November 22, 2023

Iceni Gold Limited (ASX: ICL) (Iceni or the Company) is pleased to provide an exploration update on the commencement of drilling at highly prospective targets within the 14 Mile Well Project.

Highlights

- An RC drilling contractor has been engaged and is mobilising to site, with drilling activities to commence this week.

- Access and drill pads have been established on site for the commencement of drilling.

- Initial targets planned to be tested include:

- The Breakaway Well gold anomaly.

- Monument lithium anomaly.

- The Monument North shear zone hosted gold anomaly.

- Intrusion related gold anomaly at Claypan.

GM Exploration David Nixon commented:

“Preparations have been underway in recent weeks for the upcoming RC drilling program and include heritage surveys, establishing site access and drill pads. The drilling rig will mobilise to site this week and commence the drilling program, testing targets in the Claypan, Breakaway and Monument target areas. The geological team are excited to commence drilling and test the anomalous targets”.

Figure 1 Iceni field crew pegging proposed drillholes in preparation for drilling (ASX release 24 October 2023).

14 Mile Well Project

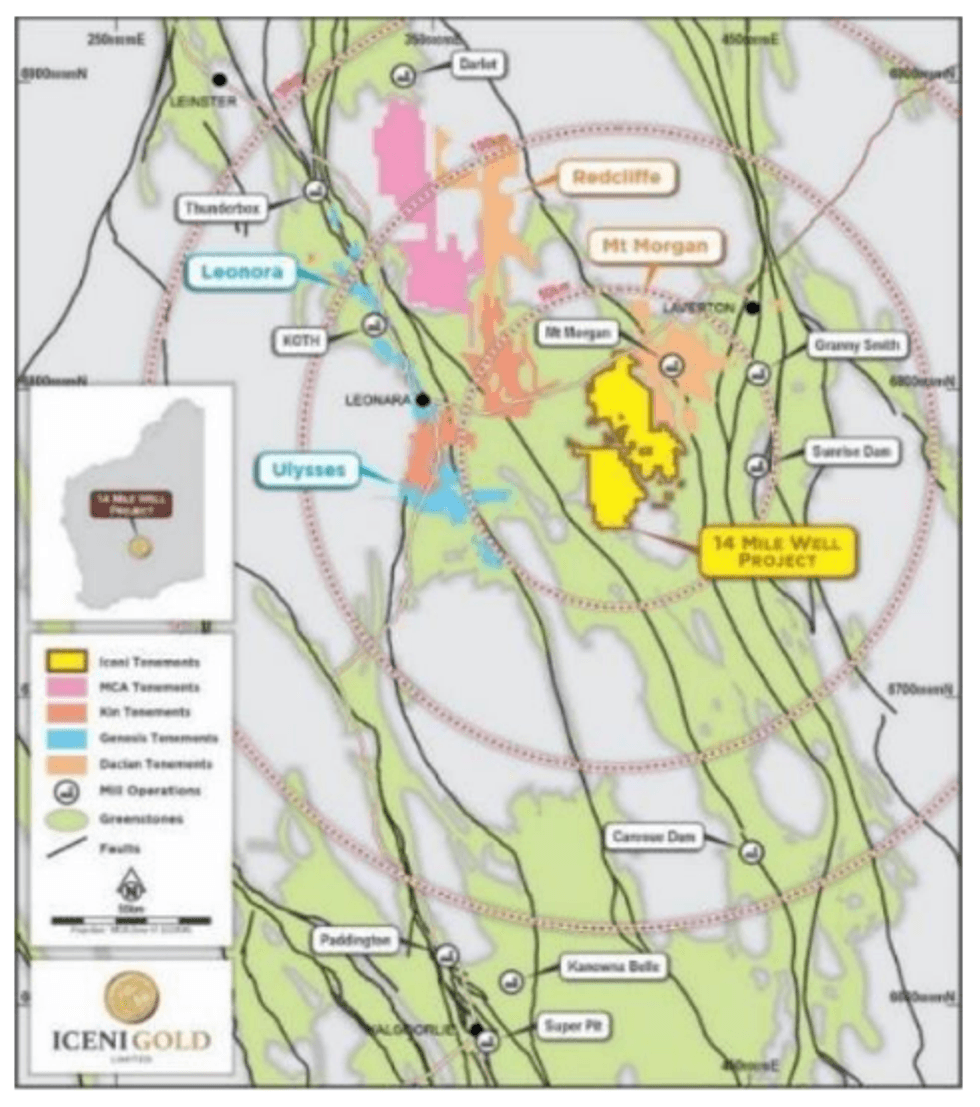

Iceni Gold Limited is a Perth based exploration company that operates the 14 Mile Well Gold Project in the Laverton Greenstone Belt. The ~900km2 14 Mile Well tenement package is situated on the western shores of Lake Carey, ~50km from Laverton in Western Australia. Iceni is searching for the three styles of gold mineralisation that are known to exist within the Laverton-Leonora District, as well as nickel and lithium:

- Intrusion Related Gold (IRG)

- Strong association between gold and syenite intrusions within the Laverton-Leonora District.

- Analogous to the Wallaby, Jupiter and Cameron Well gold deposits.

- Orogenic Lode Gold

- Related to deep tapping structures and their associated second/third order splays.

- Significant gold deposits in the district include Granny Smith, Sunrise Dam and Mt Morgans.

- Volcanogenic Massive Sulphides (VMS)

- Related to geothermal vents on the ancient sea floor.

- Favourable geological environment, with VMS deposits known in the district, for example Teutonic Bore, Anaconda and Jaguar.

- Nickel

- Related to ultramafic volcanics and intrusions.

- Three significant nickel projects are within a 50km radius, being Murrin Murrin, Kilkenny/Eucalyptus and Windarra.

- Lithium

- Related to pegmatites and felsic intrusions into mafic-ultramafic sequences.

- Pegmatites intruding mafic-ultramafic sequences have been mapped by the GSWA in the district.

Figure 2 Location of Iceni’s 14 Mile Well project within the highly gold endowed Laverton-Leonora District (ASX release 8 August 2023).

Click here for the full ASX Release

This article includes content from Iceni Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

ICL:AU

The Conversation (0)

18h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

19h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00