- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

February 03, 2022

Burin Gold Corp. (“Burin Gold” or the “Company”) (TSX-V:BURG) is pleased to announce that drilling operations have commenced at its Hickey’s Pond – Paradise Gold Project (“HPP Project”) on the Burin Peninsula in southeastern Newfoundland. The first of two planned diamond drills has been mobilised to site and has started drilling at the Hickey’s Pond prospect. A minimum of 10,000 m of diamond drilling is planned for the property in 2022. This will include the first phase of a resource definition program at Hickey’s Pond, as well as exploration drilling of several of the other high priority, yet to be drill tested targets on the property. The program is fully funded, with approximately CAD 5.6 million currently in the Company treasury.

Hickey’s Pond drilling program

Drilling has commenced on the historical Hickey’s Pond showing. The Company’s initial scout drilling in 2020 obtained a best result of 10.8 m of 4.43 g/t Au within a larger interval of 58.25 m of 1.12 g/t Au in hole HP-20-002 (see Bonavista Resources news release of February 24, 2021). Overall, the footprint of the alteration system around Hickey’s Pond is over 7 km in strike length, and less than 10% of this has received even cursory drill testing.

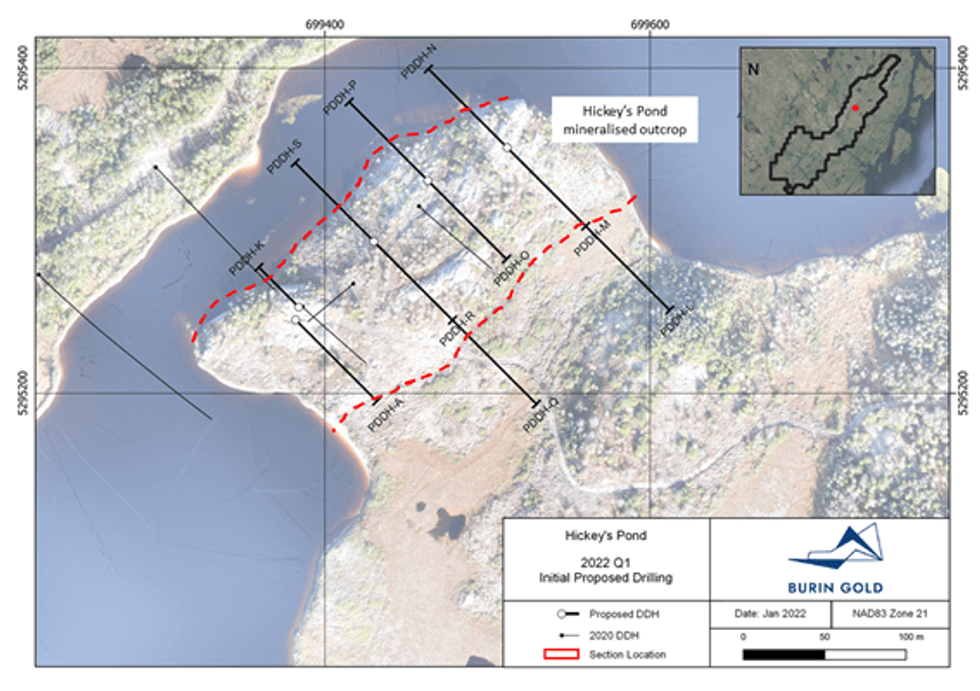

The first ten drill holes of the 2022 program will be located on the Hickey’s Pond showing, as follow-up drilling to the Company’s 2020 scout drill holes. The new holes are designed to both expand the footprint of mineralisation along strike, provide infill drilling for resource modelling, and test down-dip of the mineralised structure for continuity of mineralisation to depth. A map of planned drilling on the Hickey’s Pond knob is given in Figure 1, showing systematic drill testing of the mineralised outcrop. A total of 1,900 m in ten diamond drill holes are planned for the area of the historical showing, drilled on four 50 m spaced sections.

Burin Gold’s Chief Executive Officer, David Clark PGeo, said: “I am pleased that our exploration team in Newfoundland has mobilised a diamond drill quickly to start our 2022 drill program. We have many excellent targets to test, so an early start will maximise the amount of drilling we can complete this year at Hickey’s Pond and elsewhere on the property. We anticipate that, with current assay laboratory backlogs, gold assay results for the first drill holes should be available in mid-April. However, our 2020 drill program has given us a good understanding of the appearance of the mineralised units at Hickey’s Pond, so while gold assay results are pending, we should be able to keep our shareholders updated with geological descriptions of alteration and mineralisation observed in the drill holes.”

Second diamond drill mobilisation

A second diamond drill is planned for mobilisation in the next two weeks. The selection of drill targets for the second drill will be dependent on the long-term weather forecast for the remainder of winter on the Burin Peninsula. Along-strike drilling at Hickey’s Pond to quickly expand the footprint of alteration and mineralisation and early testing of other undrilled high priority targets are both planned; the order of drilling will proceed in the most efficient manner possible.

Airborne geophysical survey update

Geotech Ltd. continue their airborne geophysical survey over the property. Survey equipment failures and bad weather have slowed production significantly. The Company expects the survey to be completed in the coming weeks.

About Burin Gold Corp.

Burin Gold is a recently listed public company on the TSX Venture Exchange. The Company’s principal asset is its Hickey’s Pond-Paradise Gold Project on the Burin Peninsula, Newfoundland. This project contains the Hickey’s Pond gold prospect, drill tested with an initial 1,000 m drill program in 2020 with best results of 10.8 m of 4.43 g/t Au, as well as numerous other historical high-sulphidation epithermal gold showings that have yet to be drill tested. With the successful completion of its IPO, the Company is well-positioned to commence a significant diamond drilling campaign at the Hickey’s Pond prospect, planned to start Q1/2022.

Qualified Person

David Clark, MSc, PGeo, Chief Executive Officer of Burin Gold, is the Company’s designated Qualified Person within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). He has prepared the technical content of this news release.

Acknowledgement

The Company acknowledges the financial assistance of the Mineral Development Division, Department of Industry, Energy, and Technology, Government of Newfoundland & Labrador, via its Junior Exploration Assistance Program. The program provides valuable financial rebates on exploration expenditures made in the province to qualifying exploration companies. The Company has benefited from the program yearly since 2018.

On behalf of the Board

“David Clark”

CEO & Director

Forward Looking Statements

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This News Release includes certain “forward-looking statements” which are not comprised of historical facts. Forward looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management’s expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, the Company’s objectives, goals or future plans, statements, exploration results, potential mineralization, the estimation of mineral resources, exploration and mine development plans, timing of the commencement of operations and estimates of market conditions. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to failure to identify mineral resources, failure to convert estimated mineral resources to reserves, the inability to complete a feasibility study which recommends a production decision, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, inability to fulfill the duty to accommodate First Nations and other indigenous peoples, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital and operating costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry, an inability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to the effects of COVID-19 on the price of commodities, capital market conditions, restriction on labour and international travel and supply chains, and those risks set out in the Company’s public documents filed on SEDAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

BURG:CA

The Conversation (0)

5h

Flow Metals to Acquire the Monster IOCG Project in Yukon

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to report that it has entered into an option agreement dated February 9, 2026 (the "Option Agreement") with Go Metals Corp. ("Go Metals") to acquire the Monster IOCG project (the "Monster Project"), located approximately 90... Keep Reading...

17h

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

18h

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

18h

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

19h

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

19h

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00