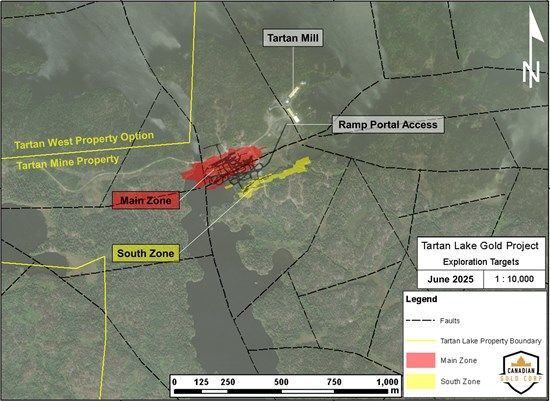

Canadian Gold Corp. (TSXV: CGC) ("Canadian Gold" or the "Company") is pleased to announce ongoing drill results from its Phase 4 drill program at the 100%-owned Tartan Mine, near Flin Flon, Manitoba. Results contained in this news release are from the South Zone, which is parallel to the Main Zone (Fig. 1, 2 & 3), and prior to the recent drilling, was planned as a supplemental source of potential ore for future production. However, our objective has been to expand the resource in this area to 1) increase the number of ounces per vertical metre, 2) allow for higher production in a potential mine restart, and 3) drive economies of scale in order to lower future production and development costs. Recent expansion results from the South Zone, which increased the vertical extent of the mineralization by 120%, included 9.4 gpt gold over 3.3 metres and 6.1 gpt gold over 6.0 metres.

"Today's results continue to build on the potential we see emerging at the South Zone. Despite the ongoing forest fire evacuation orders of Flin Flon and the surrounding region, including Tartan, our geology team, working diligently offsite, were able to get these encouraging drill results completed. Significant rainfall and cooler temperatures in the region over recent days have helped the firefighting crews and reduced the scope of the forest fires. We eagerly await the 'all clear' from the Province of Manitoba to be able to get back on site and resume the Phase 4 drill program." - Michael Swistun, CFA, President & CEO

Drilling Highlights:

Hole TLSZ25-35 intersected two separate high-grade gold zones, returning 12.9 gpt gold over 3.0 metres and 7.6 gpt gold over 5.8 metres, both occurring within broader zones of 3.7 gpt gold over 23.0 metres and 3.3 gpt gold over 17.2 metres, respectively.

Similar to the Main Zone's lower grade material, the Company will be evaluating how best to mine and process this material within the potential mine life to best maximize the financial returns of the project.

The identification of two distinct zones opens a new target for exploration not previously known at the South Zone.

This development could materially increase the South Zone's total ounces per vertical metre, enhancing project economics and supporting a larger-scale restart scenario at the Tartan Mine.

These intersections occur in separate intervals within the same hole, confirming the presence of two discrete zones of gold mineralization between 345 and 376 metres below surface, a new geological development not previously observed at the South Zone.

Forest Fire Update

On May 28, 2025, the Company temporarily suspended drilling at the Tartan Mine due to safety concerns related to the forest fires near Flin Flon. The Company will announce when it is safe to resume drilling.

Table 1. Drilling Assay Highlights

| Drill Hole | From (metres) | To (metres) | Interval1 (metres) | Depth Below Surface (metres) | Gold Grade (gpt) | Zone2 |

