September 12, 2024

Description

Positive progress on the development of Ora Gold’s (ASX:OAU) Crown Prince project is a key factor in Argonaut Securities’ recent equity research report issuing a speculative buy recommendation for Ora Gold.

“OAU is making steady progress on its Crown Prince development targeting first production towards the middle of next year. Once in production, we expect Crown Prince to be a high-margin, open-pit operation with a ~2-year mine-life,” the report said,

The report also noted the potential for extending the mine life given recent “encouraging exploration results” at Crown Prince.

“We make a slight price target increase to $0.019 ($0.018 prior) and maintain our speculative buy recommendation,” the report said. The valuation is modeled based on Ora Gold entering production in the second quarter of 2026, with a small but high-grade open pit mine returning cash flows.

The project’s prospects are further de-risked by the ore purchase agreement with Westgold (ASX:WGX), the report said.

Key Highlights:

- Diamond drilling for geotechnical studies is currently underway to finalise the open pit designs for Crown Prince. Environmental studies have been completed and metallurgy work indicates excellent free milling material with total recoveries ranging between 98 to 99 percent.

- OAU plans to submit a mining proposal to DEMIRS mid to late H2 of CY2024. OAU’s cash position totalling AU$7 million is expected to fund development work up to a decision to mine. Pre-production capex and working capital requirements for Crown Prince is AU$15 million.

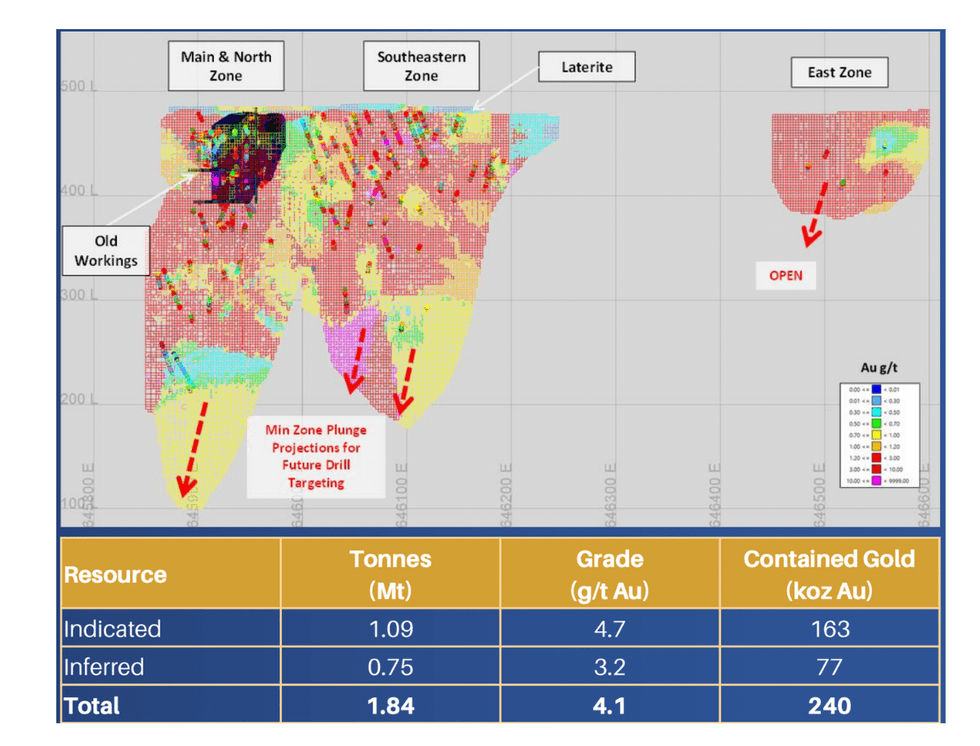

- An updated mineral resource estimate (MRE) is expected in October 2024. Current MRE totals 240 koz at 4.1 g/t gold with 67 percent in the indicated category.

- Despite its relatively small production size, Crown Prince is one of the highest margin development projects, with a resource that includes 164 koz shallow high-grade (5.2 g/t gold) ounces, driving a compelling economics.

For the full analyst report, click here.

This content is intended only for persons who reside or access the website in jurisdictions with securities and other applicable laws which permit the distribution and consumption of this content and whose local law recognizes the scope and effect of this Disclaimer, its limitation of liability, and the legal effect of its exclusive jurisdiction and governing law provisions [link to Governing Law section of the Disclaimer page].

Any investment information contained on this website, including third party research reports, are provided strictly for informational purposes, are general in nature and not tailored for the specific needs of any person, and are not a solicitation or recommendation to purchase or sell a security or intended to provide investment advice. Readers are cautioned to seek the advice of a registered investment advisor regarding the appropriateness of investing in any securities or investment strategies mentioned on this website.

OAU:AU

The Conversation (0)

7h

Jeffrey Christian: Gold, Silver Prices Going Higher, Risk Highest Since WWII

Jeffrey Christian, managing partner at CPM Group, sees gold and silver prices continuing to rise as global political and economic risks persist. "We look at the world right now and we see a world where the risks and uncertainties are greater now than at any time since Pearl Harbor. December... Keep Reading...

7h

Precious Metals Price Update: Gold, Silver, PGMs Volatile on Oil Spike, Fed Rates

Precious metals prices are responding to the impact of the US-Iran war, as well as inflation data.The war has weighed on the precious metals market for much of this past week. An oil price surge past US$100 per barrel increased the threat of inflation and strengthened the US dollar, softening... Keep Reading...

15h

Pan African To Acquire Emmerson Resources in US$218 Million Gold Deal

South African gold producer Pan African Resources (LSE:PAF) has agreed to acquire Australian explorer Emmerson (LSE:EML) in an all-share transaction valued at approximately US$218 million.The acquisition will be carried out through a scheme of arrangement under which Pan African will acquire 100... Keep Reading...

19h

American Eagle Announces Exercise of Participation Rights by South32 and Teck, Updates Details of Recently Announced Financing

Highlights: South32 and Teck will maintain their equity ownership in American Eagle Gold.Including Eric Sprott's private placement, American Eagle Gold's cash balance will increase by $34 million to more than $55 million upon close of this financing.Eric Sprott, South32 and Teck are the sole... Keep Reading...

10 March

David Erfle: Gold, Silver Under Pressure, Key Price Levels to Watch

David Erfle, editor and founder of Junior Miner Junky, explains why gold and silver prices took a hit not long after war in the Middle East was announced. While the near term could be volatile, he said the long-term outlook for precious metals is strong. Don't forget to follow us @INN_Resource... Keep Reading...

10 March

Tavi Costa: Gold, Silver Stocks to Rerate, "Explosive" Energy, Copper Opportunities

Tavi Costa, CEO of Azuria Capital, explains where he's looking to deploy capital right now, mentioning mining, energy and emerging markets. "When I apply macro analysis into markets, there's a few things that look exceptionally cheap today that could be extremely asymmetric," he commented.... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00