April 29, 2025

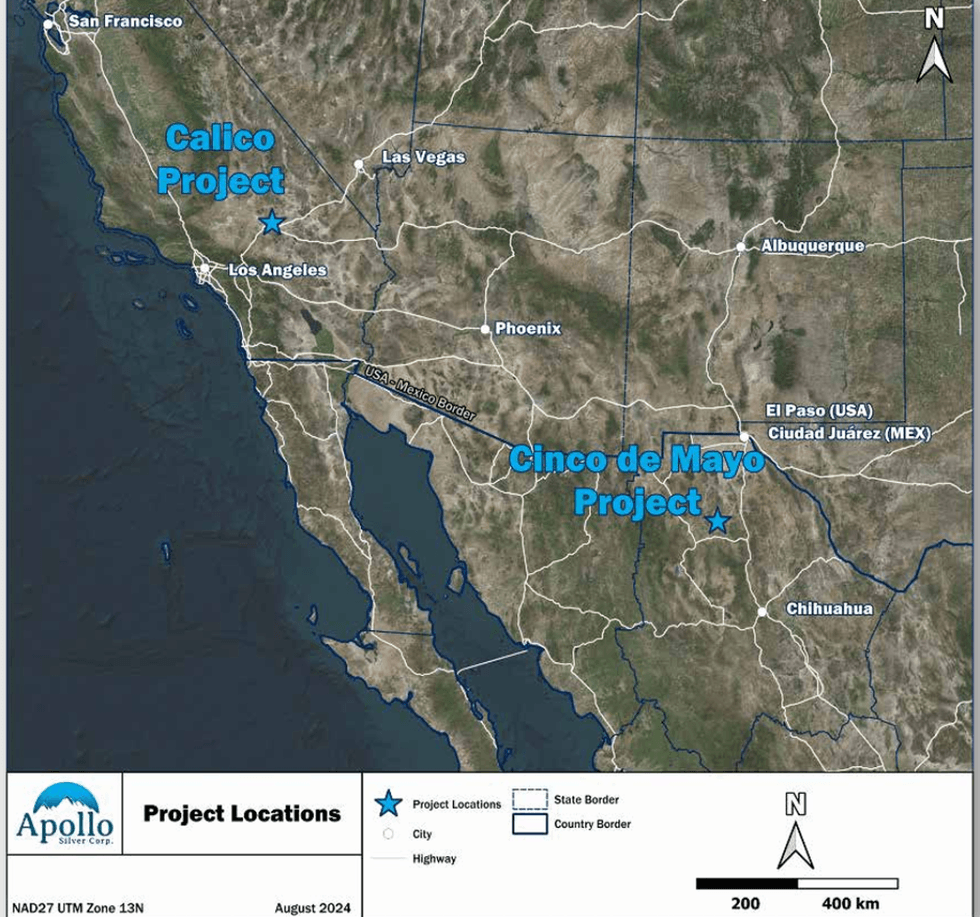

Apollo Silver (TSXV:APGO,OTCQB:APGOF,FSE:6ZF0) is a silver-focused exploration company advancing a dual-asset strategy through two high-potential projects in North America: the Calico Silver Project in California, USA, and the Cinco de Mayo project in Chihuahua, Mexico. Both projects are situated in mining-friendly jurisdictions with robust infrastructure and a history of significant exploration work.

At Calico, Apollo Silver advances the Waterloo deposit through geological modeling, barite resource definition, and engineering studies. Calico hosts 110 Moz of silver (measured and indicated) and 51 Moz (inferred), with recent test work producing a 94.6 percent barite concentrate.

In Mexico, the Cinco de Mayo project offers rare optionality, featuring a historical inferred resource of 154 Moz silver equivalent (385 g/t) and a high-impact discovery opportunity at the Pegaso Zone. Under an option agreement with MAG Silver, Apollo is executing a 20,000-meter drill program to earn full ownership of the project.

