(TheNewswire)

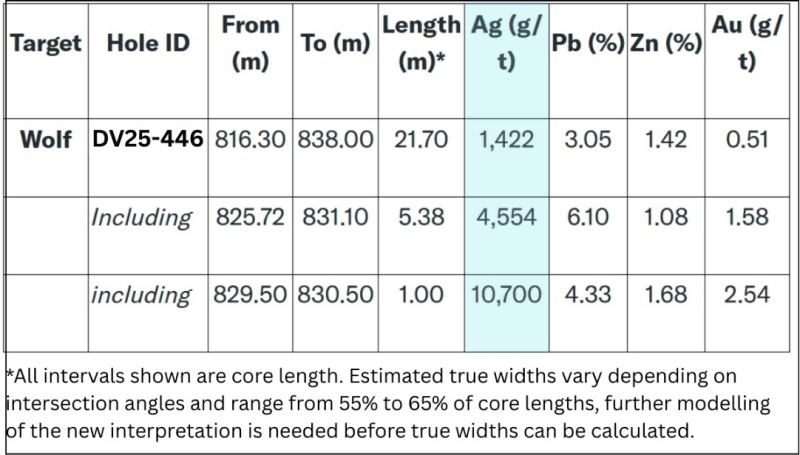

Vancouver, BC TheNewswire - September 4, 2025 Global Stocks News - Sponsored content disseminated on behalf of Dolly Varden Silver. On September 2, 2025 Dolly Varden Silver (TSXV: DV) (NYSE American: DVS) (FSE: DVQ) announced that backfill directional drilling at the Wolf Vein in hole DV25-446 has intersected 1,422 gt silver over 21.70 meters including 10,700 gt silver over 1.00 meter.

The ongoing success at the Wolf Vein is a lesson in the importance of hiring and empowering young geological talent. DV inherited archival drill data that went back to 1910. Four years ago, a new hire, Amanda Bennett, reviewed and analysed the old data.

Bennett zeroed in on the Wolf Vein as an area of interest. Dolly Varden's VP of Exploration Rob van Egmond looked at her model, and said, "Let's give it a try".

"Back in 2021, we drilled the downward extension from the Wolf Mine and found a continuation of the system," Bennett told Global Stocks News (GSN). "We've followed it at depth, extending it well over 1,100 meters. The Wolf Vein has exceeded my expectations."

"These high-grade silver results over wide intervals suggest excellent continuity at the Wolf Vein," stated Shawn Khunkhun, CEO of Dolly Varden Silver, in the August 2, 2025 press release. "The mineralization in drill hole DV25-446 includes native silver and is consistent with the robust style of mineralization with a significant increase in associated gold and base metal values . Additional drilling at Wolf is being prioritized for the remainder of the season."

"The gold and base metal grades are getting stronger as we go deeper at the Wolf Vein," van Egmond confirmed to GSN. "With gold at an all-time high, that is a positive development. The lead and zinc numbers also impact the metallurgy. The lead helps with the silver recoveries."

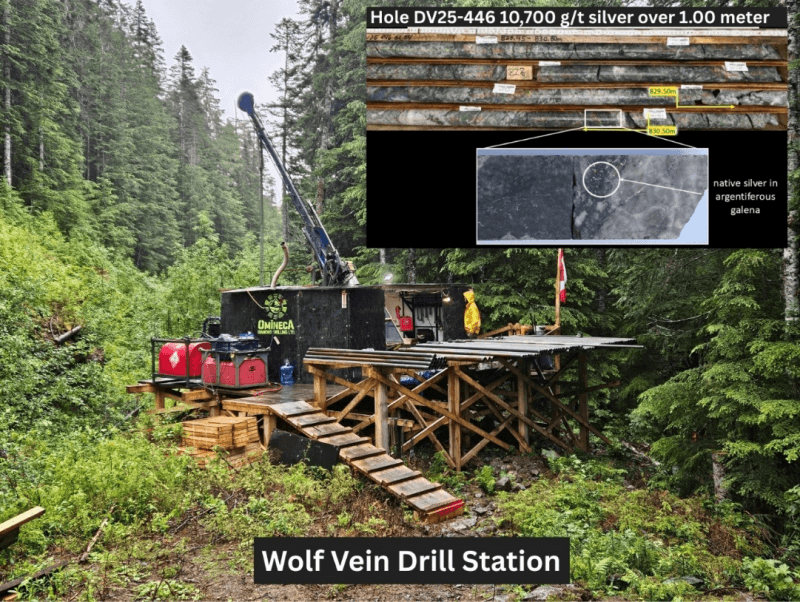

The existing road to the Wolf Vein is currently not accessible. It is more efficient to use a helicopter for crew change and resupply.

"There's no camp there," confirmed Bennett. "It's just a drill site. Every 12 hours, the helicopter delivers the drill crew, and the other crew rotates out. We have two project managers spelling each other off, who supervise the drillers."

Leasing a helicopter is not cheap, but van Egmond told GSN that new technologies available in remote locations are providing savings.

"We now have a reliable satellite internet connection," van Egmond told GSN, "which enables both the drilling crew and geologists to communicate with us in real time. They log the data onto a tablet and download it to an off-site server."

"The drills also have satellite connection now," continued van Egmond. "So the drillers can send pictures of the core in real time."

