March 18, 2024

Culpeo Minerals Limited (“Culpeo” or the “Company”) (ASX:CPO, OTCQB:CPORF) is pleased to announce that assay results returned from ongoing regional mapping and sampling programs at its Fortuna Project (the Project) have led to the discovery of new mineralisation at the El Quillay East Prospect. The Company intends to quickly delineate the full extent of this new target prior to drill testing.

HIGHLIGHTS

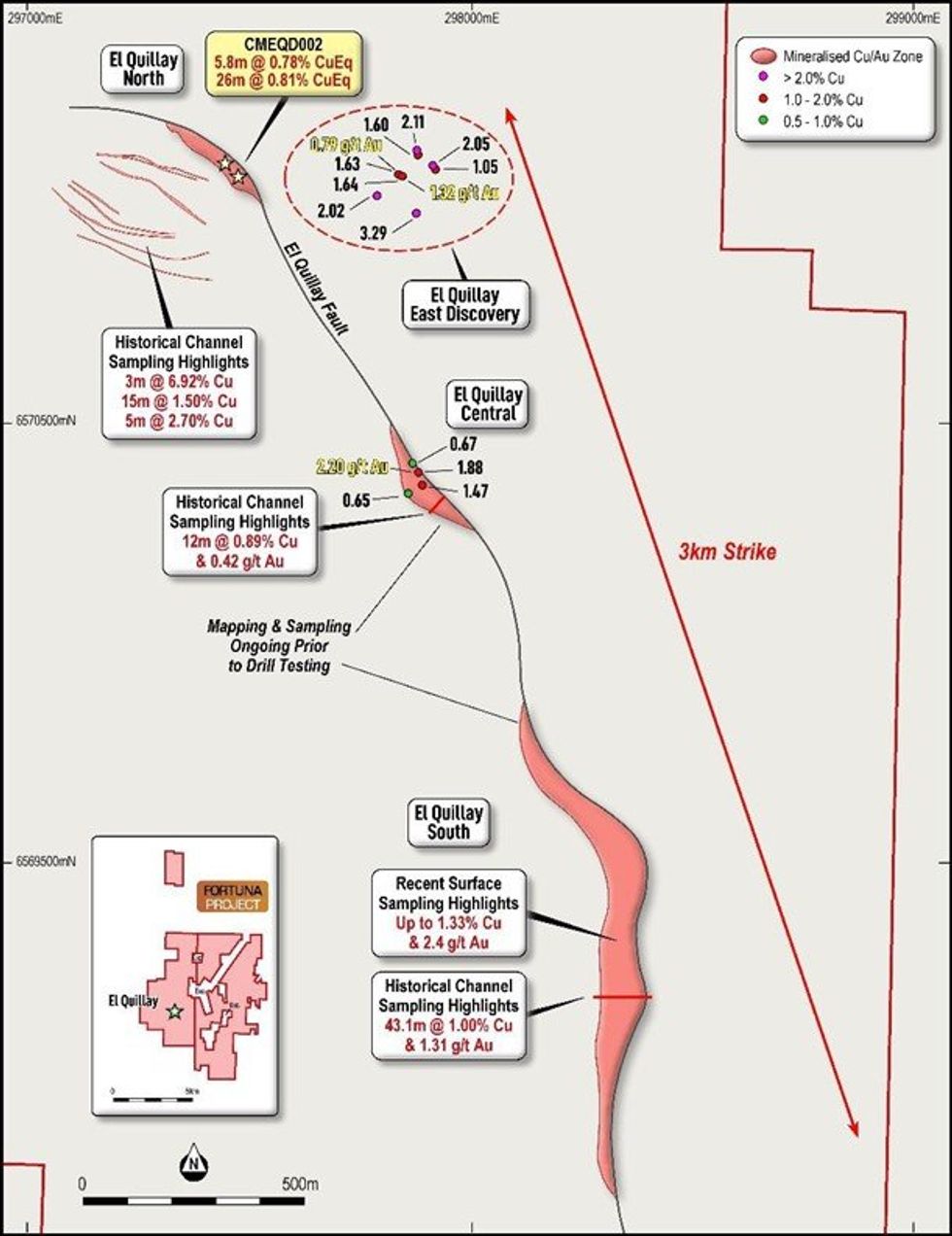

- Newly discovered El Quillay East Prospect hosts high-grade copper and gold mineralisation 500m to the east of the main El Quillay Fault (see Figure 1).

- Rock chip samples returned assay grades up to 3.29% Cu and 1.32g/t Au, with all samples being greater than 1.0% Cu.

- Samples collected over an initial area of 250m x 150m with potential to extend in all directions.

- The El Quillay East Prospect is located on a structure parallel to the main El Quillay Fault and remains open to the southeast.

- The El Quillay Fault Zone spans >3km and links the El Quillay South, Central and North Prospects, where previous drilling returned an intersection of 26m @ 0.81% CuEq1.

- New breccia targets defined at Lana Corina and Vista Montana are scheduled for drilling in the coming weeks.

Culpeo Minerals’ Managing Director, Max Tuesley, commented:

“We are highly encouraged by these promising initial results from our target generation programs. The newly defined and well mineralised El Quillay East Prospect illustrates an abundance of copper mineralisation at surface within the structural corridor. Given this prospect has never been drilled, we see good potential for a second mineralised trend to be discovered, parallel to the 3km long El Quillay Fault.”

EL QUILLAY EAST AND CENTRAL MAPPING AND SAMPLING

The El Quillay East Prospect is a newly discovered zone of mineralisation located 500m east of the El Quillay North Prospect where previous drilling returned an intersection of 26m @ 0.81% CuEq1. Samples were taken from outcrop and subcrop locations, and areas where copper and gold mineralisation has historically been exploited by small scale surface and underground mining (see Figure 1).

Results from sampling returned grades up to 3.29% Cu with strong gold mineralisation of up to 1.32g/t Au (refer Table 1).

Confirmatory sampling was also completed at El Quillay Central where assay results returned grades up to 1.88% Cu and gold mineralisation of up to 2.20g/t Au (refer Table 2).

Click here for the full ASX Release

This article includes content from Culpeo Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CPO:AU

The Conversation (0)

03 April 2024

Culpeo Minerals

Exploring High-grade Outcropping Copper-Gold Projects in Chile

Exploring High-grade Outcropping Copper-Gold Projects in Chile Keep Reading...

26 February

T2 Metals Acquires High-Grade Aurora Gold-Silver Project in the Yukon from Shawn Ryan

Past Drilling Results Include 3.4m @ 24.45 g/t Au at AJ Prospect

T2 Metals Corp. (TSXV: TWO) (OTCQB: TWOSF) (WKN: A3DVMD) ("T2 Metals" or the "Company") is pleased to announce signing of an Option Agreement (the "Option") with renowned explorer Shawn Ryan ("Ryan") and Wildwood Exploration Inc. (together with Ryan, the "Optionor") to earn a 100% interest in... Keep Reading...

25 February

Copper Prices Rally on Tariff Fears, Weak US Dollar

Copper prices continue to rise, driven by supply and demand fundamentals and boosted by tariff fears.Prices for the red metal reached a record high on January 29, and while they have since moderated somewhat, several factors have injected fresh concerns and volatility into the market.Among them... Keep Reading...

25 February

Top 10 Copper-producing Companies

Copper miners with productive assets have much to gain as supply and demand tighten. The price of copper reached new all-time highs in 2026 on both the COMEX in the United States and the London Metals Exchange (LME) in the United Kingdom. In 2025, the copper price on the COMEX surged during the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00