(TheNewswire)

Vancouver, British Columbia TheNewswire - October 8, 2025 Arizona Gold & Silver Inc. (TSXV: AZS,OTC:AZASF) ( OTCQB:AZASF ) is pleased to announce high-grade antimony samples from the Silverton gold-antimony project located in Nye County, Nevada, immediately north of US Highway 6, between Tonopah and Ely. Silverton hosts two target types: a Carlin-type large tonnage gold system, and an overlying high-grade antimony+gold-silver veins that are well exposed at surface.

AZS has initiated exploration to focus on the antimony potential of the project given that antimony is a "critical metal" currently trading at US$57.50/lb.

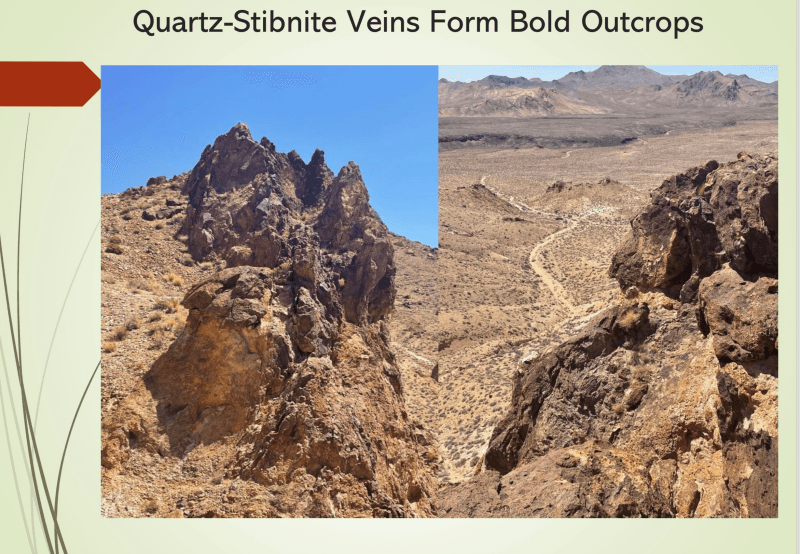

Figure 1. Outcrop Examples of Quartz-Stibnite veins

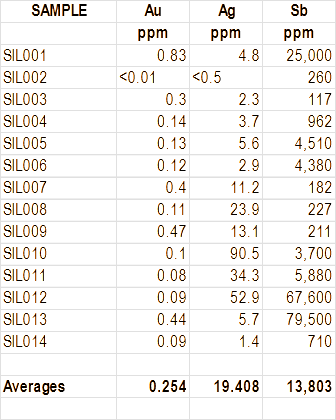

Recent Chip Sampling Results

In 2002-2004 the project was controlled by Newcrest Resources who completed a shallow drilling program targeting the bulk tonnage gold potential of the site. As Newcrest did not consider over-limits, the objective of this sampling program was to determine the ultimate antimony content of some of the historic +10,000 ppm Sb outcrop samples.

AZS collected 14 samples across stibnite-quartz veins and adjacent silicified and argillized ash flow tuff where previous sample tags could be found in the field. Sample lengths ranged from 7.5 to 61.0 centimeters across stibnite-bearing veins. The highest grade of 7.95% Sb came from a vein 25.4 centimeters wide. The average of all fourteen samples was 1.38% Sb, including non-vein material. The rock chip samples were taken across a strike length of 500 metres and a width of 300 metres. The results demonstrate the size of the antimony target present on the property. Sample preparation and analyses were done by ALS Global Labs. Sample preparation was done at their sample prep facility in Tucson, Arizona. MS-ICP analyses were done at their analytical facility in Vancouver, BC. Over-limits for antimony were done at their laboratory in Loughrea, Ireland. The individual results are tabulated below. The samples contain anomalous gold and silver along with anomalous to high-grade antimony. Gold was determined by fire assays with an AA finish. Silver was determined by ICP analyses.

