February 08, 2023

GALENA MINING LTD. (“Galena” or the “Company”) (ASX: G1A) announces assay results from the first exploration holes drilled from underground at the Abra Mine (“Abra” or the “Project”) have been received. The holes were drilled in Q4 2022 as dual-purpose holes for both exploration (previously identified target) and geotechnical evaluation (underground development planning). Assays associated with these holes have been received after the release of the December quarter activities report.

HIGHLIGHTS:

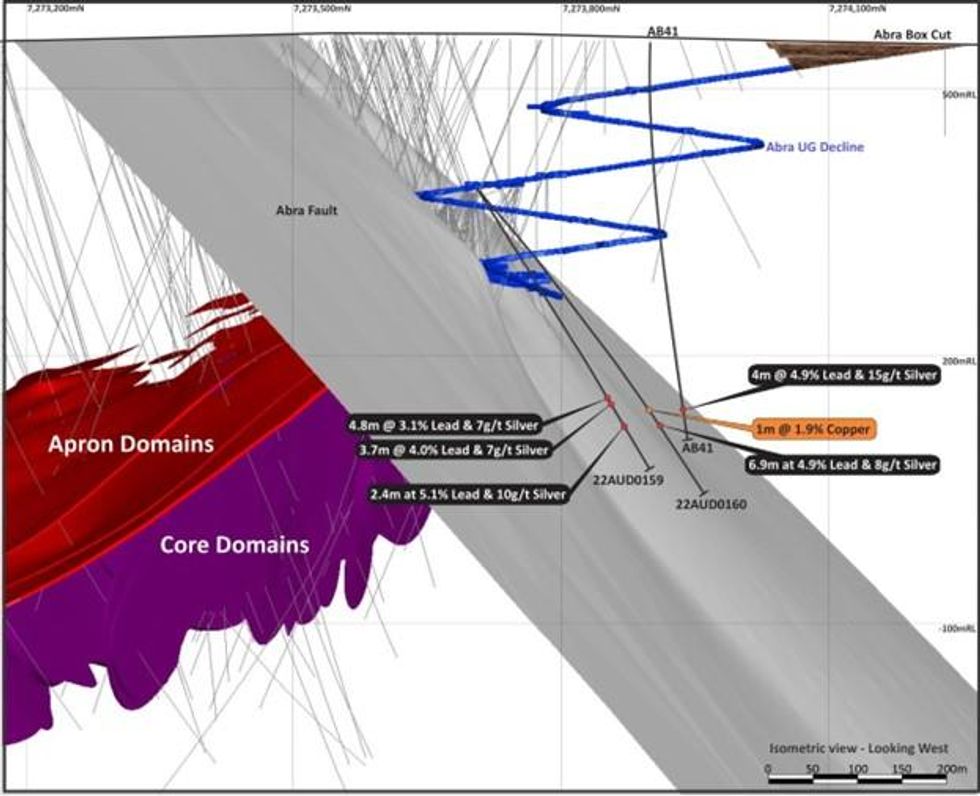

- Two underground diamond drill holes drilled to the north of the Abra Fault have confirmed the presence of the Abra style Apron and Core mineralisation, with multiple lead, silver, and copper intercepts, including,

- 4.8m at 3.1% lead and 6.7g/t silver from 276.88m in 22AUD0159

- 3.7m at 4.0% lead and 7.2g/t silver from 286.48m in 22AUD0159

- 2.4m at 5.1% lead and 9.6g/t silver from 314.42m in 22AUD0159

- 6.9m at 4.9% lead and 7.5g/t silver from 352.73m in 22AUD0160, including,

- 2.1m at 10.6% lead and 22g/t silver from 352.73m and

- 1.0m at 1.9% copper from 338.66m in 22AUD0160.

- Existing Abra Mineral Resource estimate is constrained to the north by Abra Fault and does not include the newly identified mineralisation.

- Newly identified mineralisation is quite expansive, covering an area approximately 100 metres by 300 metres (in plan) and is open to the north, east and west directions.

