April 19, 2023

Siren Gold Limited (ASX: SNG) (Siren or the Company) is pleased to announce a Maiden JORC (2012) Mineral Resource Estimate (MRE) for the Big River Gold Project in New Zealand.

Highlights

- The Big River gold project consists of 6 identified gold mineralised shoots across more than 500m of strike, with potential to discover additional high-grade shoots.

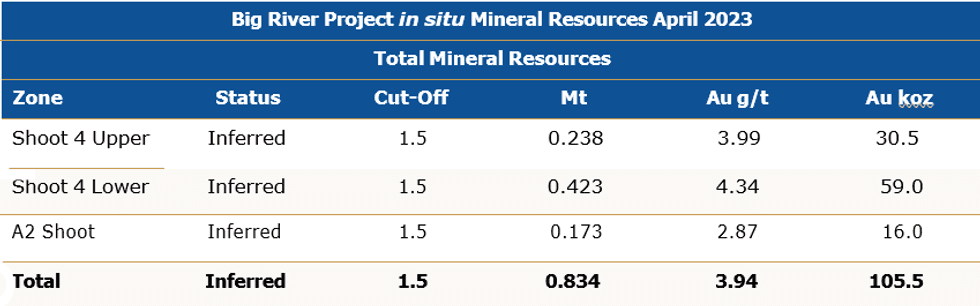

- Maiden 105koz Resource at 3.94g/t Au defined from 2 of these 6 shoots (A2 Shoot and Shoot 4)

- Big River deposit remains open in all directions with significant potential for increased gold resources from additional exploration drilling.

- Gold soil geochemistry shows large untested anomalies at Big River mine and an untested 3km long anomaly from the Golden Hill prospect to St George in the south.

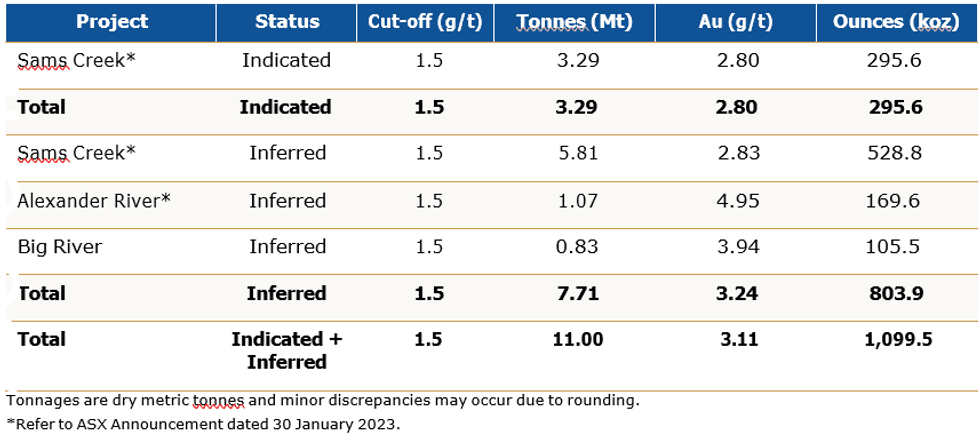

- Siren’s Global Mineral Resource now stands at 1.1Moz at 3.1g/t Au (100% basis).

Background

The Big River project (comprised of Exploration Permit 60448) is located ~15 kms SE of Reefton. The project overlays the areas of the historic Big River Mine which produced ~136,000 oz of gold at an average recovered grade of 34g/t between 1880 and 1942 (Figure 1).

The historic underground mine workings have been modelled in 3D and this, coupled with historic mine reports, shows that four main ore shoots were mined around the Sunderland anticline (Figure 2). Shoot 1 was mined to Level 4, Shoot 2 to Level 6, Shoot 3 to Level 12 and Shoot 4 to Level 7, when the mine closed in 1942. Two new potential shoots, the A2 and Prima Donna, are located east and west of the Big River mine. The A2 shoot, Big River Mine and Prima Donna shoot combined cover a strike length of around 500m, which is overlaid by anomalous gold and arsenic soil geochemistry.

Diamond drilling commenced at the Big River project in 2011 when OceanaGold Limited (OGL) drilled 26 holes for a total of 5,032.6m. Siren commenced drilling in October 2020 and initially drilled 16 holes for a total of 2,743m.

Drilling was focused on Shoots 4 and A2. Previous drillhole results that intersected Shoot 4 include BR03 (2m @ 12.1g/t Au), BR04 (4m @ 4.4g/t Au from 128m and 6.6m @ 21.4g/t Au from 136m), BR09 (3m @ 18.5g/t Au from 147m and 4m @ 7.8g/t Au from 158m), BR12 (3m @ 5.4g/t Au from 170m and 3m @ 2.0g/t Au from 205m), BR27 (6m @ 5.1g/t Au), BR34 (5.9m @ 4.1g/t Au) and BR35 (6.3m @ 3.4g/t Au from 374.8m).

The A2 shoot is in a second anticline 200m to the west of the Sunderland anticline that hosts the Big River mine. Mapping and channel sampling identified outcropping quartz reef up to 1m thick surrounded by sulphide-rich sediments containing lenses of massive sulphide in the footwall. Channel sampling indicates that the quartz reef is relatively low grade, but the footwall mineralisation assayed up to 11g/t Au. Seven shallow diamond holes drilled into the A2 Shoot tested 100m along strike to a depth of around 25-50m. Drillhole BR20 intersected 5.0m @ 4.2g/t Au from 24m and BR31 intersected 3.4m @ 2.5g/t Au from 41m. BR22 - BR24 were drilled on a second structure 30m to the west. These holes intersected a 10m wide zone with lower grade gold mineralisation but with the same high arsenic and sulphur mineralisation. BRDDH023 has very high sulphur, averaging 10.9% over 8m, with a high of 36% over 1m. These results are encouraging and indicate a strongly mineralised system near surface.

The deeper drilling in the A2 Shoot indicates that the shoot has a slightly shallower plunge than previously interpreted and that drillholes BR40 and BR41 intersected the footwall. Drillholes BR37 (5.2m @ 6.3g/t Au from 213m), BR41 (6m @ 1.5g/t Au from 252m) and BR39 (10m @ 1.2g/t Au from 271m, including 3m @ 2.5g/t Au) have extended the A2 Shoot to around 250m below the surface.

SNG:AU

The Conversation (0)

18 March 2024

Siren Gold

Exploring Highly Prospective Gold Assets in A Historic New Zealand Mining District

Exploring Highly Prospective Gold Assets in A Historic New Zealand Mining District Keep Reading...

18h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

19h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00