- WORLD EDITIONAustraliaNorth AmericaWorld

Overview

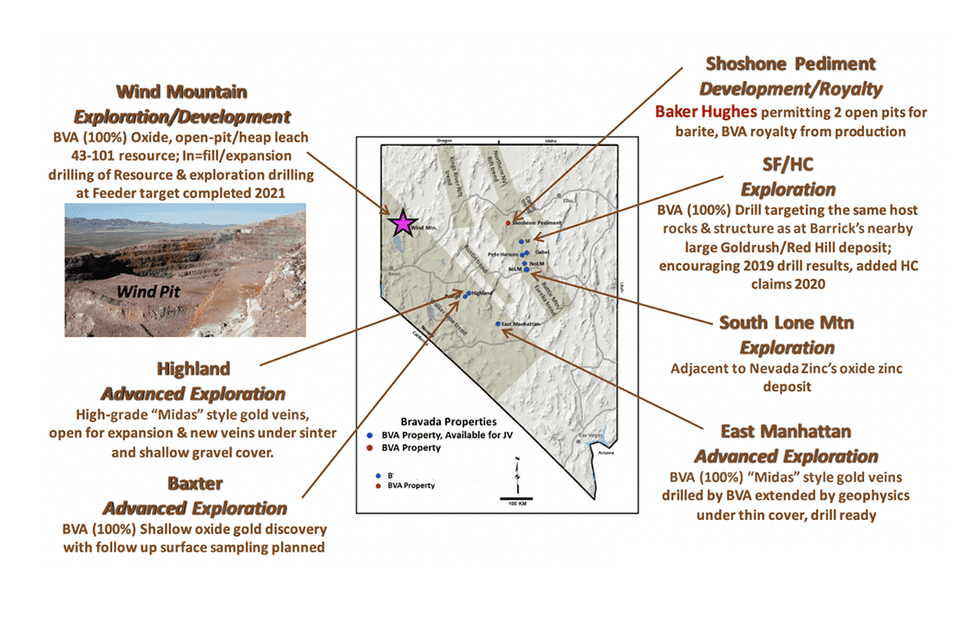

Bravada (TSXV:BVA,OTCQB: BGAVF) is an exploration company with a portfolio of high-quality properties in Nevada, one of the best mining jurisdictions in the world. Bravada has successfully identified and advanced properties with the potential to host high-margin deposits while successfully attracting partners to fund later stages of project development.

The company’s value is underpinned by a substantial gold and silver resource with a positive preliminary economic assessment (PEA) at Wind Mountain, and the company has significant upside potential from possible new discoveries at its exploration properties.

Since 2005, the company entered into 32 earn-in joint-venture agreements for its properties with 19 publicly traded companies, as well as a similar number of property-acquisition agreements with private individuals. Bravada currently has 10 projects in its portfolio, consisting of 810 claims for approximately 6,500 hectares in the Battle Mountain/Eureka and Walker Lane Trends, two of Nevada’s most prolific gold trends. Most of the projects host encouraging drill intercepts of gold and already have drill targets developed. Several videos are available on the company’s website that describe Bravada’s major properties, responding to investor’s commonly asked questions. Simply click on this link.

Get access to more exclusive Gold Investing Stock profiles here