- Drilling also confirms the approximate displacement on the north side of the Abra fault is approximately 70-100 metres lower so newly encountered mineralised zone remains within the mining reach of the existing mine plan.

Prior to these holes, underground drilling has been focused on grade control and resource conversion to support Abra mine production planning for 2023. A total of 122 underground drill holes have been completed in 2022 and the company is currently updating the geology and mining models in the areas where this drilling has occurred. Results and geological confidence associated with the drilling completed to date is considered positive in relation to the previous work.

The Abra mine successfully achieved its first concentrate production on 12 January 2023 (See ASX announcement 13 January 2023). Over 1,000t of saleable concentrate has been produced during plant commissioning to date and the project remains on target to achieve first concentrate shipment in Q1, 2023.

Two new drillholes (22AUD0159 and 0160) were drilled in October 2022, adjacent to a historical intercept drilled by Abra Mining Limited in 2007 (AB41). The new holes confirm the presence of Abra style mineralisation north of the Abra fault. Including the historical hole, the three holes are spread over an area of 300m (east-west) and 100m (north-south). They are approximately 200m from the current Abra Deposit and 100m from the proposed Abra decline infrastructure.

Managing Director, Tony James commented, “This drilling confirmed our belief that Apron style mineralisation is north of the Abra fault and offset some 70 - 100m below the top of the Abra mineralisation. Its very pleasing to see these results in the very first underground exploration holes we have drilled, and its great reward for the team’s hard work to get the mine to this stage. It’s also nice that our progress to date and confidence in the ore body has allowed us to start to do some exploration work on one of the many targets we have at Abra.”

ABRA UNDERGROUND DIAMOND DRILLING

The underground drilling program at Abra Deposit commenced on 9 June 2022 with the establishment of the first underground drilling platform. A second underground drill rig was introduced into the mine on 13 September 2022. The initial drilling has been focussed on the 2023 production areas with 122 holes completed in 2022, complementing our 2023 production mine plan. The drilling associated with this announcement was done for dual purposes to understand the geotechnical conditions lower on the northern side of the Abra fault where long- term Abra mine infrastructure will be established, whilst also testing a previously identified mineralisation target seen in that location from previous exploration drilling and electromagnetic work.

Click here for the full ASX Release

This article includes content from Galena Mining, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

G1A:AU

The Conversation (0)

12 September 2022

Galena Mining

Galena Mining CEO Tony James said, “People have been just sitting and watching how we would perform this year, a perceived difficult construction period. But we've done a great job."

Galena Mining CEO Tony James said, “People have been just sitting and watching how we would perform this year, a perceived difficult construction period. But we've done a great job." Keep Reading...

13h

Southern Silver Intersects 5.8 metres averaging 781g/t AgEq at Cerro Las Minitas Project in Durango, México

Southern Silver Exploration Corp. (TSXV: SSV,OTC:SSVFF) (the "Company" or "Southern Silver") reports additional assays from drilling which continues to outline extensions of mineralization on the recently acquired Puro Corazon claim and identified further thick intervals of high-grade and... Keep Reading...

06 February

After Major Gold Payout, Bian Ximing Turns Bearish Sights on Silver

A Chinese billionaire trader known for profiting from gold’s multi-year rally has turned sharply bearish on silver, building a short position now worth nearly US$300 million as the metal's price slides. Bian Ximing, who earned billions riding gold’s multi-year rally and later turned aggressively... Keep Reading...

03 February

Silver Supply Tight, Demand Rising — What's Next? First Majestic's Mani Alkhafaji

Mani Alkhafaji, president of First Majestic Silver (TSX:AG,NYSE:AG), discusses silver supply, demand and price dynamics, as well as how the company is positioning for 2026.He also shares his thoughts on when silver stocks may catch up to the silver price: "You've got to give it a couple of... Keep Reading...

03 February

Rio Silver’s Path to Near-Term Cashflow

Rio Silver (TSXV:RYO,OTCPL:RYOOF) President and CEO Chris Verrico outlines the company’s transition into a pure-play silver developer. With the silver price reaching historic highs, Rio Silver is capitalizing on its strategic position in Peru — the world’s second largest silver producer — to... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00