September 12, 2024

Description

Positive progress on the development of Ora Gold’s (ASX:OAU) Crown Prince project is a key factor in Argonaut Securities’ recent equity research report issuing a speculative buy recommendation for Ora Gold.

“OAU is making steady progress on its Crown Prince development targeting first production towards the middle of next year. Once in production, we expect Crown Prince to be a high-margin, open-pit operation with a ~2-year mine-life,” the report said,

The report also noted the potential for extending the mine life given recent “encouraging exploration results” at Crown Prince.

“We make a slight price target increase to $0.019 ($0.018 prior) and maintain our speculative buy recommendation,” the report said. The valuation is modeled based on Ora Gold entering production in the second quarter of 2026, with a small but high-grade open pit mine returning cash flows.

The project’s prospects are further de-risked by the ore purchase agreement with Westgold (ASX:WGX), the report said.

Key Highlights:

- Diamond drilling for geotechnical studies is currently underway to finalise the open pit designs for Crown Prince. Environmental studies have been completed and metallurgy work indicates excellent free milling material with total recoveries ranging between 98 to 99 percent.

- OAU plans to submit a mining proposal to DEMIRS mid to late H2 of CY2024. OAU’s cash position totalling AU$7 million is expected to fund development work up to a decision to mine. Pre-production capex and working capital requirements for Crown Prince is AU$15 million.

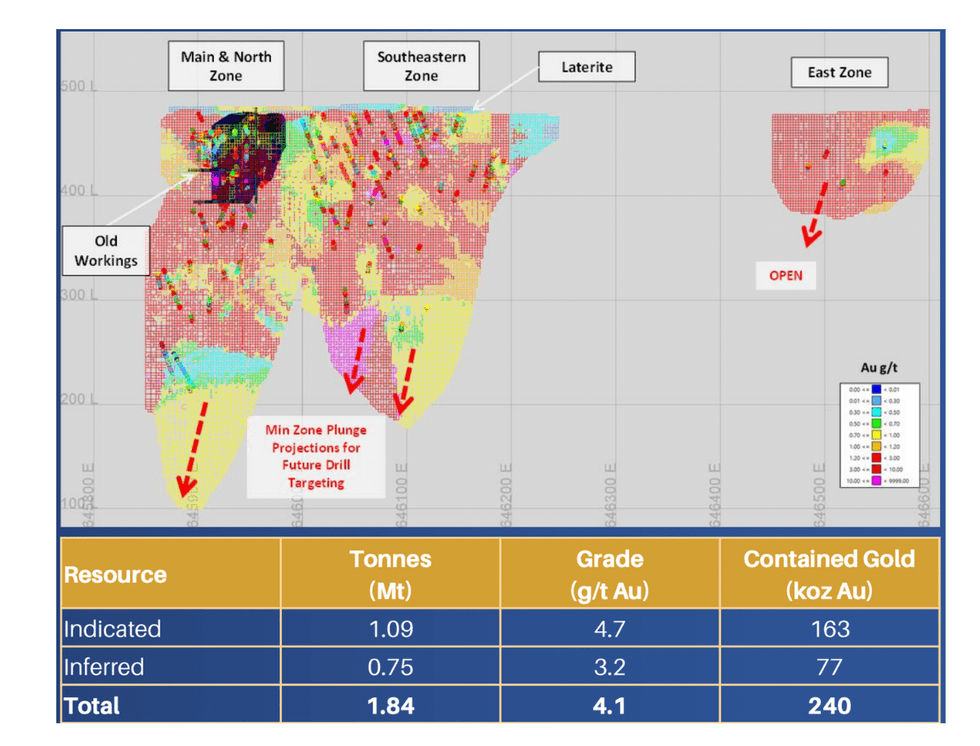

- An updated mineral resource estimate (MRE) is expected in October 2024. Current MRE totals 240 koz at 4.1 g/t gold with 67 percent in the indicated category.

- Despite its relatively small production size, Crown Prince is one of the highest margin development projects, with a resource that includes 164 koz shallow high-grade (5.2 g/t gold) ounces, driving a compelling economics.

For the full analyst report, click here.

This content is intended only for persons who reside or access the website in jurisdictions with securities and other applicable laws which permit the distribution and consumption of this content and whose local law recognizes the scope and effect of this Disclaimer, its limitation of liability, and the legal effect of its exclusive jurisdiction and governing law provisions [link to Governing Law section of the Disclaimer page].

Any investment information contained on this website, including third party research reports, are provided strictly for informational purposes, are general in nature and not tailored for the specific needs of any person, and are not a solicitation or recommendation to purchase or sell a security or intended to provide investment advice. Readers are cautioned to seek the advice of a registered investment advisor regarding the appropriateness of investing in any securities or investment strategies mentioned on this website.

OAU:AU

The Conversation (0)

17h

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

17h

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

17h

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

18h

Oreterra Metals Fully Financed for Maiden Discovery Drilling at Trek South

Oreterra Metals (TSXV:OTMC) is set to launch its first-ever discovery drill program at the Trek South porphyry copper-gold prospect in BC, Canada, a pivotal moment following a corporate restructuring that culminated in the company emerging under its new name on February 2.Speaking at the... Keep Reading...

04 March

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00