Highlights:

- Filed the Mineral Resources Statement in compliance with the National Instrument 43-101 Standards that defines the large and high-grade Mineral Resources at the Ferguson Lake Project (Figure 1 and 2). 80% of the Indicated Mineral Resource is Open Pit, which provides a solid Mineral Resource base for the initial development of a potential large mine.

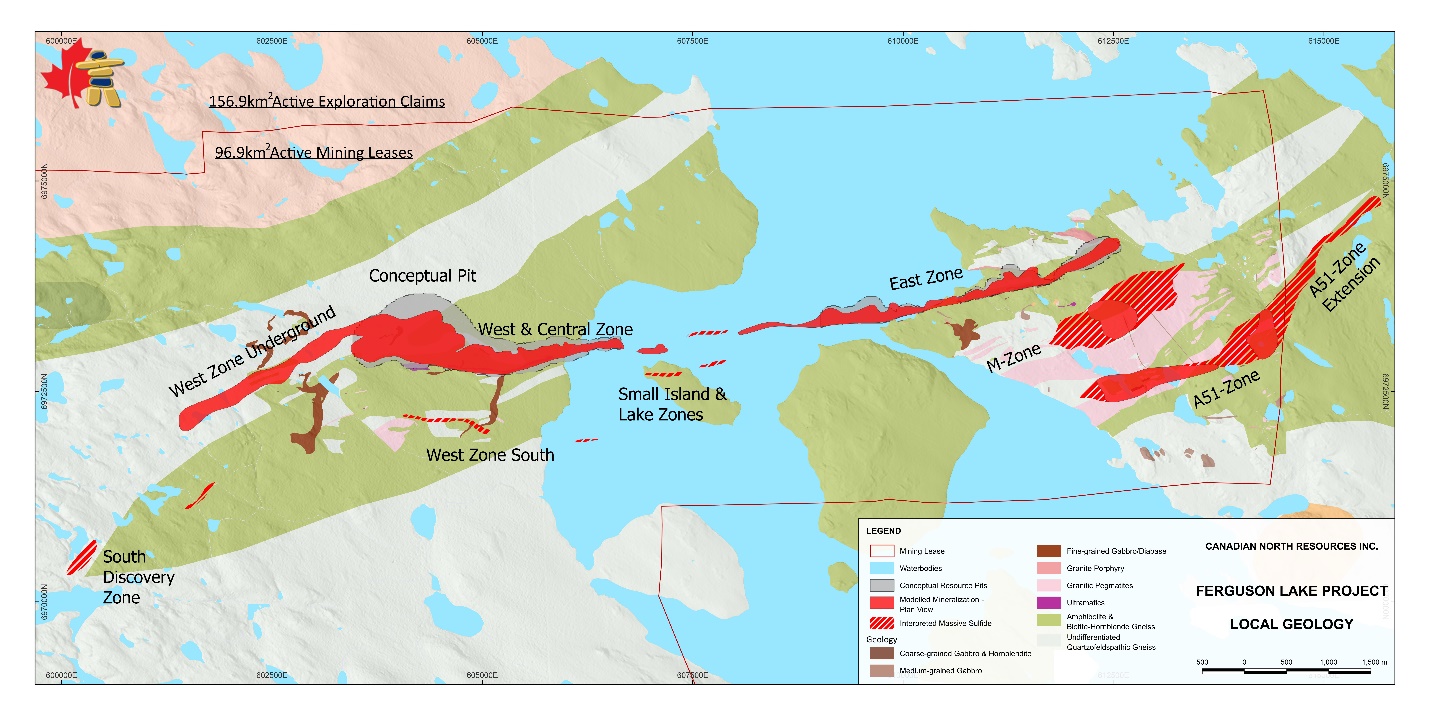

- Identified new targets with significant resource upside potential along strike and down dip of the 15 km long main mineralized horizon and on additional zones including M-Zone, A51-Zone, A51 Zone Extension, Small Island and Lake Zone, West Zone South and South Discovery Zone (Figure 1).

- Planned new metallurgical tests, economic evaluation and infrastructure and environmental studies for low-carbon footprint mine development at the Ferguson Lake Project.

Canadian North Resources Inc. ("Canadian North" or the "Company") (TSXV: CNRI; OTCQX: CNRSF; FSE: EO0 (E-O-zero)) is pleased to report its operational and financial results for the first quarter ended March 31, 2024.

