The base metal has increased almost 4 percent in October supported by supply concerns.

Zinc prices have surged almost 4 percent since the beginning of October on the back of global supply worries, China’s environmental crackdown and a weaker US dollar.

On Thursday (October 26), LME zinc closed up 1.1 percent at $3,225 per tonne. The base metal has been trading above the $3,000-per-tonne mark since August, and earlier this month touched $3,308.75, its highest price in a decade.

“Chinese supply-side reforms are driving up zinc prices to levels not seen in years,” analysts at FocusEconomics said in their latest report.

Chinese environmental inspectors have targeted zinc mines in Sichuan province, restricting or stopping some production. Meanwhile, cities in Anhui province have issued plans to curb production in the steelmaking, non-ferrous smelting, cement and coal-fired power sectors.

According to FocusEconomics, concerns over steel supply constraints have further boosted the price of zinc, which is used to galvanize steel.

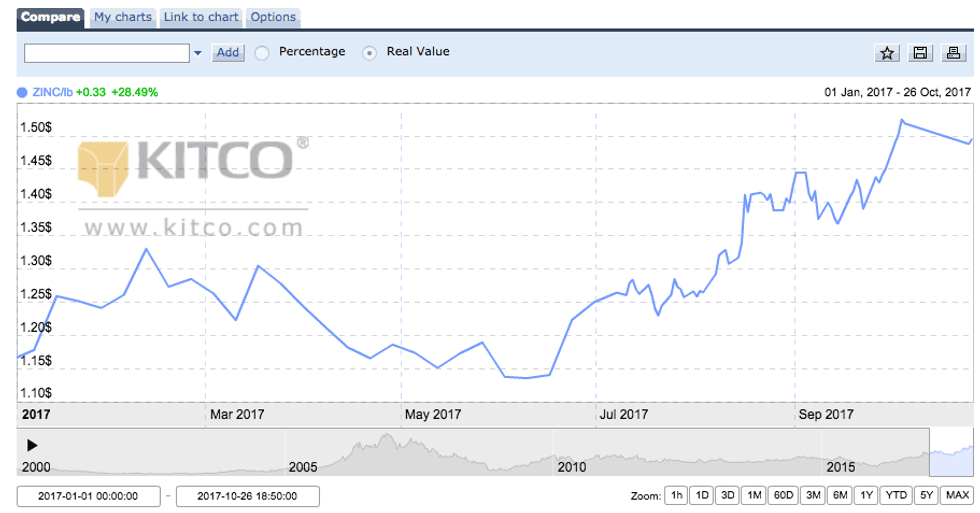

As the chart below shows, zinc prices have been trading upwards since January, up more than 28 percent year-to-date.

Chart via Kitco.com

But the recent zinc price rally is not all good news for producers, Vedanta Resources (LSE:VED) CEO Deshnee Naidoo told Bloomberg earlier this month.

“The whole market is out of whack. In the short term it’s a good price, but it’s not a sustainable price. There needs to be an incentive price for galvanizers, alloy producers, smelters,” Naidoo said.

Similarly, Commerzbank analyst Daniel Briesemann recently told Reuters that he anticipates prices pulling back from recent highs, and added, “I see the zinc price falling back below $3,000 within the next month, maybe in the next few weeks.”

On Thursday, World Bank analysts said in a report that they expect base metal prices to ease next year, as declining iron-ore prices will offset strength in other commodities, including zinc.

“Last year and this year, most commodity markets are well supplied,” John Baffes, a senior economist at the World Bank, told Bloomberg. “We’ll not see a sort of major price increase for next year.”

Looking ahead, firms polled by FocusEconomics estimate that the average zinc price for Q4 2017 will be $2,843. The most bullish forecast for the quarter comes from BMO Capital Markets, which is calling for a price of $3,527; meanwhile, Euromonitor is the most bearish with a forecast of $2,309.

Don’t forget to follow us @INN_Resource for real-time news updates.

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.