April 28, 2024

Culpeo Minerals Limited (“Culpeo” or the “Company”) (ASX:CPO, OTCQB:CPORF) is pleased to report on its activities for the Quarter ended 31 March 2024 (the Quarter).

HIGHLIGHTS

- Discovery of large copper-gold porphyry system at La Florida Prospect (Fortuna Project)1:

- Surface sampling results returned grades of up to 3.96% Cu and 2.61g/t Au.

- Large 1.7km x 0.5km mineralised footprint.

- Maiden drill program at El Quillay North Prospect returned shallow, wide copper mineralisation2:

- 26m @ 0.81 CuEq from 29m, including 4m @ 1.87% CuEq from 51m; and

- 5.8m @ 0.78% CuEq from 15.2m.

- El Quillay South Prospect strike length extended to 1,200m and up to 100m wide

- Assays up to 1.33% Cu and 2.40g/t Au3 returned from rock chip sampling.

- El Quillay Fault zone now hosts mineralisation over 3km strike length.

- Discovery of new high-grade mineralised trend at El Quillay East Prospect4:

- Grades up to 3.29% Cu and 1.32g/t Au and all samples >1.0% Cu from rock chip sampling

- Mineralised footprint spans an initial area of 250m x 150m with and open in all directions

- El Quillay East is a separate parallel structure to the extensive El Quillay Fault.

- Culpeo’s interest in the high-grade Lana Corina Project increased to 50%5.

- Equity capital raisings totaling A$2.5M (before costs) to existing and new sophisticated and high-net-worth investors.

- Cash balance of A$1.3M and no debt as at 31 March 2024 adequately funds exploration programs.