"During this quarter, we filed the Mineral Resource Statement and subsequently the new NI43-101 Technical Report, which included the results of 39,270 meter drilling programs completed during 2022-23 (Refer to "Independent Technical Report on the Mineral Resource Estimate for the Ferguson Lake Project, Nunavut, Canada ("the Technical Report")", prepared by SRK Consulting and Ronacher McKenzie Geoscience Inc., effective March 19, 2024, filed by the Company to the System for Electronic Document Analysis and Retrieval (" SEDAR+" ) through the Internet at https://www.sedarplus.ca/landingpage/ on May 3, 2024. The Technical Report has also been posted on the Company's website at www.cnresources.com )." Said Dr. Kaihui Yang, the President and CEO, "The result demonstrates that the Ferguson Lake project is one of the highest-grade and largest undeveloped copper, nickel, cobalt, palladium and platinum projects in North America, and possesses high potential for resource expansion along the strike and down dip of the 15-main mineralized horizon and within a number of undefined mineralization zones and prospective areas."

"We will continue to build up the shareholders' value." Dr. Yang added, "We will expand the mineral resources from surface to the depth of 1,200 meter along the confirmed the high-grade mineralized zones at the Ferguson Lake Project. We will also conduct more metallurgical testing, including new technologies such as bio-hydrometallurgy, and commence economic evaluation, infrastructure and environmental studies for a low-carbon footprint mine development plan at the Ferguson Lake Project."

Figure 1, Geological map showing mineralization zones. The Mineral Resources incorporate West, Central and East Zones.

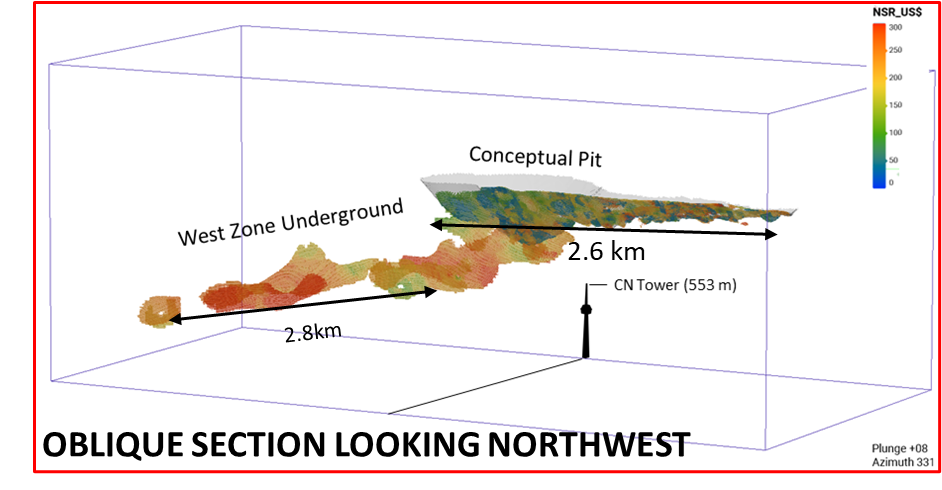

Figure 2, the 3D model of the mineral resources for the West and Central Zones of the Ferguson Lake Project

Quarter 1 of 2024 Highlights:

- The Company ended the quarter with cash and cash equivalents of $ 4,749,941

- The Company engaged in the following activities in the first quarter:

- January 2, 2024, the Company reported the results from the processing of Borehole Time-Domain Electromagnetic (BHTEM) surveys from deep West Zone drillholes FL22-481A and FL23-481B completed at its 100% owned Ferguson Lake Project. The results demonstrate the continuance of the West Zone greater than 200 metres beyond the historically defined down-dip drilled extent of the zone and show its open potential for continued expansion both laterally and further down-dip at depths of 650 to >800 metres. The Company also announced that Dr. Trevor Boyd was retired from the VP Exploration and would continue to be a Technical Advisor and QP for the Company.

- January 18, 2024, the Company announced that its IR team would attend the Vancouver Resource Investment Conference (the VRIC) in Vancouver on January 21-22, 2024. During and after the VRIC, the IR team would do the roadshows to the investors in Vancouver.

