Rowlands

Accenture

+44 7952 594784

andy.rowlands@accenture.com

Francois Luu

Accenture

+33 1 53 23 68 55

francois.luu@accenture.com