May 24, 2023

Augustus Minerals (ASX: AUG; “Augustus” or the “Company”) is pleased to advise that its shares will commence trading on the Australian Securities Exchange today (25 May 2023), bringing to market an exceptional selection of exploration targets covering the critical minerals Lithium, Rare Earths and Copper.

Highlights

- Early mover to the Gascoyne region - large contiguous land holding (~3,600km2) – drill ready critical mineral targets.

- Dominant tenement position covers 85kms of strike along the Ti-Tree Shear, a significant geological structure in the Gascoyne.

- High-quality portfolio of targets covering the critical minerals lithium, rare earths and copper.

- $10m raised in successful Initial Public Offer, oversubscribed and well supported.

- Augustus Minerals shares to commence trading on ASX at 11am AEST today under the ticker AUG.ASX

- Experienced board and management team including Andrew Reid (Managing Director) and Andrew Ford (General Manager Exploration) with extensive Gascoyne critical minerals experience.

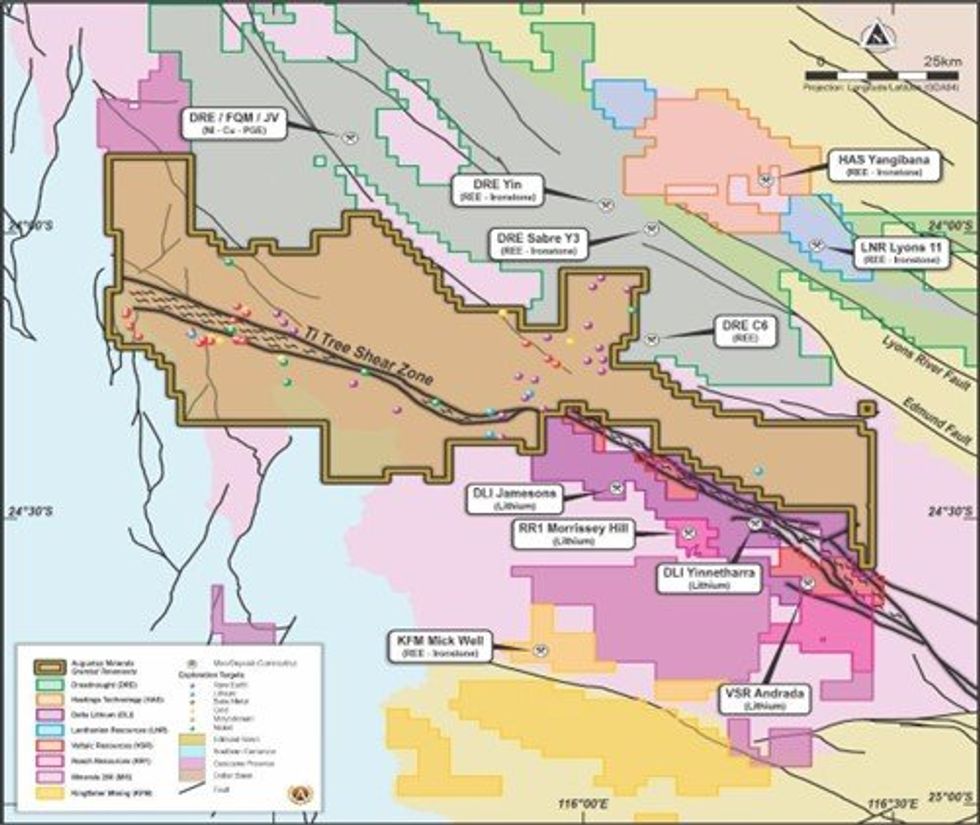

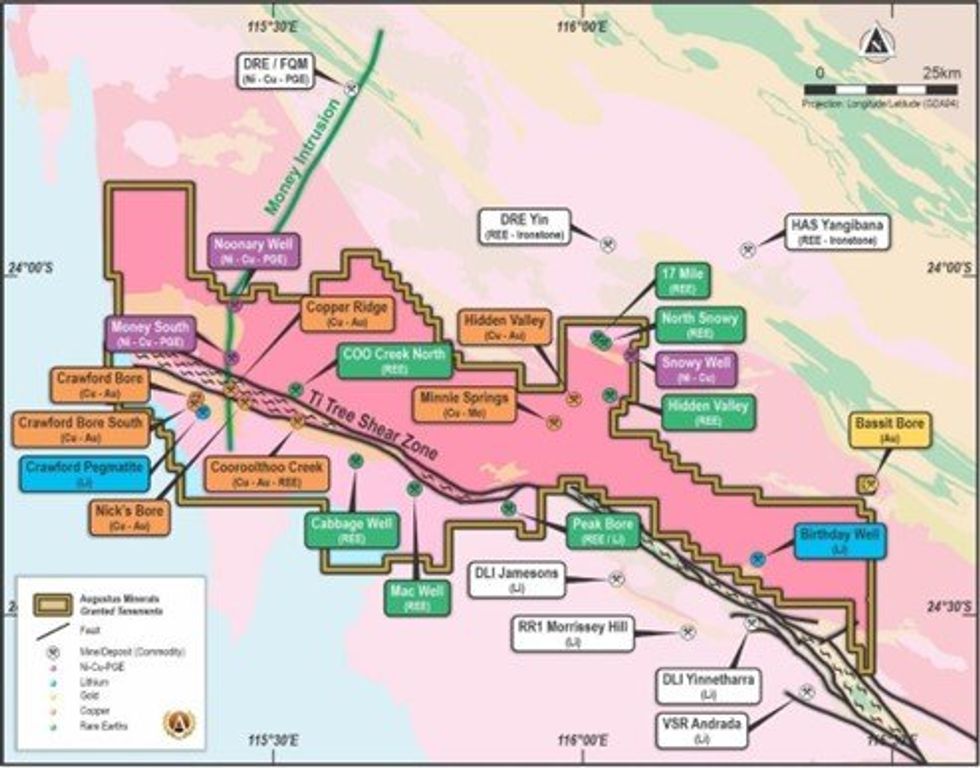

Augustus has secured a large strategic contiguous package of ground (~3,600km2) in the highly sought after Gascoyne Region of Western Australia (Figure 1), which contains 85kms of the large regional geological structure, the Ti-Tree Shear.

Multiple discoveries of the critical minerals rare earths and lithium have been made to the immediate north and south of the Augustus tenement package over the last several years.

During the last 5 years, Augustus has generated an outstanding inventory of high-quality targets with similar geological host rocks and conditions as are present in these nearby discoveries that will now be explored with a focused systematic scientific program over the coming months.

Our Team

Augustus will be led by a highly experienced board and senior executives Andrew Reid and Andrew Ford, who have led the way in developing what is only the third ex-China Rare Earths Mine in the World.

Augustus Managing Director Mr Reid was Chief Operating Officer at Hastings Technology Metals Ltd (ASX:HAS) growing its Mineral Resources, receiving its environmental permits to operate and guiding the project through equity and debt fund raising, offtake agreements and initial project construction activities.

Augustus General Manager Exploration Mr Ford was General Manager exploration at Hastings Technology Metals Ltd and has a career that spans 35 years of exploration and mine development experience in multiple commodities for both majors (Homestake and Barrick Gold) as well as junior ASX listed companies.

Andrew Reid, Managing Director

“The successful listing and raising of $10m, which was oversubscribed, is a testimony to the quality of the asset, its location and the potential that it could unlock through active discovery.

The interest and activity in the Gascoyne region geologically is backed by at least a dozen companies actively exploring, with several of them embarking on major drill outs to define and increase Mineral Resources from recent discoveries.

