June 19, 2023

Lithium development company Critical Resources Limited ASX:CRR (“Critical Resources” or “the Company”) is pleased to announce that, after more than a year of positive interaction and dialogue, it has executed an Agreement In Principle (AIP) with the Wabigoon Lake Ojibway Nation (“WLON”) regarding ongoing exploration and development activities at the Company’s 100%- owned Mavis Lake Lithium Project in Ontario, Canada.

Highlights

- Agreement In Principle (AIP) follows over 18 months of positive dialogue and relationship development between the Wabigoon Lake Ojibway Nation (WLON) and Critical Resources

- Formalises the processes and communication to ensure that the Mavis Lake Lithium Project is advanced in a mutually beneficial manner

- AIP sets the framework to achieve WLON community consent for the future development of the Mavis Lake Lithium Project

Pathway for Exploration and Development

The AIP defines how Critical Resources and WLON will work together and collaborate to allow continued exploration and project development work by the Company at Mavis Lake. It also ensures that all activities are undertaken in a respectful manner that acknowledges WLON’s connection to the land and waters in the Mavis Lake area.

The AIP formalizes what has been a very positive relationship and informal dialogue between the two groups over the past 18 months.

Moving forward, the AIP introduces structure around regular community engagement, including formal project updates and meetings between WLON and the Company. The AIP also lays the foundation for the development of an impact benefit agreement as well as achieving WLON community consent for the future development of the operation.

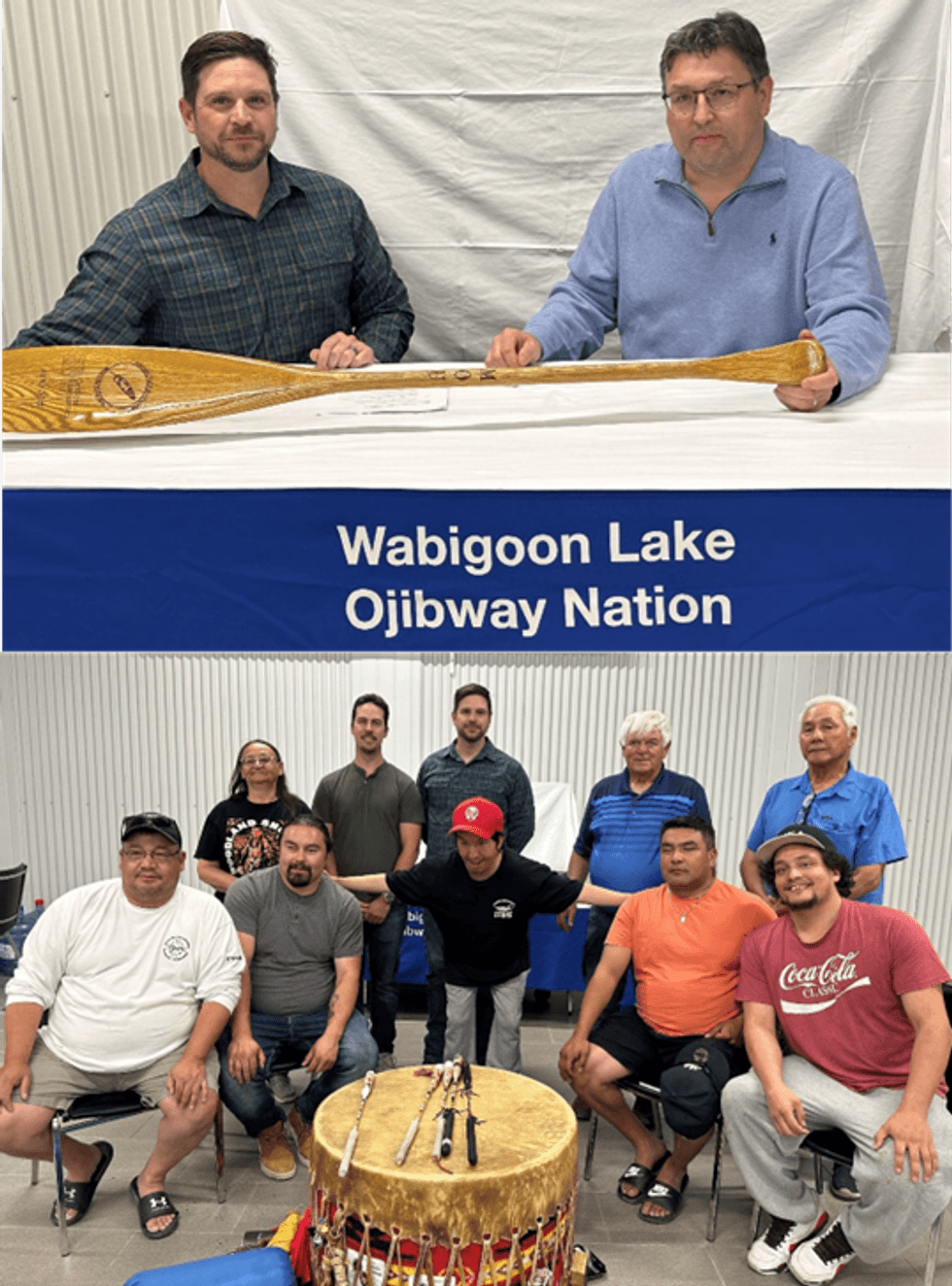

The AIP was formally signed at an official ceremony held in the WLON community. The ceremony was attended by Chief Clayton Wetelainen and his Council, Elders, community members and representatives from Critical Resources.

About Wabigoon Lake Ojibway Nation

Wabigoon Lake Ojibway Nation is a proud, progressive and resilient indigenous nation on the shores of what is now called Dinorwic Lake, west of the township of Dryden, Ontario, with strong roots in the traditional Anishinaabeg culture.

The ancient presence of WLON people on their land is reflected in its vast forests and countless lakes, rivers, and streams. Land and water are vital resources and connections to the WLON people.

WLON understand and support the principles of sustainable development and the economic opportunities that such sustainable development will bring to their people.

Chief Clayton Wetelainen, said:

“We acknowledge the importance of lithium as a critical mineral that is needed to support renewable energy and more sustainable future.

“We remain aware of the importance of developing projects in a manner that respects our lands, our water and our Elders.

“This is the first step in our journey together.”

Critical Resources Managing Director, Alex Cheeseman, said:

“Over the past 18 months, the Company has built very strong relationships with the WLON community. We engaged early, openly and respectfully.

Formalising the relationship through the AIP reflects the desire of both groups to collaborate and advance the Mavis Lake Project in a manner that is sustainable, while also ensuring that the economic benefits of the Project will have a positive impact on WLON and other First Nation Communities that hold a deep and unbroken connection to the land and waters in the area.

It was a privilege and an honour to be able to attend the official signing ceremony and we look forward to continuing to work with WLON for many years to come.”

This article includes content from Critical Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CRR:AU

The Conversation (0)

21 June 2022

Critical Resources

High-grade Lithium Portfolio, in a Tier 1 Location, Aligned with the World’s Green Energy Transition

High-grade Lithium Portfolio, in a Tier 1 Location, Aligned with the World’s Green Energy Transition Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00