July 23, 2023

GALENA MINING LTD. (“Galena” or the “Company”) (ASX: G1A) reports on its activities for the quarter ended 30 June 2023 (the “Quarter”), primarily focused on the ongoing production ramp-up of both the underground mine and the processing plant to achieve steady-state production in the second half of 2023, at its 60%-owned Abra Base Metals Mine (“Abra” or the “Project”) located in the Gascoyne region of Western Australia.

HIGHLIGHTS

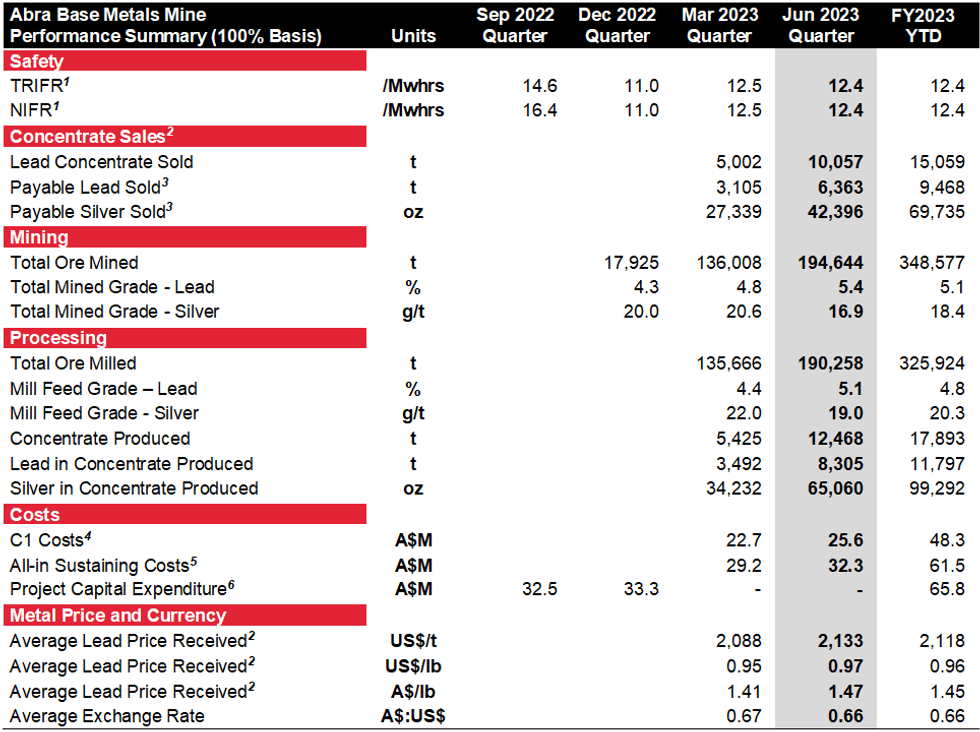

- Strong recovery achieved with May and June physicals following limited activities in April due to rainfall events. Ore mined of 194,644t at 5.4% Pb grade and 16.9g/t Ag grade and processed 190,258t at 5.1% Pb grade and 19.0g/t Ag grade for the Quarter.

- Second and third in-specification lead concentrate shipments of ~5kt each completed in the Quarter, doubling revenue from the previous quarter to ~A$20.4 million.

- July month to date on track to achieve first positive monthly operating cash flows with over 90% of the next ~9-10kt concentrate shipment produced and committed shipment set for loading between 28 July and 4 August.

- Underground development achieved 1,583m advance during the Quarter with the decline reaching 1,234mRL (312m vertically below the surface). Underground stope production achieved 81,592t at 6.3% Pb grade. Pb grade is slowly improving and will continue to do so in the coming months as new work areas are established and the ratio of stoping ore to development ore increases to required production levels.

- Cash balance at Quarter-end of A$19.3 million.

- Galena completed an oversubscribed placement to provide additional working capital funding for the Abra ramp-up.

- September quarter mining plans set to achieve over 2,000m development and over 250,000t stope production expecting to process over 300,000t of ore as next quarter ramp-up milestones. Targeting ~25-30kt of lead concentrate shipments expected to generate positive operating cash flows.

Managing Director, Tony James commented, “We made a strong recovery from no production in April to set new project highs in both May and June, and we expect to achieve first positive operating cash flows in July. The plant is showing its capacity to process everything put in front of it so far and the focus remains on increasing mine production levels. The key to the mine reaching the levels required is good planning and execution. With the mine plans at 90% grade control status through to January 2024 we see the pathway well laid out to achieve our targets. Some very strong technical work has been completed to increase our confidence in hitting our targets.”

ABRA BASE METALS MINE (60%-OWNED)

Abra comprises a granted Mining Lease, M52/0776 and surrounding Exploration Licence E52/1455, together with several co-located General Purpose and Miscellaneous Leases. The Project is 100% owned by Abra Mining Pty Limited (“AMPL” the Abra Project joint-venture entity), which in turn is 60% owned by Galena and 40% owned by Toho Zinc Co., Ltd. (“Toho”) of Japan.