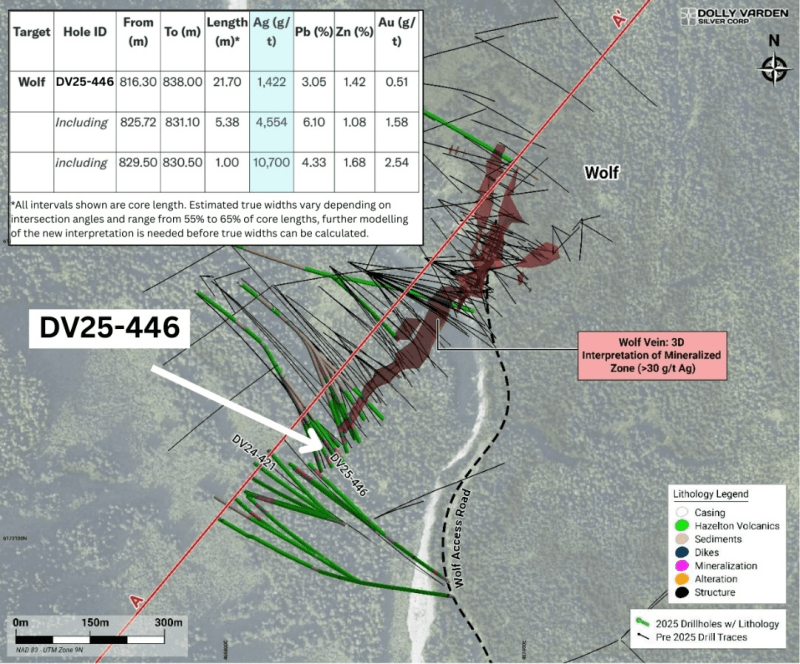

Dolly Varden is using directional drilling technology to precisely target areas for step-out and infill work at both Wolf and Homestake Silver. Drillhole DV25-446 is a deflection hole (daughter hole) off the initial "mother" hole. The vein intercept in DV25-446 is approximately 105 meters up plunge (in-fill) from the 2024 step out DV24-421.

The directional drilling has allowed DV to decrease total meters drilled by utilizing the same mother hole numerous times .

The 55,000-meter 2025 summer drill campaign is estimated using the total length of each drill hole as if each hole started from surface. Since the total meterage estimate includes those "re-drilled" mother hole lengths, actual meters of new core will be in the order of 41,000 meters, thus achieving the same number of mineralized intercepts while drilling significantly fewer meters at Wolf and Homestake Silver.

"Mining companies use directional drilling when they want to reduce the total number of drilled meters for a multi-target drilling program," confirms DV drill contractor Aziwell . "It is highly efficient and precise."

Ten years ago, Dolly Varden was a "silver pure play", which is quite rare. Seventy percent of global silver production comes from lead, zinc and gold mines, where silver is produced as a by-product.

In the last few years, Dolly Varden has started hitting significant gold intercepts. For example, in February 2024, a step-out drill program at Homestake Ridge intersected a new gold-rich zone: HR23-389: 79.49 g/t gold over 12.45 meters.

DV's metal inventory value is now approximately a 50/50 split between silver and gold.

The rising price of gold has a double benefit for Dolly Varden: 1. It increases the value of the gold-in-the-ground inventory, 2. If the silver-gold ratio returns to its historical norm, it may boost the price of silver.

"The Silver price jumped above the USD 40 per troy ounce mark for the first time in 14 years at the beginning of the week, buoyed by the rise in the Gold price," Commerzbank's commodity analyst Carsten Fritsch notes .

On April 15, 2025 – DV Announced Common Shares Have Been Approved for Listing on the NYSE

Since then, Dolly Varden has significantly increased its land package:

May 5, 2025 – DV Announces Agreement to Quadruple Tenure Area in the Golden Triangle by Acquiring Hecla Mining Company's Adjacent Kinskuch Property

May 8, 2025 - DV Acquires High-Grade Silver Porter Project in Golden Triangle

"Our progress in 2025 is the culmination of five years of hard work by our team," Khunkhun told GSN. "In that time span, we've gone from two past-producing historical mines to five, we've drilled 141,000 meters with consistent high-grade silver and gold hits , our land package has gone from 7,000 hectares to 100,000 (+1,400%), and our market capitalisation has moved from $20 million to $460 million (+2,200%).

As the drilling season closes out, five diamond drills are working on the Kitsault Valley and Big Bulk Projects. Focus has been on step-out and infill drilling of the Wolf Vein and Homestake Silver deposits , as well as exploration drilling of the copper-gold porphyry system at Big Bulk and several other targets in the Kitsault Valley. More results will be released as they are received and incorporated into the company's models.

Rob van Egmond, P.Geo., Vice-President Exploration for Dolly Varden Silver, the "Qualified Person" as defined by NI43-101, has reviewed, validated and approved the scientific and technical information contained in this GSN release.

Disclaimer: Dolly Varden Silver paid GSN $1,750 for the research, creation and dissemination of this content.

Contact: guy.bennett@globalstocksnews.com

Full Disclaimer: Global Stocks News (GSN) researches and fact-checks diligently, but we cannot ensure our publications are free from error. Investing in publicly traded stocks is speculative and carries a high degree of risk. GSN makes no recommendation to purchase any individual stock. When compensation has been paid to GSN, the amount and nature of the compensation will be disclosed clearly. GSN publications may contain forward-looking statements such as "project," "anticipate," "expect," which are based on reasonable expectations, but these statements are imperfect predictors of future events. When compensation has been paid to GSN, the amount and nature of the compensation will be disclosed clearly.

Copyright (c) 2025 TheNewswire - All rights reserved.