April 27, 2022

GALENA MINING LTDLTD. (“Galena” or the “Company”) (ASX: G1A) reports on its activities for the quarter ending 31 March 2022 (the “Quarter”), primarily focused on construction of its 60%-owned Abra Base Metals Mine (“Abra” or the “Project”) located in the Gascoyne region of Western Australia.

HIGHLIGHTS:

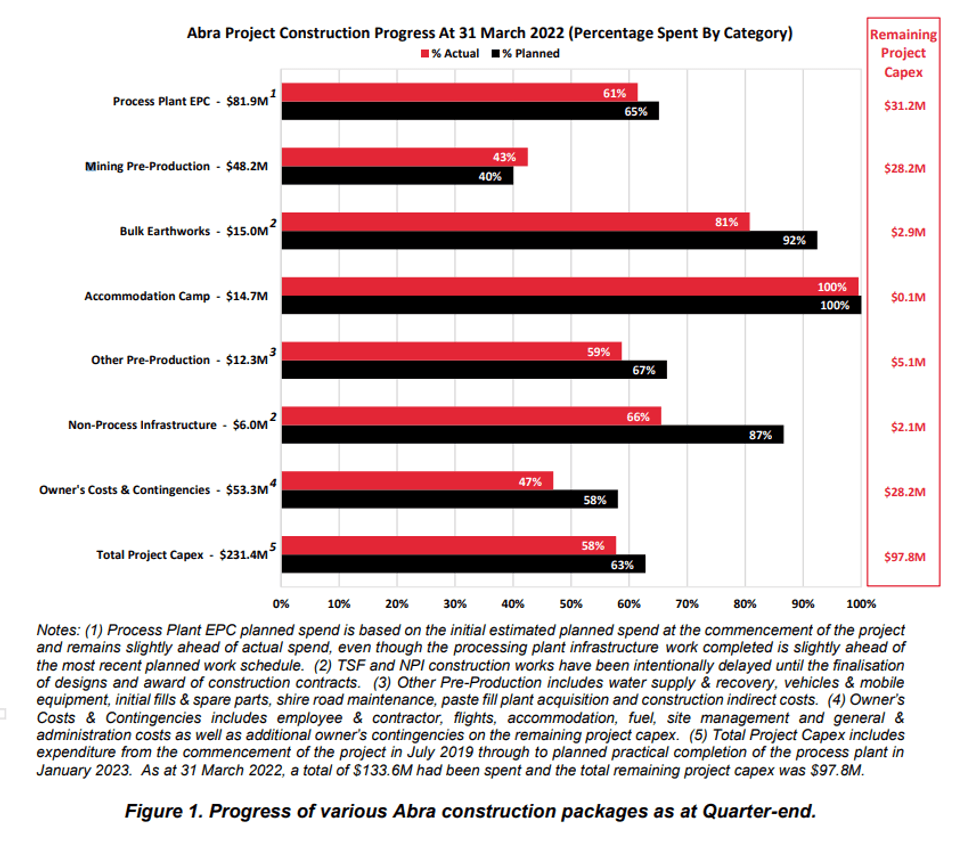

- Abra Project 58% complete at end of the March Quarter (19% of Abra construction works were completed during the March Quarter). Project focus remains on underground access to the Abra orebody and completion of the processing plant and power station.

- Underground development achieved 694m advance during the Quarter remaining ahead of schedule with the decline reaching 1,395mRL. The decline is 82m above the orebody and 155m below the surface.

- Overall processing plant construction has reached 61% complete. Plant engineering and drafting work is 95% complete and site construction work is 35% complete.

- Contracts have been awarded for the remaining non-processing surface infrastructure work representing only 10% of the remaining project capex of $97.8M.

- Power supply company Contract Power have commenced site works associated with the Abra power station (build, own, operate contract).

- US$35M additional debt drawdown was completed under the Taurus Debt Facilities, leaving US$45M remaining undrawn.

- Cash balance at Quarter-end A$60.0M.