Project locations

Project locationsThe Calico Silver Project, located 15 km from Barstow, California, includes the adjacent Waterloo and Langtry properties. Calico hosts a combined resource of 110 Moz silver (measured and indicated, 100 g/t) and 51 Moz silver (inferred, 77 g/t). The shallow, laterally extensive deposit offers strong geologic continuity and a low 1.1:1 strip ratio, supporting a potential low-impact open-pit operation. Recent drilling confirmed a 95 percent conversion rate from inferred to measured and indicated resources at Waterloo.

Company Highlights

- Tier-1 US Silver Asset – Calico Project: Hosts 110 Moz silver (measured and indicated) and 51 Moz silver (inferred), making it the largest undeveloped primary silver deposit in the US.

- High-grade Discovery Potential – Cinco de Mayo: An option to acquire a district-scale carbonate replacement deposit with a historical inferred resource of 154 Moz silver equivalent at 386 g/t, offering further upside from the Pegaso Zone discovery target.

- Barite Critical Minerals Exposure: Calico includes a historical in-ground barite estimate of 4.5 Mt, with 2023 flotation tests producing 94.6 percent barite concentrate, meeting US estimates API specifications for petroleum drilling fluids.

- Strategic Shareholder Registry: Backed by Jupiter Asset Management, Eric Sprott, Terra Capital, Commodity Capital and Ninepoint.

- Experienced Leadership Team: Proven M&A, discovery and capital markets expertise with over $5 billion in past transactions and most applicable to Apollo Silver, the success at Prime Mining.

This Apollo Silver profile is part of a paid investor education campaign.*

Click here to connect with Apollo Silver (TSXV:APGO) to receive an Investor Presentation

APGO:CA

Sign up to get your FREE

Apollo Silver Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

22 October 2025

Apollo Silver

Advancing two significant silver projects in the US and Mexico

Advancing two significant silver projects in the US and Mexico Keep Reading...

27 February

Obonga Project: Wishbone VMS Update

Panther Metals Plc (LSE: PALM), the exploration company focused on mineral projects in Canada, is pleased to provide an update for the Obonga Project's Wishbone Prospect which is an emerging and highly prospective base metal volcanogenic massive sulphide ("VMS") system in Ontario,... Keep Reading...

26 February

Agadir Melloul Mining Licence

Critical Mineral Resources is pleased to announce that a Mining Licence has been awarded for Agadir Melloul, marking an important step forward as the Company accelerates development towards production.The Mining License is 14.6km 2 and covers Zone 1 North and Zone 2, which remain the focus of... Keep Reading...

26 February

EIA Approval for Agdz Cu-Ag Project and Funding

Aterian plc (AIM: ATN), the Africa-focused critical metals exploration company, is pleased to announce the approval of it's recently commissioned Environmental Impact Assessment (''EIA'') for the 100%-owned Agdz Mining Licence, part of the Agdz ("Cu-Ag") Project ("Agdz" or the "Project") in the... Keep Reading...

25 February

Clem Chambers: I Sold My Gold and Silver, What I'm Buying Next

Clem Chambers, CEO of aNewFN.com, explains why he sold his gold and silver, and where he's looking next, mentioning the copper and oil sectors. He also speaks about the importance of staying positive as an investor: "The media negativity is the most wealth-crushing thing you can fall for. So be... Keep Reading...

25 February

What Was the Highest Price for Silver?

Like its sister metal gold, silver has been attracting renewed attention as a safe-haven asset. Although silver continues to exhibit its hallmark volatility, a silver bull market is well underway. Experts are optimistic about the future, and as the silver price's momentum continues in 2026,... Keep Reading...

23 February

Stefan Gleason: Silver Wakeup in the West — What's Happening, What's Next

Stefan Gleason, CEO of Money Metals, breaks down recent silver and gold dynamics, discussing trends in the US retail market, as well as backups at refineries. While the situation has begun to normalize, he sees potential for further disruptions in the future. Don't forget to follow us... Keep Reading...

Latest News

Sign up to get your FREE

Apollo Silver Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00