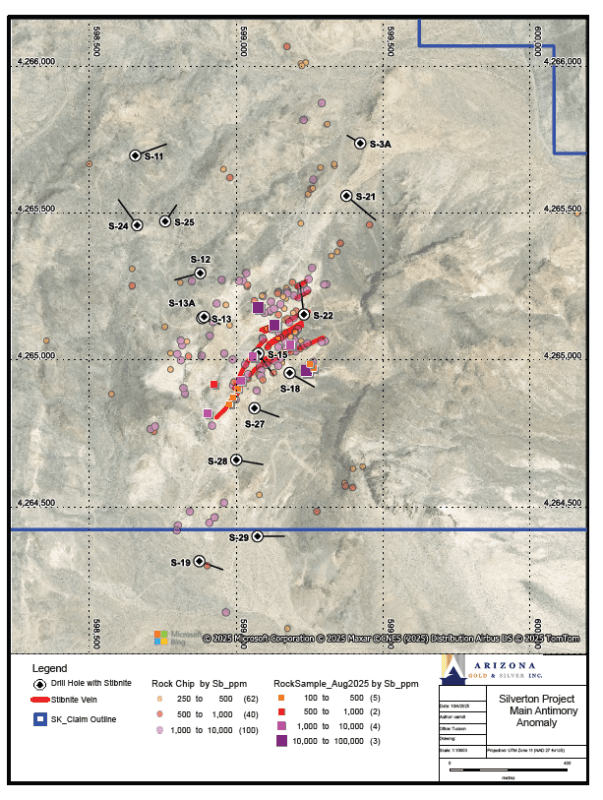

Figure 2. High-Grade Stibnite Quartz Vein

Antimony at the Silverton Project

The Silverton property database contains multi-element geochemistry from over 2000 rock samples collected primarily by previous companies, mostly by Newcrest Resources Inc., between 2002-2004. The database has over 25 surface samples that contain greater than 1% antimony (Sb), for which they did not assay the over-limits, 95 surface samples greater than 1000 ppm Sb, and 217 surface samples greater than 200 ppm (Figure 3). Samples with anomalous antimony values also contain 0.1 to +1.0 grams per tonne gold values.

Newcrest Resources Inc. had all surface samples prepared and analyzed at ALS Labs in Sparks, NV. Gold was determined by Au-AA23 method which is a 30-gram fire assay analysis with AA finish. Trace metals, including antimony, were determined by the ME-ICP41 method, which is a four-acid digestion using ICP analyses to report 41 elements. Over-limits >10,000 ppm were not determined. Samples consisted of both rock chip and channel samples of unknown weight or length. Drill hole samples were analyzed by Chemex Labs, in Reno, NV. Chemex has since been incorporated into ALS Labs. Coarse bladed stibnite is visible in all vein samples containing high antimony values (Figure 2).

Figure 3: Sample Locations Containing High Antimony Values

Newcrest Resources drilled 15 RC (reverse circulation) percussion holes that all contained anomalous antimony values, including one hole (S-18) which intersected 20 feet at +1% Sb (they did not assay the over-limits) between 100-120 feet (30-5-36.6 metres) depth. Historic geologic mapping on the property identified numerous discrete quartz-stibnite veins and stringers but the price of antimony was too low to specifically target these vein swarms with drilling. The Company has re-assessed the quartz-stibnite vein occurrences and has identified a zone roughly +900 metres by 400 metres that shows up on satellite imagery as highly clay-altered. That zone hosts the preponderance of quartz-stibnite veins and stockworks (Figure 3).

Drilling Program Permitted

The US Bureau of Land Management has accepted the financial guarantee to cover the reclamation attendant to a proposed drilling program of 27 reverse circulation drill holes from 17 drill pads. Road and drill pad construction and drilling can commence at any time.

Qualified Person

Gregory Hahn, VP-Exploration and a Certified Professional Geologist (#7122) is a Qualified Person under National Instrument 43-101 ("NI 43-101") and has reviewed and approved the technical information contained in this news release.

About Arizona Gold & Silver Inc.

Arizona Gold & Silver Inc. is a leading exploration company focused on uncovering precious metal resources in Arizona and Nevada. With a commitment to sustainable practices and innovative exploration techniques, the company aims to drive value for stakeholders while prioritizing environmental stewardship. The flagship asset is the Philadelphia gold-silver property where the Company is drilling off an epithermal gold-silver system ahead of an initial resource calculation.

On behalf of the Board of Directors:

ARIZONA GOLD & SILVER INC.

Mike Stark, President and CEO, Director

Phone: (604) 833-4278

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

This news release includes certain forward-looking statements or information. All statements other than statements of historical fact included in this release are forward-looking statements that involve various risks and uncertainties. Forward-looking statements in this news release include statements in relation to the timing, cost and other aspects of the 2024 exploration program; the potential for development of the mineral resources; the potential mineralization and geological merits of the exploration properties; and other future plans, objectives or expectations of the Company. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's plans or expectations include the risk that actual results of current and planned exploration activities, including the results of the Company's 2025 drilling program(s) on its properties, will not be consistent with the Company's expectations; the geology, grade and continuity of any mineral deposits and the risk of unexpected variations in mineral resources, grade and/or recovery rates; fluctuating metals prices; possibility of accidents, equipment breakdowns and delays during exploration; exploration cost overruns or unanticipated costs and expenses; uncertainties involved in the interpretation of drilling results and geological tests; availability of capital and financing required to continue the Company's future exploration programs and preparation of geological reports and studies; delays in the preparation of geological reports and studies; the metallurgical characteristics of mineralization contained within the exploration properties are yet to be fully determined; general economic, market or business conditions; competition and loss of key employees; regulatory changes and restrictions including in relation to required permits for exploration activities (including drilling permits) and environmental liability; timeliness of government or regulatory approvals; and other risks detailed herein and from time to time in the filings made by the Company with securities regulators. In connection with the forward-looking information contained in this news release, the Company has made numerous assumptions, including that the Company's 2025 programs would proceed as planned and within budget. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as otherwise required by applicable securities legislation.

Copyright (c) 2025 TheNewswire - All rights reserved.