- February 27, 2024, the Company announced that its participation in the Prospectors and Developers Association of Canada (PDAC) in Toronto on March 3-6, 2024. Dr. Kaihui Yang, the President of CEO was invited to present an overview of the Company and its Ferguson Lake project at the Corporate Presentation Forum for Investors ("CPFI"). During and after the PDAC, the IR team would do the roadshows to the investors in Toronto.

- March 19, 2024, the Company announced an updated Mineral Resource estimate for its 100% owned Ferguson Lake project. The updated Mineral Resources includes (1) a 172% increase of Indicated Mineral Resources to 66.1 million tonnes (Mt) containing 1,093 million pounds (Mlb) copper at 0.75%, 678Mlb nickel at 0.47%, 79Mlb cobalt at 0.05%, 2.34 million ounces (Moz) palladium at 1.10 g/t and 0.42Moz platinum at 0.19 g/t, of which 80% is the Open pit Indicated Mineral Resources with 52.7Mt at 0.65% Cu, 0.43% Ni, 0.05% Co, 0.97g/t Pd and 0.17% Pt; (2) an Inferred Mineral Resources of 25.9Mt containing 558Mlb copper at 0.98%, 333Mlb nickel at 0.58%, 40Mlb cobalt at 0.07%, 1.12Moz palladium at 1.43 g/t and 0.21Moz platinum at 0.25 g/t. The updated Mineral Resource Model shows the successful major upgrade of Mineral Resource tonnages from Inferred to Indicated category combined with continued expansion of overall Mineral Resource size along strike and down / up dip, and the potential for continued Mineral Resource expansion along strike and at depth over the 15 km long main mineralized horizon and within the open satellite mineralized zones.

- March 21, 2024, the Company announced the amendment on the exercise price of options to purchase a total of 1,600,000 Common Shares from $2.45 to $1.70 per share, for options previously granted to consultants to the Corporation.

- For the quarter ended March 31, 2024, the Company reported a net loss and comprehensive loss of $791,061 or $0.01 per share.

Subsequent to Quarter 1, the Company achieved the following:

- April 3, 2024, the Company provided an update for the metallurgical testing programs. Metallurgical flotation and gravity test results indicate the reasonable probability of producing three payable copper, nickel and PGM bearing concentrates from the various types of mineralized materials that comprise its National instrument 43-101 Mineral Resource of the Ferguson Lake Project, suggesting a potential low-capital cost option for the project development. Alternatively, hydrometallurgy is considered as an effective option albeit with higher capital and operating cost. The Company will focus on follow-up investigations using new technologies for metal extraction.

- April 5, 2024, the Company announced that it has filed with the TSX Venture Exchange a Notice of Intention to Make a Normal Course Issuer Bid ("NCIB") which will commence on April 10, 2024 and terminate on April 9, 2025 or the earlier of the date all shares which are subject to the Normal Course Issuer Bid are purchased. In the opinion of the Board of Directors of the Company, the market price of the Common Shares does not accurately reflect the value of those shares. As a result, the Company intends to repurchase CNRI's Common Shares that may become available for purchase at prices, which make them an appropriate use of funds of the Company. The Company intends to attempt to acquire up to an aggregate of 5,726,380 of its Common Shares over the next 12-month period, representing approximately 5% of the issued and outstanding Common Shares of CNRI.

- April 24, 2024, the Company filed the annual financial results and operational updates for 2023. During the year, the Company raised over $17 million for exploration, with cash and cash equivalents of $5,540,312 at the year end. The Company completed an aggressive exploration program with 21,126 meters drilled in 2023 for a cumulative total of 39,270 meters in 145 holes of new diamond drilling to the project database for the updated Mineral Resources estimation reported on March 19, 2024. The statement of the updated Mineral Resources demonstrates the Ferguson Lake project is one of the highest-grade and largest undeveloped critical mineral projects in North America. The Company plans to continue drilling to expand the mineral resources and to conduct follow-up metallurgical testing, commence economic evaluation, infrastructure and environmental studies for a low-carbon footprint mine development plan at the Ferguson Lake Project.

