July 08, 2025

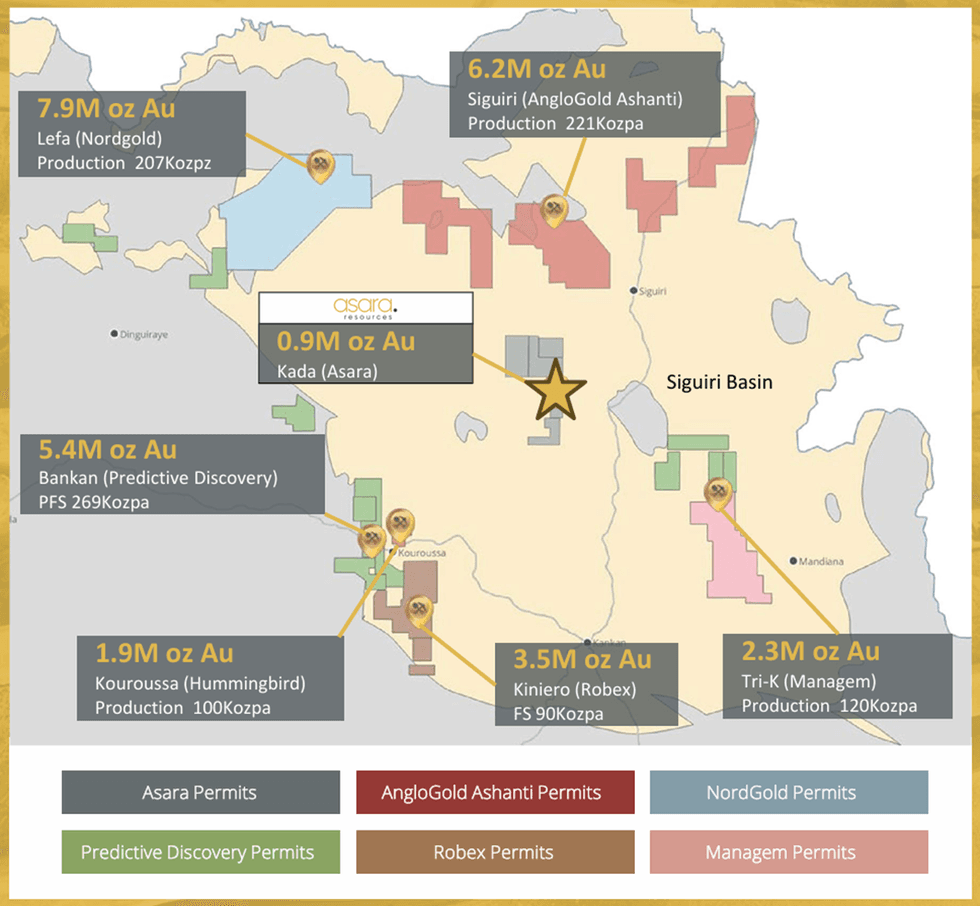

Asara Resources (ASX:AS1,FSE:ALM) is leading the next West African gold rush from a strategic position in Guinea’s underexplored Siguiri Basin—an emerging gold district with over 30 million ounces of historical and current gold production.

Asara Resources’ flagship Kada Kold project hosts a 923,000-ounce, oxide-dominant gold resource just 35 km south of AngloGold Ashanti’s 6.2 Moz Siguiri mine. The company is systematically advancing development using the proven “string-of-pits” model that has driven success across West Africa, guided by a seasoned team behind the Kiniero Project, now a cornerstone asset for Robex (TSX:RBX).

Asara’s near-term strategy focuses on three key priorities: accelerating resource growth with 33,600 metres of RC and diamond drilling planned for 2025; advancing a low-CAPEX, oxide-first development approach that capitalizes on free-dig saprolite, strong gold recoveries, and a conventional CIL flowsheet; and preserving upside exposure to copper and silver-zinc through its Loreto joint venture with Teck and the optional Paguanta asset in Chile.

Company Highlights

- Flagship Kada gold project – 923,000 oz gold and counting: 30.3 Mt @ 0.95 g/t gold with 59 percent oxide-transition ounces that show over 90 percent CIL recoveries and <3.5:1 strip ratio; resource remains open in every direction along a 15 km corridor.

- Aggressive growth runway: Three contiguous licence applications (Talico, Banan and Syli) would lift the land package to 348 sq km and extend strike control to 35 km, only ~6 percent of which is drilled.

- Experienced team who took the Kiniero project from an exploration resource to construction: Senior executives previously turned Robex’s Kiniero from 1 Moz to ~3.5 Moz and into a C$750 million market cap company, bringing an identical on-ground team, in-country relationships and proven workflows to Asara.

- Strategic Land Package: Kada is in the heart of the prolific Siguiri Basin (>30 Moz gold endowment), just 35 km south of AngloGold Ashanti’s Siguiri Mine.

- Strong Institutional Support: Top 20 shareholders control 70+ percent of the company.

This Asara Resources profile is part of a paid investor education campaign.*

Click here to connect with Asara Resources (ASX:AS1) to receive an Investor Presentation

AS1:AU

Sign up to get your FREE

Asara Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

07 July 2025

Asara Resources

Advancing the next West African gold camp from the heart of Guinea’s prolific Siguiri Basin

Advancing the next West African gold camp from the heart of Guinea’s prolific Siguiri Basin Keep Reading...

19 February

Massan Indicated Conversion Programme Continues to Deliver

Asara Resources (AS1:AU) has announced Massan indicated conversion programme continues to deliverDownload the PDF here. Keep Reading...

26 January

Drilling confirms grade continuity at depth and along strike

Asara Resources (AS1:AU) has announced Drilling confirms grade continuity at depth and along strikeDownload the PDF here. Keep Reading...

22 January

Quarterly Activities and Cashflow Report - December 2025

Asara Resources (AS1:AU) has announced Quarterly Activities and Cashflow Report - December 2025Download the PDF here. Keep Reading...

04 January

Ongoing Drilling Continues to Return Broad Gold Intercepts

Asara Resources (AS1:AU) has announced Ongoing drilling continues to return broad gold interceptsDownload the PDF here. Keep Reading...

08 December 2025

Asara Expands Kada Gold Project

Asara Resources (AS1:AU) has announced Asara Expands Kada Gold ProjectDownload the PDF here. Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Asara Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Obonga Project: Wishbone VMS Update

27 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00