Update on Moly Prices: Traders Hoping for Stability

Moly prices have seen some stability in recent weeks, but market participants aren’t sure if it will hold.

As moly market watchers are no doubt aware, 2015 hasn’t been kind to moly prices.

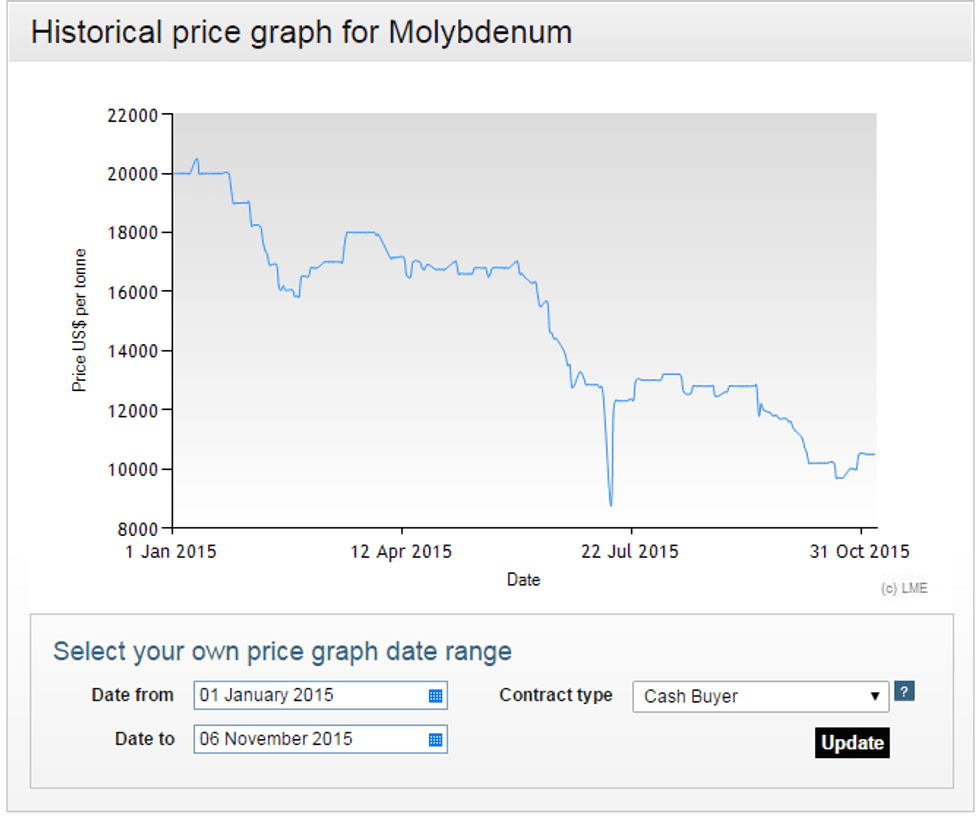

While moly prices ticked upward briefly at the start of 2015, they took a steep fall later in Q1. And though prices for the metal were able to hold steady during Q2, at the end of June they plunged drastically again.

Moly prices were able to make a quick recovery from that June drop, but at the start of October began to fall more slowly, nearly hitting the low point they reached in June. Fortunately, since then there has been some stabilization in moly prices, as the chart below from the London Metal Exchange illustrates:

According to a recent Platts article, that stability may be due at least in part to a dearth of material on the market. “Producers are holding back now, so there’s limited availability. Traders are also hesitating to offer, they prefer to wait. It’s difficult to find oxide at the moment,” one European buyer told the news outlet.

However, market participants are not yet convinced that a true turnaround is in the cards.

“We prefer to watch the market for a few days to understand if there is anything else besides a technical correction,” another European trader told the news outlet. Similarly, the European buyer said, “[t]he question is whether this is sustainable or just a flash in the pan.”

As 2015 draws to a close, market watchers will no doubt be watching moly prices closely to see if a true turnaround is in the cards. Currently the consensus seems to be that while the metal’s prospects are uncertain in the short-term, moly prices should fare better longer term.

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Related reading: