Decade Resources Ltd. (TSXV: DEC,OTC:DECXF) ("Decade" or the "Company") is pleased to report results from a recent reconnaissance program on the North Mitchell Property, located approximately 7 km north of Newmont's Brucejack Mine and east of Seabridge Gold's Iron Cap deposit in the prolific Golden Triangle of British Columbia.

Highlights

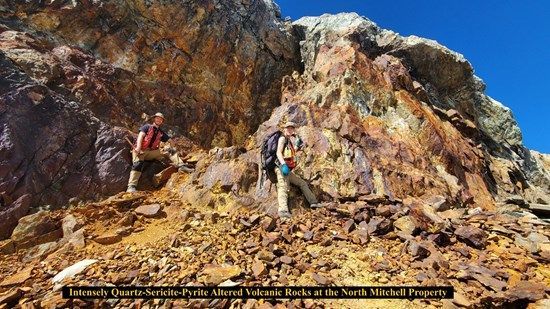

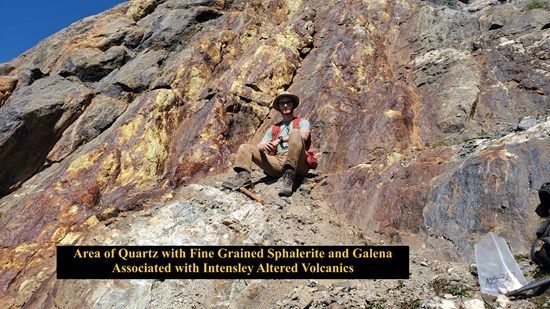

- Observation of multiple gossanous outcrops with strong silicification, iron-oxide staining, and quartz veining.

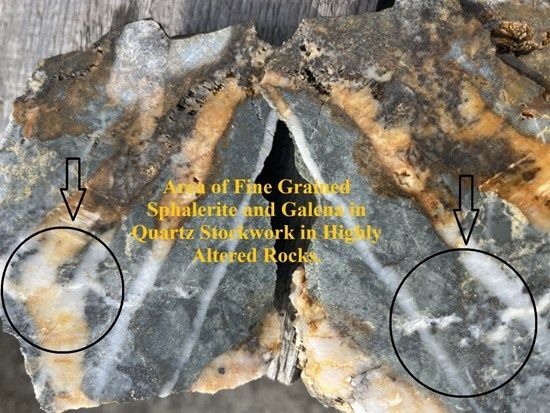

- Discovery of grey saccharoidal ("sugary") quartz adjacent to white quartz veins, hosting fine-grained sphalerite and galena — a mineral assemblage commonly associated with gold-silver systems in the Golden Triangle.*

- Identification of porphyritic intrusive rocks (diorite-granodiorite), providing a potential link to a copper-gold porphyry system at depth.

- Collection of multiple chip and grab samples across veined and altered exposures — assays are pending.

- Observation earlier in the week of a rock sample containing possible chalcocite, suggesting local copper enrichment.

*there is no guarantee that the presence of these minerals implies that similar mineralization will be located on the claims.

Exploration Program

The 2025 field program consisted of prospecting, geological mapping, and systematic chip sampling across newly exposed outcrops and float trains. Sampling focused on gossanous walls, quartz-veined boulders, and altered host rocks. All samples have been submitted to an accredited laboratory for multi-element geochemical analysis including fire assay for gold and ICP-MS for silver, copper, lead, zinc, and pathfinder elements.

Results will be reported once received and interpreted. The Company has sent a few samples in for rush assaying in order to guide further exploration this season.

Photo showing gossanous outcrops with strong silicification, iron-oxide staining, and quartz veining on the North Mitchell property.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3615/266585_2d1b0433741b2aa8_001full.jpg

Another photo showing gossanous outcrops with strong silicification, iron-oxide staining, and quartz veining on the North Mitchell property.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3615/266585_2d1b0433741b2aa8_002full.jpg

Photo of grey saccharoidal ("sugary") quartz adjacent to white quartz veins, hosting fine-grained sphalerite and galena.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3615/266585_2d1b0433741b2aa8_003full.jpg

Geological Context

The North Mitchell Property is underlain by Hazelton Group volcanic and intrusive rocks and cut by north-south trending structures interpreted to be splays of the Brucejack Fault. The new mineralized exposures are located less than 3 km from Tudor Gold's Perfect Storm Zone drill hole PS-23-10, which intersected 102.15 m of 1.28 g/t AuEq. The presence of sphalerite- and galena-bearing quartz veins, iron-oxide alteration, and nearby porphyritic intrusives suggests the potential for an epithermal Au-Ag system with a porphyry source — similar to systems that host nearby Iron Cap and Brucejack deposits.

President's Comment

"Our 2025 reconnaissance program has identified a highly prospective target area at North Mitchell," said Ed Kruchkowski, President of Decade Resources. "The combination of veining, alteration, and sulfide mineralization significantly advances our understanding of the property. We are eager to receive assays and plan follow-up work, including detailed mapping and potential drill targeting."

Qualified Person

The technical information contained in this news release has been reviewed and approved by Ed Kruchkowski, P.Geo., a Qualified Person for the Company as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects. E. Kruchkowski is not independent of Decade as he is the president of the Company.

Decade Resources Ltd. is a Canadian based mineral exploration company actively seeking opportunities in the resource sector. Decade holds numerous properties at various stages of development and exploration from basic grass roots to advanced ones. Its properties and projects are all located in the "Golden Triangle" area of northern British Columbia. For a complete listing of the Company assets and developments, visit the Company website at www.decaderesources.ca. For investor information please call 250- 636-2264 or Gary Assaly at 604-377-7969.

ON BEHALF OF THE BOARD OF Decade Resources Ltd.

"Ed Kruchkowski"

Ed Kruchkowski, President

"Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release."

"This news release may contain forward-looking statements. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements."

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/266585