| TLSZ25-34 | 463.00 | 464.00 | 1.00 | 403 | 12.3 | SZ |

| TLSZ25-35 | 210.00 | 214.00 | 4.00 | 172 | 4.4 | HWZ |

| Including | 212.00 | 213.00 | 1.00 | 10.9 | ||

| And | 410.20 | 427.40 | 17.20 | 345 | 3.3 | SZ |

| Including | 410.20 | 416.00 | 5.80 | 7.6 | ||

| Including | 415.00 | 416.00 | 1.00 | 26.2 | ||

| And | 450.00 | 473.00 | 23.00 | 376 | 3.7 | |

| Including | 457.00 | 460.00 | 3.00 | 12.9 | ||

| Including | 457.00 | 458.00 | 1.00 | 21.0 | ||

| And including | 467.00 | 470.00 | 3.00 | 385 | 5.7 | |

| TLSZ25-37 | 167.00 | 169.00 | 2.00 | 4.3 | SZ | |

| Including | 168.00 | 169.00 | 1.00 | 7.0 | ||

| And | 172.00 | 175.50 | 3.50 | 3.0 | ||

| Including | 174.50 | 175.50 | 1.00 | 5.9 | ||

| 1Interval widths reported; true widths of the system are not yet known due to lack of drilling.2 SZ and HWZ refers to the South Zone and Hanging Wall Zone. | ||||||

Table 2. Details of Drill Holes Reported in This News Release

| Drill Hole | Azimuth (Degrees) | Dip (Degrees) | Length (metres) | Easting (UTM) | Northing (UTM) |

| TLSZ25-33W1 | 002 | -66 | 686 | 324852 | 6081843 |

| TLSZ25-33W2 | 002 | -66 | 686 | 324852 | 6081843 |

| TLSZ25-34 | 358 | -61 | 557 | 324851 | 6081848 |

| TLSZ25-35 | 002 | -57 | 503 | 324881 | 6081867 |

| TLSZ25-36 | 002 | -54 | 599 | 324919 | 6081839 |

| TLSZ25-37 | 359 | -50 | 239 | 324784 | 6081959 |

For Further Information, Please Contact:

Michael Swistun, CFA

President & CEO

Canadian Gold Corp.

(204) 232-1373

info@canadiangoldcorp.com

Social Media Accounts:

X (Twitter)

Instagram

Facebook

LinkedIn

Qualified Person

The scientific and technical information disclosed in this news release was reviewed and approved by Wesley Whymark, P. Geo., Consulting Geologist for the Company, and a Qualified Person as defined under National Instrument 43-101.

Technical Information

The samples collected by Canadian Gold Corp. described in this news release were transported in secure sealed bags for preparation and assay by ALS Labs in Thunder Bay, Ontario. The samples reported are NQ size ½ core samples crushed in their entirety to 80% passing -10 mesh, with one 500 g subsample split analysed for gold by PhotonAssay.

About Canadian Gold Corp.

Canadian Gold Corp. is a Canadian-based mineral exploration and development company whose objective is to expand the high-grade gold resource at the past producing Tartan Mine, located in Flin Flon, Manitoba. The historic Tartan Mine currently has a 2017 indicated mineral resource estimate of 240,000 oz gold (1,180,000 tonnes at 6.32 g/t gold) and an inferred estimate of 37,000 oz gold (240,000 tonnes at 4.89 g/t gold). The Company also holds a 100% interest in greenfields exploration properties in Ontario and Quebec adjacent to some of Canada's largest gold mines and development projects, specifically, the Canadian Malartic Mine (QC), the Hemlo Mine (ON) and Hammond Reef Project (ON). McEwen Mining Inc. (NYSE: MUX)) (TSX: MUX) holds a 5.7% interest in Canadian Gold, and Robert McEwen, the founder and former CEO of Goldcorp, and Chairman and CEO of McEwen Mining, holds a 32.8% interest in Canadian Gold.

CAUTION REGARDING FORWARD-LOOKING INFORMATION

This news release of the Company contains statements that constitute "forward-looking statements." Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Canadian Gold's actual results, performance or achievements, or developments in the industry to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements.

Figure 1. Tartan Mine Plan Map illustrating the location of the Main and South Zones.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3276/255015_e434725b04c079c3_001full.jpg

Figure 2. Tartan Mine - South Zone Longitudinal Section illustrating the location of holes reported in this release.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3276/255015_e434725b04c079c3_002full.jpg

Figure 3. Tartan Mine - Main Zone Longitudinal Section (from Feb 18, 2025 press release).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3276/255015_e434725b04c079c3_003full.jpg

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/255015