Atlas Lithium Corporation (NASDAQ: ATLX) ("Atlas Lithium" or the "Company"), a leading developer of hard-rock lithium assets, today announced that SGS Canada Inc.'s facility, located in Lakefield, Canada ("SGS Lakefield"), a premier center for independent metallurgical assays, produced over 10 kg of commercial-grade lithium concentrate from processing approximately 117 kg of representative ore from the Company's 100%-owned Minas Gerais Lithium Project using standard dense media separation ("DMS") technology. Processing of Atlas Lithium's ore showed easy separation, high recovery, and no significant contaminants. SGS Lakefield has been providing testing and analytical services to the mining industry since 1941 and has earned the reputation as a leading provider of bankable metallurgical services.

Marc Fogassa, Atlas Lithium's Chairman and Chief Executive Officer, commented: "These results indicate that efficient and cost-effective processing using well-established DMS methods is possible for our ore. Our samples achieved commercial grade for use within established battery supply-chain processing routes. We believe that this is a key milestone as we further advance our project."

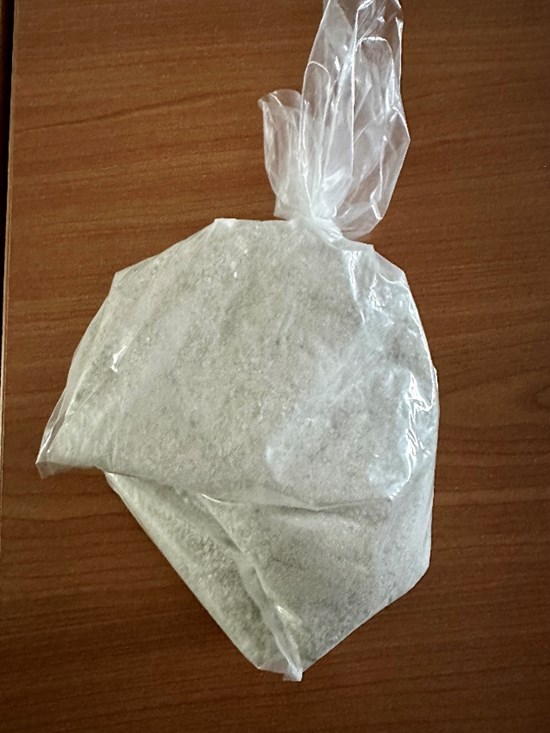

Marc Fogassa, and Igor Tkachenko, the Company's Vice President of Strategic Development, recently visited SGS Lakefield to meet its metallurgical experts on-site and to receive a sample of Atlas Lithium's concentrate. A photo of Massoud Aghamirian, Director of Metallurgical Analysis at SGS Lakefield, alongside Marc Fogassa during the site visit is attached to this release. A photo of the retrieved lithium concentrate sample is also included in this release.

Atlas Lithium expects to receive the finalized metallurgical testing report from SGS Lakefield in the coming weeks. Importantly, the data from this report is an essential component of the forthcoming Preliminary Economic Analysis ("PEA") of the Company's lithium project.

Figure 1

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6706/158497_2e8bfbe0140f0ba8_002full.jpg

Figure 2

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6706/158497_2e8bfbe0140f0ba8_003full.jpg

About Atlas Lithium Corporation

Atlas Lithium Corporation (NASDAQ: ATLX) is focused on advancing and developing its 100%-owned hard-rock lithium projects which consist of 64 mineral rights spread over approximately 75,040 acres (304 km2) located primarily in the Lithium Valley area of the state of Minas Gerais in Brazil. In total, Atlas Lithium has 100% ownership of mineral rights for almost all battery metals including lithium (304 km2), nickel (222 km2), rare earths (122 km2), titanium (89 km2), and graphite (56 km2), in addition to mining concessions for gold, diamonds, and sand. The Company also owns approximately 45% of Apollo Resources Corp. (private company; iron) and approximately 28% of Jupiter Gold Corp. (OTCQB: JUPGF) (gold and quartzite).

Safe Harbor Statement

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements are based upon the current plans, estimates and projections of Atlas Lithium Corporation and its subsidiaries (collectively, "Atlas Lithium" or "Company") and are subject to inherent risks and uncertainties which could cause actual results to differ from the forward-looking statements. Such statements include, among others, those concerning our ability to effectively process our minerals and achieve commercial grade at scale; risks and hazards inherent in the mining business (including risks inherent in exploring, developing, constructing and operating mining projects, environmental hazards, industrial accidents, weather or geologically related conditions), uncertainty about the Company's ability to obtain required capital to execute its business plan; Company's ability to hire and retain required personnel; changes in the market prices of lithium and lithium products and demand for such products; changes in technology or the development of substitute products; the uncertainties inherent in exploratory, developmental and production activities, including risks relating to permitting, zoning and regulatory delays related to our projects; uncertainties inherent in the estimation of lithium resources; risks related to competition; risks related to the information, data and projections related to our projects; occurrences and outcomes of claims, litigation and regulatory actions, investigations and proceedings; risks regarding our ability to achieve profitability, enter into and deliver product under supply agreements on favorable terms, our ability to comply with governmental regulations and our ability to obtain necessary permits; uncertainties related to conducting business in Brazil; volatility in the markets caused by concerns of potential financial instability with a number of US financial institutions experiencing significant losses and loss of consumer confidence; macro-economic conditions caused by global supply chain disruptions and the war in Ukraine; as well as all assumptions, expectations, predictions, intentions or beliefs about future events. Therefore, you should not place undue reliance on these forward-looking statements. The following factors, among others, could cause actual results to differ from those set forth in the forward-looking statements: results from ongoing geotechnical analysis of projects; business conditions in Brazil; general economic conditions, geopolitical events and regulatory changes; availability of capital; Atlas Lithium's ability to maintain its competitive position; and dependence on key management.

Atlas Lithium advises U.S. investors that its properties and projects, and those of its subsidiaries, as of now, are exploratory and do not have measured "reserves" as such term is defined by the rules of the Securities and Exchange Commission (the "SEC"). Additional risks related to the Company and its subsidiaries are more fully discussed in the section entitled "Risk Factors" in the Company's Registration Statement on Form S-1 filed with the SEC on January 28, 2022 and declared effective on January 9, 2023, as well as discussions of potential risks, uncertainties, and other important factors in the Company's other filings with the SEC, all of which are available at www.sec.gov. In addition, any forward-looking statements represent the Company's views only as of today and should not be relied upon as representing its views as of any subsequent date. The Company explicitly disclaims any obligation to update any forward-looking statements.

Investor Relations:

Michael Kim or Brooks Hamilton

MZ Group - MZ North America

+1 (949) 546-6326

ATLX@mzgroup.us

https://www.atlas-lithium.com/

@Atlas_Lithium

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/158497