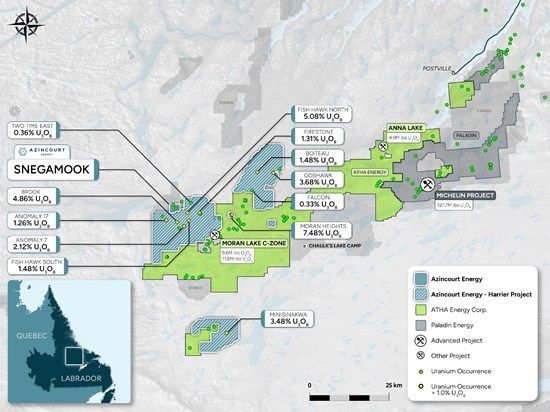

- High-Grade Targets: The Harrier Project hosts over a dozen uranium zones with surface samples up to 7.48% U₃O₈, and 10 zones above 1% U₃O₈

- Snegamook Uranium Deposit: A key near-term drill target with historical intersections of 20-50 m wide uranium-bearing zones; an updated NI 43-101 resource is planned for 2026.

- Under-Explored: Only 124 historical drill holes have been completed, leaving strong discovery potential.

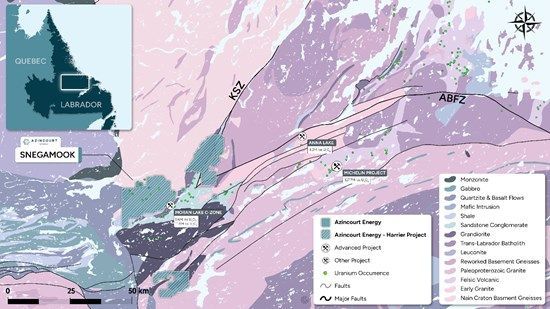

- Large-Scale Land Position: The 49,400-hectare Project is one of the largest land positions in the Central Mineral Belt, and is directly adjacent to Paladin Energy's Michelin and Atha Energy's Moran Lake and Anna Lake projects.

azincourt energy corp. (TSXV: AAZ,OTC:AZURF) (OTCQB: AZURF) ("azincourt" or the "Company"), is pleased to announce that the introductory work program has commenced on the Harrier Project in the Central Mineral Belt in Labrador, Canada.

azincourt's Harrier Project — which includes its previously acquired Snegamook deposit — covers 49,400 hectares over five distinct licence groups, representing one of the largest land positions in the Central Mineral Belt. The Harrier Project straddles key uranium-bearing structural corridors directly adjacent to and on trend with Atha Energy's Moran Lake and Anna Lake projects, and Paladin Energy's Michelin project — placing azincourt at the center of a proven and growing uranium camp.

The Harrier Project, with over a dozen known uranium mineralization zones and surface rock samples grading up to 7.48% U₃O₈ (and >1.0% U₃O₈ in 10 distinct zones), offers a rare combination of grade, scale, and geological continuity. Notably, only 124 drill holes (19,851 metres total, over half of this on the former Snegamook project area) have ever been completed across the combined property — leaving ample opportunity for new discovery with modern methods.

The introductory work program is underway and consists of up to three weeks of helicopter supported reconnaissance of existing identified uranium occurrences and prospecting of previously identified radiometric anomalies. The purpose of this program is to expand the target inventory on the project and prepare the higher priority targets for diamond drilling.

A high priority target for diamond drilling is the Snegamook Uranium Deposit, where drilling in 2007 and 2008 to follow up a radon gas anomaly identified uranium mineralization located 1.3 km along strike to the southeast of the Two Time Zone (Indicated and Inferred resource of 5.55 Mlb U3O8, Silver Spruce Resources, June 2008). 17 drill holes intersected a 20 to 50 m wide section of uranium bearing brecciated and altered monzodiorite with moderate to strong chlorite, hematite and carbonate alteration, the same geological setting as the Two Time Zone. (Figure 3)

In 2008 a preliminary resource estimate for the Snegamook Zone was prepared by Silver Spruce Resources, however it was never finalized in a report or filed. Preparing an updated NI 43-101 compliant resource for this deposit will be a priority in conjunction with the 2026 field program.

