American Manganese receives Drill Permits for Rocher Deboule from Ministry of Energy, Mines and Low Carbon Innovation

American ManganeseInc. ("AMY" or the "Company") (TSX.V:AMY)(OTCQB:AMYZF)(FSE:2AM) reports Vent Zone IP Geophysics Identifies High Chargeability and coincident and Significant Rare Earth Values on Rocher Deboule Cu-Au-AgProject

The Vent Zone alteration consists of chlorite-quartz-carbonate-garnet-clay hosted in andesiticflows/tuffs (porphyritic) of Upper Cretaceous Kasalka Group Brian Boru Formation. SGH (spatiotemporal geochemical hydrocarbon) surveys carriedout in 2017 resulted in redox cell (6.0 out of 6.0 rating), and copper-gold anomalous zones (5.0 out of 6.0 rating) that coincide with the redox cell anomaly.In 2021, pole-dipole array IP Geophysics on "Vent Zone" target identified elevated chargeability (>30mV/V), which correlates with the redox-cell soil hydrocarbon anomaly. Widespread, disseminated sulphides (mostly fine grain pyrite) are present in the portions of the Vent Zone. IP survey high chargeability and coincident low resistivity on west portion of grid area are interpreted extent of Vent Zone. In the central part of the IP survey area, relatively strong chargeability and low resistivity increases at depths of approximately 100-200 meters (328-656 feet). The Vent Zone has positive Cu- Au-Ag-Co-REE soil geochemical anomaliesand is interpreted as an Iron-Oxide Copper-Gold (IOCG) occurrence.

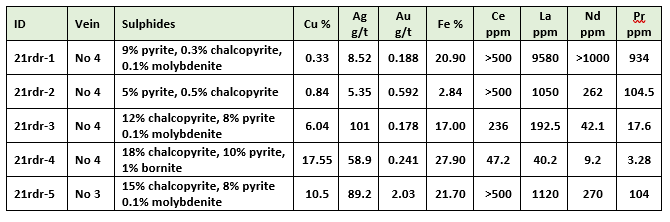

A total of 5 rock chip samples (ranging from 0.55-1.44 kgs in weight) were taken from outcrop (sampled intervals ranging from 15-35 centimeters) near the Rocher Mine area (proposed drilling of "Main Zone" No 4 & 3 Veins) and shippedto ALS Canada Ltd for ME-MS61r four acid multi-element ICP-MS + REE, and AuICP21Au 30-gram Fire Assay ICP-AES finish (certificate VA 21172433). The following significant results are listed:

Rock chip sample geochemical analysisresults indicate massiveand semi-massive chalcopyrite-pyrite mineralization (with minor bornite and molybdenite) contain significant rare earth elements (REE elements Ce- La-Nd-Pr are listed above). The Rocher Mine No 2 & 4 Veins are considered primarily as vein type (tabular shaped)copper resources accompanied by silver, gold and rare earth element bearing minerals. The distribution of rare earth elements (La-Ce-Sc-Y-Pr-Nd-Pm-Sm-Eu-Gd-Tb-Dy-Ho-Er-Tm-Yb-Lu) are associated with silicified fault zones that have magnetite and massive sulphide.Sulphides & REE do not correlate well. It is unclear whetherrare earth bearing minerals are associated with sulphide minerals or re-distributed (re-mobilized) from earlier geological (e.g., pegmatitic phase) events, or a combination of both. Rare earth elements weakly correlate with increased P, and U/Th. Note- U values ranging between 1.1-19.7 ppm uranium and Th values ranging between 0.12-13.9 ppm thorium are well below thresholdvalues of 100 ppm U.

The two main deposit types are observed at theRocher Mine No 4 & 2 Veins:

- EARLY FORMING POLYMETALLIC VEIN/BRECCIA: semi-massive and coarse grain (blebby) chalcopyrite with increased magnetite-REE bearing mineralization is related to elevated Cu-Au-Ag-REE in ‘polymetallic' fissureveins/breccias developed in pegmatitic/aplitic phases of early forming intrusions.

- LATE FORMINGSUB-VOLCANIC VEIN/BRECCIA: massivechalcopyrite, minor bornite-tetrahedrite- arsenopyrite-sphalerite-argentiferous galena bearing mineralization is related to elevated Cu-Ag-As-Sb in ‘sub-volcanic' fissureveins/breccias.

A drillprogram is plannedon the Rocher Mine 2 & 4 Veins and Vent Zones for 2022.

Andris Kikauka (P. Geo.), Director for American Manganese Inc, has prepared, reviewed, and approved technical information in this press release. Mr. Kikauka is a non-independent Qualified Person adhering to National Instrument 43-101 reporting standards.

On behalf of Management

AMERICAN MANGANESEINC.

Larry W. Reaugh

President and Chief Executive Officer

Telephone: 778 574 4444

Email:reaugh@amymn.com

www.americanmanganeseinc.comwww.recyclico.com

Neither the TSX Venture Exchangenor its Regulation Services Provider (as that term is definedin the policies of the TSX VentureExchange) accepts responsibility for the adequacyor accuracy of this release.This news releasemay contain "forward-looking statements", which are statements about the future based on current expectations or beliefs. For this purpose,statements of historical fact may be deemed to be forward-looking statements. Forward-looking statements by their nature involve risks and uncertainties, and there can be no assurance that such statements will prove to be accurateor true. Investorsshould not placeundue reliance on forward-looking statements. The Company does not undertake any obligation to update forward-looking statements except as required by law.

SOURCE: American Manganese Inc.

View source version on accesswire.com:

https://www.accesswire.com/695164/American-Manganese-Reports-Significant-Rare-Earth-Values-on-Rocher-Deboule-Cu-Au-Ag-Project