Abra is fully permitted, and construction of the processing plant and surface infrastructure was completed in December 2022. First production of its lead-silver concentrate occurred in January 2023 with first product shipment achieved in March 2023.

Review of operations

Notes:

1. Total Recordable Injury Frequency Rate (“TRIFR”) and Notifiable Incident Frequency Rate (“NIFR”) are the 12-month moving average at the end of each quarter calculated per million work hours.

2. Concentrate sales and average lead price received initially based on provisional invoices and subsequently updated with final invoices, including final assays and quotational period adjustments.

3. Payable lead and silver based on 95% metal payability subject to standard deductions (i.e., 3 units for lead and 50g/t for silver).

4. C1 costs include mining costs, processing costs, site general and administration costs, transport, logistics and shipping costs, and treatment and refining charges, adjusted for inventory movements and net of silver by-product credits.

5. All-in sustaining costs include C1 Costs plus royalties, corporate general and administration costs, sustaining capital and capitalised mine development costs. All-in sustaining costs exclude growth capital and exploration costs.

6. Abra Project construction works were completed by the end of the December 2022 quarter (see Galena ASX announcements of 10 January 2023 and 13 January 2023).

During the Quarter, new quarter high mining and processing production levels were achieved. This achievement also takes into account the limited activities in April 2023 due to the rainfall issues affecting access to the Abra mine site.

In June, a mine development record was set with 646m of lateral and vertical development achieved during the month. A third Jumbo commenced in the mine in June with the aim of increasing the mine’s monthly development rates to 800m per month during the September quarter.

The mine delivered 194,644t (April: 31,915t, May: 81,014t and June: 81,715t) at 5.4% Pb grade to the plant during the Quarter, including stope production ore of 81,592t at 6.3% Pb grade. The higher development ore during the Quarter is consistent with the ramp-up of mine production as new stoping areas are established. In general, mine production in the Quarter was also affected by congestion in the available work areas, production delays associated with upgrading secondary ventilation networks and loader availability. These impediments were continually rectified during the quarter.

The plant effectively processed all the ore delivered from the mine during the Quarter with 190,258t processed (April: Nil, May: 102,719t and June: 87,539t). 12,468t of concentrate was produced containing 8,070t Pb and 63,122oz Ag. Plant availability in May was 99% and in June 86%. A flotation blower (compressor) breakdown caused the lower availability in June. The plant was able to operate consistently at the 150dmt/hr level during the Quarter.

The mine call grade for ore processed during the Quarter was estimated at 5.4% Pb, which is approximately 0.3% Pb higher than the reconciled processing grade of 5.1% Pb.

Considerable technical improvements were achieved during the Quarter with detailed resource modelling and mine planning work completed. A new Mineral Resource Estimate (“MRE”) is expected to be finalised in the coming weeks which will include all the recent underground drilling and revised geological modelling. This work will lead into a new Ore Reserve estimate and 2024 budget completion in the December quarter. Three month rolling mine plans have been established and the mine planning for the remainder of 2023 is well advanced with 90% of that plan built on grade control drilling down to a 12.5x12.5m spacing.

Click here for the full ASX Release

This article includes content from Galena Mining, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

G1A:AU

The Conversation (0)

12 September 2022

Galena Mining

Galena Mining CEO Tony James said, “People have been just sitting and watching how we would perform this year, a perceived difficult construction period. But we've done a great job."

Galena Mining CEO Tony James said, “People have been just sitting and watching how we would perform this year, a perceived difficult construction period. But we've done a great job." Keep Reading...

03 February

Silver Supply Tight, Demand Rising — What's Next? First Majestic's Mani Alkhafaji

Mani Alkhafaji, president of First Majestic Silver (TSX:AG,NYSE:AG), discusses silver supply, demand and price dynamics, as well as how the company is positioning for 2026.He also shares his thoughts on when silver stocks may catch up to the silver price: "You've got to give it a couple of... Keep Reading...

03 February

Rio Silver’s Path to Near-Term Cashflow

Rio Silver (TSXV:RYO,OTCPL:RYOOF) President and CEO Chris Verrico outlines the company’s transition into a pure-play silver developer. With the silver price reaching historic highs, Rio Silver is capitalizing on its strategic position in Peru — the world’s second largest silver producer — to... Keep Reading...

02 February

When Will Silver Stocks Catch Up to the Silver Price?

The silver price remains historically high despite a recent pullback, and many silver stocks haven't kept pace. Silver's strong performance over the past year is the result of a perfect storm of factors, including an entrenched supply deficit, growing industrial demand, a weakening US dollar and... Keep Reading...

02 February

BP Silver Initial Drilling Intersects Significant Mineralization Within Cosuño Lithocap

Hole CO-0001 Returns 29 Meters at 56 g/t Silver & 0.28 g/t Gold (80 g/t AgEq)

BP Silver Corp. (TSXV: BPAG) ("BP Silver" or the "Company") announces assay results ("Assays") from the first two drill holes of its eleven-hole Phase I drill program (the "Program") at the Cosuño Silver Project ("Cosuño") in Bolivia. The Company expects to release assays from the remaining nine... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00