"I am excited to get into the field with the crew and see what we have at the Harrier Project," commented Trevor Perkins, Vice President of Exploration. "We are eager to get working on this underexplored land package in the center of the CMB and see where we can take it," continued Mr. Perkins.

Figure 1: azincourt land position overlain on the geology of the Central Mineral Belt, Labrador, Canada

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6137/262275_1a98eb3264fdab5a_002full.jpg

Figure 2: azincourt's Harrier Project.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6137/262275_1a98eb3264fdab5a_003full.jpg

Figure 3: Snegamook and Two Time Zone mineralization map

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6137/262275_1a98eb3264fdab5a_004full.jpg

About the Central Mineral Belt

Labrador's Central Mineral Belt ("CMB") is one of Canada's most underexplored yet highly prospective uranium regions. Known for its numerous uranium and base metal deposits and showings, the CMB has seen renewed interest due to growing global demand for secure, domestic uranium supply as countries aim to increase nuclear power capacity to meet net-zero emissions goals.

The CMB hosts multiple large-scale uranium discoveries, including Paladin Energy's Michelin Uranium Project (127.7 million lbs U₃O₈), the Moran Lake C Deposit (historical resource of 9.6 Mlbs U₃O₈ and 11.8 Mlbs V₂O₅), and the Anna Lake Deposit (historical resource of 4.9 Mlbs U₃O₈). These known resources demonstrate the Belt's exceptional uranium endowment — but vast areas remain underexplored, with modern techniques only recently being applied across the region.

With its stable jurisdiction, historical high-grade discoveries, and modern exploration momentum, the CMB is emerging as one of North America's most exciting uranium exploration corridors.

Qualified Person

The technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 and reviewed and approved on behalf of the Company by C. Trevor Perkins, P.Geo., Vice President, Exploration of Azincourt Energy, and a Qualified Person as defined by National Instrument 43-101.

About azincourt energy corp.

azincourt is a Canadian-based resource company specializing in the strategic acquisition, exploration, and development of alternative energy/fuel projects, including uranium, lithium, and other critical clean energy elements. The Company is currently active at its East Preston uranium project located in the Athabasca Basin, Saskatchewan, and its Snegamook and Harrier uranium projects, located in the Central Mining Belt of Labrador.

*The historical results, interpretation and drill intersections described here in have not been verified and are extracted from news releases issued by Silver Spruce Resources Inc on April 24, 2008, and August 12, 2008, as well as annual Management Discussion and Analysis documents filed on www.sedarplus.ca, and Koba Resources Limited on April 11, 2024, and August 20, 2024, which can be found at https://kobaresources.com/investors/asx-announcements/. The Company has not completed sufficient work to confirm and validate any of the historical data contained in this news release. The Company considers the historical work a reliable indication of the potential of the Harrier Project and the information may be of assistance to readers.

The information on the Michelin, Morin Lake C, and Anna Deposits has been extracted from the websites and investor presentations of Paladin Energy Limited and Atha Energy Corp.

ON BEHALF OF THE BOARD OF azincourt energy corp.

"Alex Klenman"

Alex Klenman, President & CEO

For further information please contact:

Alex Klenman, President & CEO

Tel: 604-638-8063

info@azincourtenergy.com

azincourt energy corp.

1430 - 800 West Pender Street

Vancouver, BC V6C 2V6

www.azincourtenergy.com

Cautionary Statement Regarding Forward-Looking Statements

This news release may contain certain "Forward-Looking Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws. When or if used in this news release, the words "anticipate", "believe", "estimate", "expect", "target, "plan", "forecast", "may", "schedule" and similar words or expressions identify forward-looking statements or information. Such statements represent the Company's current views with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political, and social risks, contingencies and uncertainties. Many factors, both known and unknown, could cause results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements. The Company does not intend, and does not assume any obligation, to update these forward-looking statements or information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements and information other than as required by applicable laws, rules, and regulations.

Neither the TSX Venture Exchange nor its regulation services provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/262275