- May 6, 2024, the Company filed the Independent Technical Report on the Mineral Resources Estimation for the Ferguson Lake project. The Technical Report supports the definition of the large and high-grade Mineral Resource at the Ferguson Lake Project, including 52.7Mt of high-grade open pit Indicated Mineral Resources at 0.65% Cu, 0.43% Ni, 0.05% Co, 0.97g/t Pd and 0.17% Pt, which provides a solid Mineral Resource base for the initial development of a potential large mine. Mineral Resources are estimated for West, Central and East Zones along the 15km-long main mineralized horizon. The Mineral Resource model indicates potential for continued Mineral Resource expansion along strike and at depth over the mineralized horizon. Significant resource upside potential outside the main mineralized zone is also anticipated when sufficient grid definition drilling is completed on additional zones including M-Zone, A51-Zone, A51 Zone Extension, West Zone South and South Discovery Zone.

For the quarter end Financial Statement and Management's Discussion and Analysis, please see the Company website at www.cnresources.com or on SEDAR.

Qualified Person:

Dr. Trevor Boyd, P.Geo. and Technical Advisor for Canadian North Resources, a qualified person as defined by Canadian National Instrument 43-101 standards, has reviewed the technical content of this news release and has approved its dissemination.

About Canadian North Resources Inc.

Canadian North Resources Inc. is an exploration and development company focusing on the critical metals for the clean-energy, electric vehicles, battery and high-tech industries. The company is advancing its 100% owned Ferguson Lake nickel, copper, cobalt, palladium, and platinum project in the Kivalliq Region of Nunavut, Canada.

The Ferguson Lake mining property contains a substantial National Instrument 43-101 compliant Mineral Resource Estimate announced on March 19 2024, which include Indicated Mineral Resources of 66.1 million tonnes (Mt) containing 1,093 million pounds (Mlb) copper at 0.75%, 678Mlb nickel at 0.47%, 79.3Mlb cobalt at 0.05%, 2.34 million ounces (Moz) palladium at 1.10gpt and 0.419Moz platinum at 0.19gpt; and Inferred Mineral Resources of 25.9Mt containing 558Mlb copper at 0.98%, 333Mlb nickel at 0.58%, 39.6Mlb cobalt at 0.07%, 1.192Moz palladium at 1.43gpt and 0.205Moz platinum at 0.25gpt. In particular, 80% of the Indicated Mineral Resources is Open Pit with 52.7Mt at 0.65% Cu, 0.43% Ni, 0.05% Co, 0.97g/t Pd and 0.17% Pt, which provides a solid Mineral Resource base for the initial development of a potential large mine. The Mineral Resource model indicates significant potential for resource expansion along strike and at depth over the 15 km long mineralized belt and a number of undefined mineralization zones and prospective areas. (Refer to "Independent Technical Report on the Mineral Resource Estimate for the Ferguson Lake Project, Nunavut, Canada ("the Technical Report")", prepared by SRK Consulting and Ronacher McKenzie Geoscience Inc., effective March 19, 2024, filed by the Company to the System for Electronic Document Analysis and Retrieval (" SEDAR+" ) through the Internet at https://www.sedarplus.ca/landingpage/ on May 3, 2024. The Technical Report has also been posted on the Company's website at www.cnresources.com .)

For further information please visit the website at www.cnresources.com , or contact:

Dr. Kaihui Yang, President and CEO

Phone: 905-696-8288 (Canada) 1-888-688-8809 (Toll-Free)

Email: info@cnresources.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

Certain statements contained in this news release, including statements which may contain words such as "expects", "anticipates", "intends", "plans", "believes", "estimates", or similar expressions, and statements related to matters which are not historical facts, are forward-looking information within the meaning of applicable securities laws. Such forward-looking statements, which reflect management's expectations regarding the Company's future growth, results of operations, performance, business prospects and opportunities, are based on certain factors and assumptions and involve known and unknown risks and uncertainties which may cause the actual results, performance, or achievements to be materially different from future results, performance, or achievements expressed or implied by such forward-looking statements.

These factors should be considered carefully, and readers should not place undue reliance on the Company's forward-looking statements. The Company believes that the expectations reflected in the forward-looking statements contained in this news release and the documents incorporated by reference herein are reasonable, but no assurance can be given that these expectations will prove to be correct. In addition, although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. The Company undertakes no obligation to release publicly any future revisions to forward-looking statements to reflect events or circumstances after the date of this news or to reflect the occurrence of unanticipated events, except as expressly required by law.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/cf0138be-71cb-4530-872b-9d4a21bc3585

https://www.globenewswire.com/NewsRoom/AttachmentNg/0f42e24b-4197-44ad-a024-b236539f637a