We look forward to getting on the ground to commence exploration activities in earnest and report back on what is shaping up to be an exciting project locality.”

Our Targets

The Ti-Tree Shear project is located in a rapidly emerging critical minerals district in the Gascoyne Region of Western Australia.

The project area contains 20 granted exploration licenses covering some 3,600km2 as a single coherent block, with its location adjoining recent discoveries of lithium bearing pegmatites to the south with Delta Lithium (ASX:DLI) and Voltaic Strategic Resources (ASX:VSR) and Ironstone hosted rare earths to the north with Dreadnought Resources (ASX:DRE).

Initially the Company’s objectives are to target the most prospective geological anomalies being the outcropping ironstone’s which can host rare earths at Cabbage Tree, Macs Well, Hidden Valley and 17 Mile.

Lithium (Li) targets at Birthday Well and Crawford Bore have the potential to host pegmatites and are backed by elevated Li rock chip and stream sediment samples and will also be priority target.

Advanced copper prospects at Copper Ridge, Minnie Springs and Noonary Well are walk up drill targets with no drilling completed to date and will be drilled during calendar 2023.

Our strategy is now to move as quickly as possible with ground engaging activities to firm up our priority list of targets ahead of planned extensive drilling campaigns. The Board of Augustus believes it has assembled a significant strategic package of land with a portfolio of critical mineral targets the envy of the region.

Click here for the full ASX Release

This article includes content from Augustus Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AUG:AU

Sign up to get your FREE

Augustus Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

04 July 2023

Augustus Minerals

Vast Land Package for Critical and Precious Metals Exploration in Australia

Vast Land Package for Critical and Precious Metals Exploration in Australia Keep Reading...

25 February

Drilling to Commence at Music Well

Augustus Minerals (AUG:AU) has announced Drilling to Commence at Music WellDownload the PDF here. Keep Reading...

28 January

Quarterly Activities/Appendix 5B Cash Flow Report

Augustus Minerals (AUG:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

11 January

Heritage Approval for Drilling at Music Well

Augustus Minerals (AUG:AU) has announced Heritage Approval for Drilling at Music WellDownload the PDF here. Keep Reading...

15 December 2025

CEO Resignation

Augustus Minerals (AUG:AU) has announced CEO ResignationDownload the PDF here. Keep Reading...

18 November 2025

Exploration Update - Soil Sampling Results

Augustus Minerals (AUG:AU) has announced Exploration Update - Soil Sampling ResultsDownload the PDF here. Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Sign up to get your FREE

Augustus Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00