Operating Activities

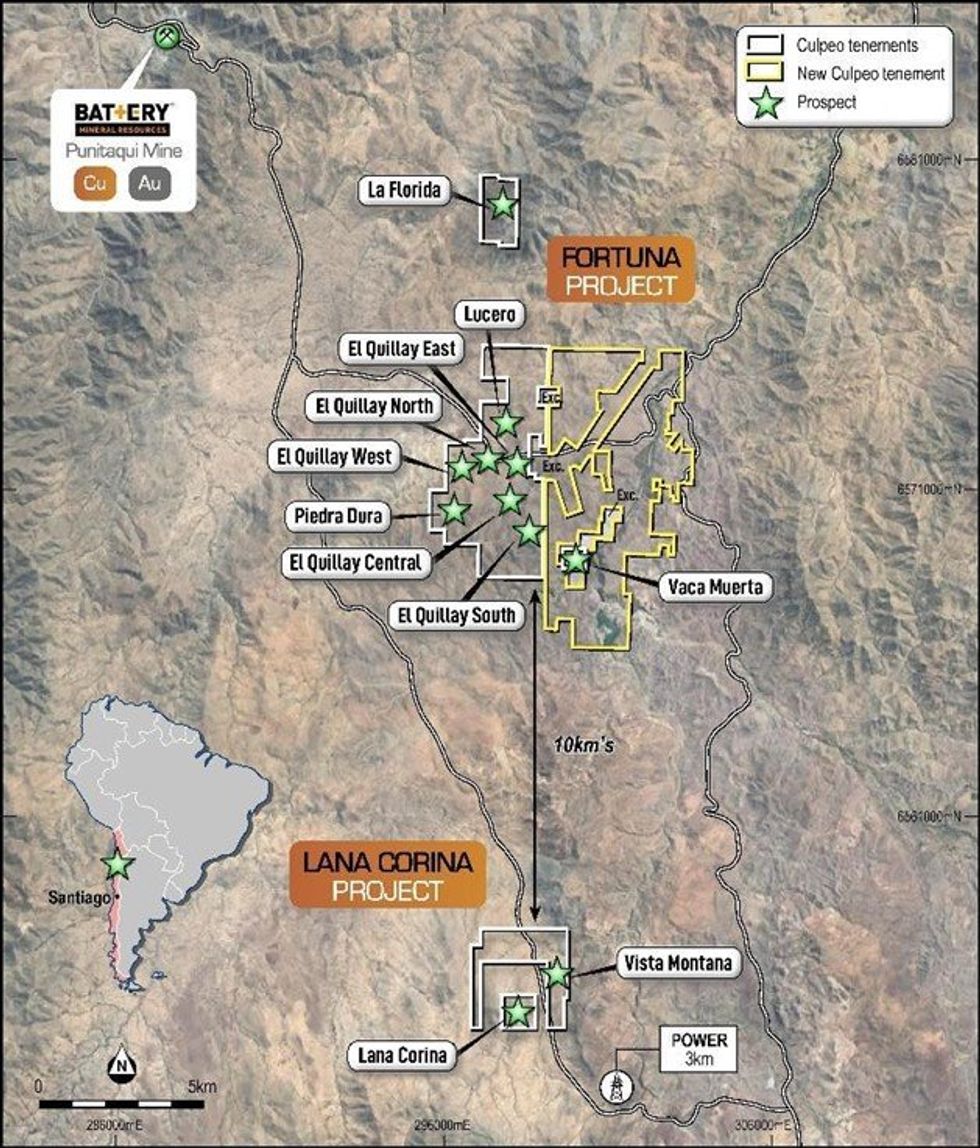

During the Quarter, Culpeo’s exploration activities were primarily focused on the Fortuna Project, targeting mineralisation along strike and proximate to the El Quillay Fault zone which has been identified to host copper and gold mineralisation over a strike length of >3km.

La Florida Prospect

The La Florida Prospect is a newly defined north-south trending belt of copper-gold mineralisation located within the northern sector of the Fortuna Project, measuring approximately 1.7km long by 0.5km wide (Figure 2). Mineralisation is hosted within andesitic volcanic rocks that have been intruded by quartz- feldspar porphyry lithologies. During the Quarter, a litho-geochemical survey was undertaken to characterise the nature and extent of the mineralised system. Rock chip samples were collected in areas including historic small scale mine workings, outcrop and subcrop on hills where bedrock/fresh rock was visible. All 14 rock chip samples returned anomalous copper and gold results, as shown in Appendix C.

The best copper result of 3.96% Cu was returned from CPO0008688, located in the northern part of the interpreted porphyry system where strong surface mineralisation was identified in the form of malachite and chrysocolla. This sample also returned a gold result of 1.17g/t Au. Of significance was CPO0008692, which returned high-grade copper and gold at 3.18% Cu and 2.61g/t Au1. The sample was taken from historical workings in fresh, unoxidised mineralisation.

Click here for the full ASX Release

This article includes content from Culpeo Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CPO:AU

The Conversation (0)

03 April 2024

Culpeo Minerals

Exploring High-grade Outcropping Copper-Gold Projects in Chile

Exploring High-grade Outcropping Copper-Gold Projects in Chile Keep Reading...

26 February

T2 Metals Acquires High-Grade Aurora Gold-Silver Project in the Yukon from Shawn Ryan

Past Drilling Results Include 3.4m @ 24.45 g/t Au at AJ Prospect

T2 Metals Corp. (TSXV: TWO) (OTCQB: TWOSF) (WKN: A3DVMD) ("T2 Metals" or the "Company") is pleased to announce signing of an Option Agreement (the "Option") with renowned explorer Shawn Ryan ("Ryan") and Wildwood Exploration Inc. (together with Ryan, the "Optionor") to earn a 100% interest in... Keep Reading...

25 February

Copper Prices Rally on Tariff Fears, Weak US Dollar

Copper prices continue to rise, driven by supply and demand fundamentals and boosted by tariff fears.Prices for the red metal reached a record high on January 29, and while they have since moderated somewhat, several factors have injected fresh concerns and volatility into the market.Among them... Keep Reading...

25 February

Top 10 Copper-producing Companies

Copper miners with productive assets have much to gain as supply and demand tighten. The price of copper reached new all-time highs in 2026 on both the COMEX in the United States and the London Metals Exchange (LME) in the United Kingdom. In 2025, the copper price on the COMEX surged during the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00