ABRA BASE METALS MINE (60%-OWNED)

Abra comprises a granted Mining Lease, M52/0776 and surrounding Exploration Licence E52/1455, together with several co-located General Purpose and Miscellaneous Leases. The Project is 100% owned by Abra Mining Pty Limited (“AMPL”), which in turn is 60% owned by Galena, with the remainder owned by Toho Zinc Co., Ltd. (“Toho”) of Japan.

Abra is fully permitted and under construction. First production of its high-value, high-grade lead- silver concentrate is currently scheduled for the first quarter of 2023 calendar-year.

Project construction / development

During the Quarter Abra Project construction works continued, passing the half-way to completion mark as the Quarter progressed.

Abra construction works conducted during the Quarter were comprised of site civil and earthworks, underground mine development, processing plant construction and ongoing front- end engineering design and procurement, including:

- Underground mining – During the Quarter, underground development continued to progress ahead of schedule, with a further 694 metres of development being completed. As at Quarter-end, total development reached 1,134 metres consisting of 885 metres of decline development and 249 metres of other lateral development. The decline reached 1,395mRL, 82 metres above the Abra orebody and 155 metres below the surface. During the Quarter the first raise bore hole (4.5m) was successfully completed for development of the mine’s primary ventilation infrastructure. The ventilation shaft is one of 3 surface holes that will be completed to provide underground ventilation as the mine progresses.

Click here for the full ASX Release

This article includes content from GALENA MINING LTD. , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.G1A:AU

The Conversation (0)

12 September 2022

Galena Mining

Galena Mining CEO Tony James said, “People have been just sitting and watching how we would perform this year, a perceived difficult construction period. But we've done a great job."

Galena Mining CEO Tony James said, “People have been just sitting and watching how we would perform this year, a perceived difficult construction period. But we've done a great job." Keep Reading...

27 February

Obonga Project: Wishbone VMS Update

Panther Metals Plc (LSE: PALM), the exploration company focused on mineral projects in Canada, is pleased to provide an update for the Obonga Project's Wishbone Prospect which is an emerging and highly prospective base metal volcanogenic massive sulphide ("VMS") system in Ontario,... Keep Reading...

26 February

Agadir Melloul Mining Licence

Critical Mineral Resources is pleased to announce that a Mining Licence has been awarded for Agadir Melloul, marking an important step forward as the Company accelerates development towards production.The Mining License is 14.6km 2 and covers Zone 1 North and Zone 2, which remain the focus of... Keep Reading...

26 February

EIA Approval for Agdz Cu-Ag Project and Funding

Aterian plc (AIM: ATN), the Africa-focused critical metals exploration company, is pleased to announce the approval of it's recently commissioned Environmental Impact Assessment (''EIA'') for the 100%-owned Agdz Mining Licence, part of the Agdz ("Cu-Ag") Project ("Agdz" or the "Project") in the... Keep Reading...

25 February

Clem Chambers: I Sold My Gold and Silver, What I'm Buying Next

Clem Chambers, CEO of aNewFN.com, explains why he sold his gold and silver, and where he's looking next, mentioning the copper and oil sectors. He also speaks about the importance of staying positive as an investor: "The media negativity is the most wealth-crushing thing you can fall for. So be... Keep Reading...

25 February

What Was the Highest Price for Silver?

Like its sister metal gold, silver has been attracting renewed attention as a safe-haven asset. Although silver continues to exhibit its hallmark volatility, a silver bull market is well underway. Experts are optimistic about the future, and as the silver price's momentum continues in 2026,... Keep Reading...

23 February

Stefan Gleason: Silver Wakeup in the West — What's Happening, What's Next

Stefan Gleason, CEO of Money Metals, breaks down recent silver and gold dynamics, discussing trends in the US retail market, as well as backups at refineries. While the situation has begun to normalize, he sees potential for further disruptions in the future. Don't forget to follow us... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Obonga Project: Wishbone VMS Update

27 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00