November 28, 2024

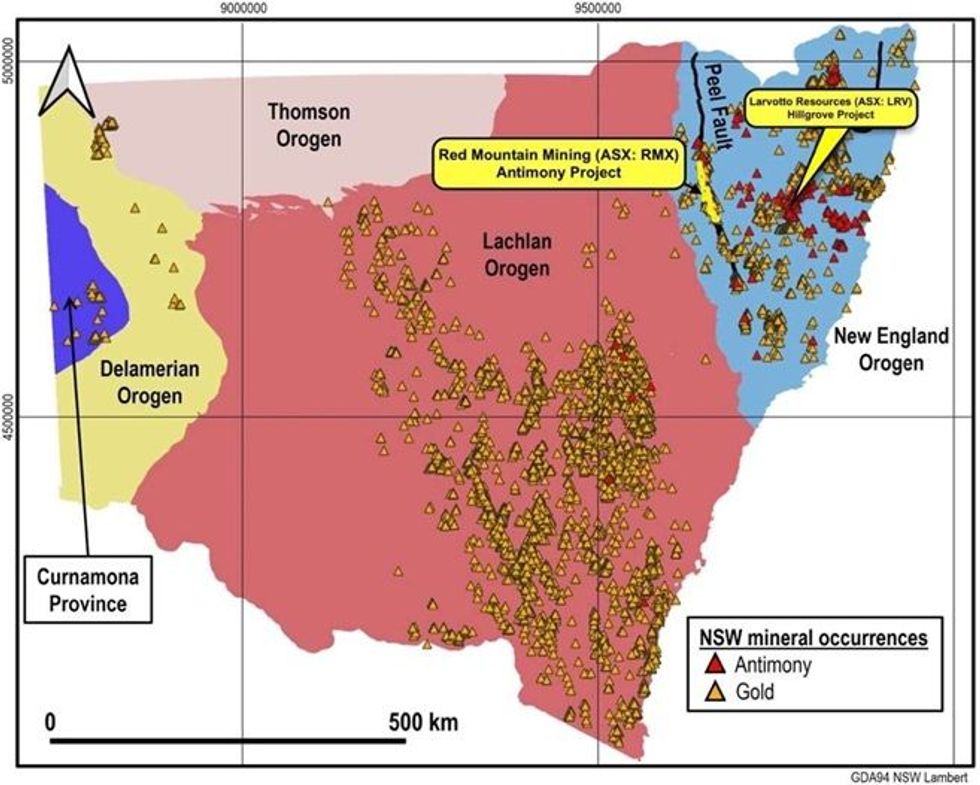

Red Mountain Mining Limited (“RMX” or the “Company”) is pleased to announce the receipt of a Notice of Proposed Grant of Exploration Licence (relating to ELA6810) from the NSW Department of Primary Industries. The project encompasses 391km2 of prospective ground within the Southern New England Orogen (SNEO) in northeastern New South Wales. The SNEO is recognised as Australia’s premier Antimony province (Figure 1). Antimony occurs in hydrothermal quartz veins, breccias and stockworks, often with associated gold and/or tungsten mineralisation.

HIGHLIGHTS

- Exploration Licence to be granted for a period of six years and covering a significant package of 391 km2 of prospective ground within the Southern New England Orogen of NSW, Australia’s premier Antimony Province

- The tenement extends over an 85km strike extent of the Peel Fault System, a known mineralised structural corridor, and includes multiple known Antimony and Gold mineral occurrences

- The best reported historical results to date include 465ppm Sb and 0.224ppm Au

- Given limited previous exploration these historical sampling results represent a significant greenfield discovery opportunity for Antimony and Gold

- Antimony prices have surged to ~US$33,500 per metric ton* as of 21 November following China’s recent export ban on a wide range of Antimony products

Figure 1: Known NSW Gold and Antimony mineral occurrences relative to basement orogenic units. The map clearly demonstrates the prospectivity of the New England Orogen for Antimony and Gold. The location of the Hillgrove Deposit, Peel Fault and ELA6810 are also shown.*Argus Media, Sb ingot min 99.65% fob China 21/11/2024 (https://www.argusmedia.com/metals-platform/metal/minor-and-specialty-metals-antimony).

The Hillgrove project (ASX: LRV) is approximately 20km east of Armidale, is Australia’s largest known Antimony deposit. The mine has recorded production of over 730,000 oz of gold and over 50,000 tonnes of Antimony and a remaining resource of 1.7Moz Au equivalent at a grade of 7.4g/t Au equivalent, including 90,000 tonnes of Antimony, with significant exploration upside1.

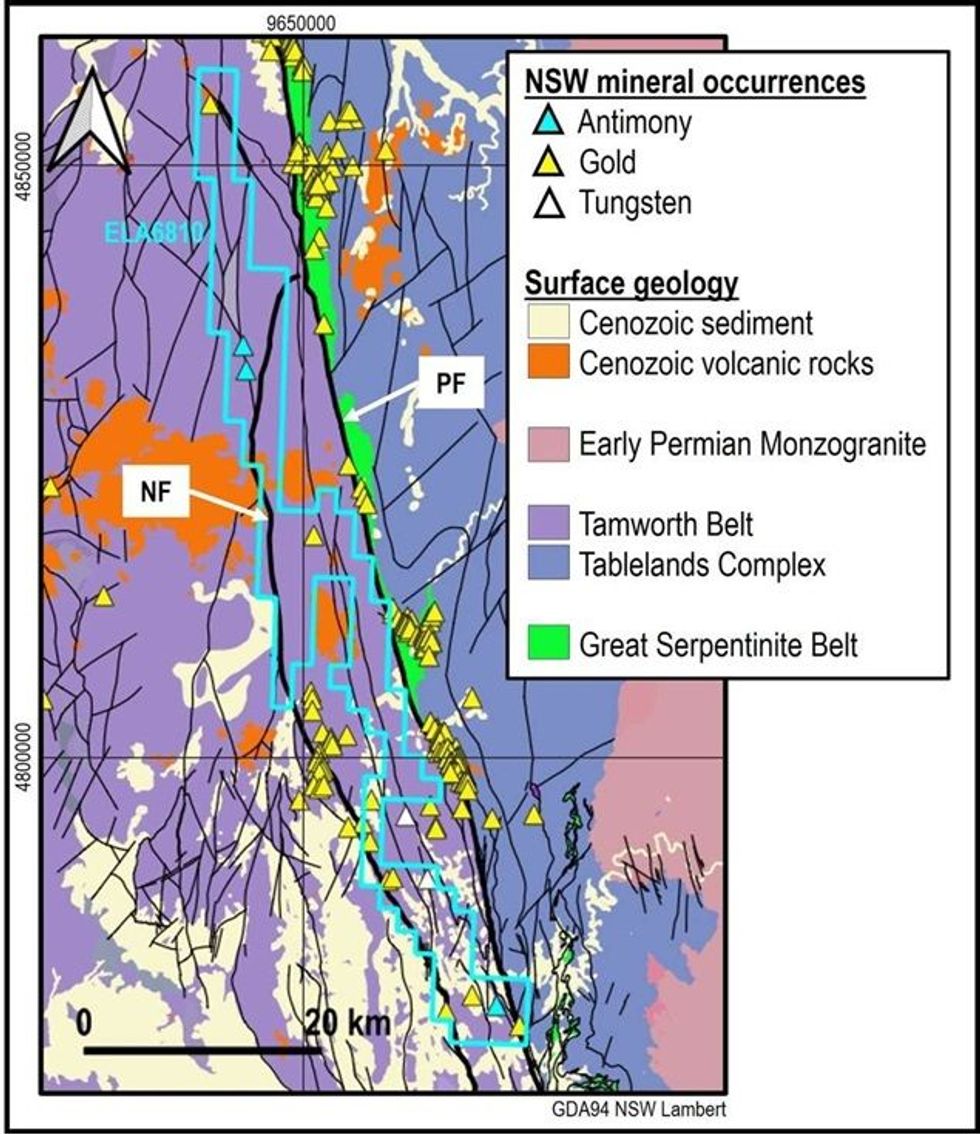

Project Geology

The project lies approximately 100km west of Hillgrove and extends for 85km immediately west of the Peel Fault. The geology of the tenement is dominated by isoclinally folded Carboniferous metasediments of the Tamworth Belt (Figure 2), which is a forearc basinal package related to west-dipping subduction of oceanic crust beneath the Lachlan Orogen. Ultramafic melanges of the Great Serpentinite Belt, which outcrop along the Peel Fault, are considered to be remnants of this oceanic crust. The Peel Fault System has recognised world-class mineral potential, with over 400 known orogenic gold and base metal mineral occurrences along its over 400km strike extent, but is underexplored with less than 200 mostly shallow drillholes over its length, the majority of which are focused on discrete prospects.

Tamworth Belt metasediments within the project are cut by multiple splays off the Peel Fault, including the major Namoi Fault (Figure 2). Gold, Antimony and Tungsten mineralisation are associated with orogenic quartz-vein and stockwork systems hosted within the Peel Fault System. The tenement encompasses nine historical gold workings (a mixture of primary orogenic vein-style and deep alluvial workings); three vein- hosted Antimony occurrences with historical workings; and one vein-hosted tungsten occurrence.

Click here for the full ASX Release

This article includes content from Red Mountain Mining, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Obonga Project: Wishbone VMS Update

27 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00