July 25, 2024

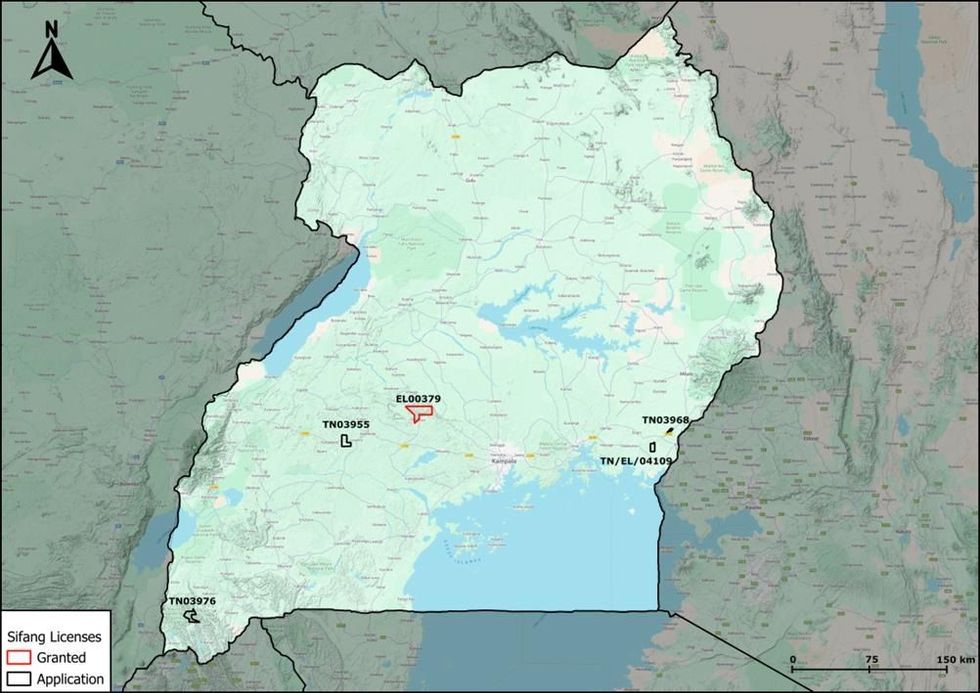

The Directors of eMetals Limited (ASX:EMT)(eMetals)(Company) are pleased advise it has entered into a binding terms sheet (Agreement) with Sifang Mineral Resources Limited (Sifang), a Ugandan incorporated company, and its shareholders (Sifang Shareholders) to acquire an interest in a granted exploration licence (EL00379) located in central Uganda (the Mubende Gold Project) through the purchase 80% of the ordinary shares in Sifang. Sifang is the 100% legal and beneficial owner of the Mubende Gold Project and four exploration license applications located in central Uganda (the Applications).

HIGHLIGHTS

- The granted exploration license EL00379 covers 202 square kilometres in the Mubende region west of Kampala and includes the highly prospective Bukuya prospect.

- The Bukuya prospect is currently being mined by 60-80 artisanal workers over 600 metres of prospective strike and remains open along strike and at depth.

- Rock chip samples taken from a recent site visit to the Bukuya prospect by consultant geologists returned numerous specimens containing visible gold in both ferro-manganese and quartz veins.

- Experienced in-country technical team appointed including Mr Dylan le Roux and Mr Allan Agumya to manage exploration activities.

- Field activities scheduled to commence 05 August 2024.

Commenting on the acquisition Managing Director Mr Mathew Walker stated, “We are delighted to have secured a significant land holding that has prospectivity confirmed by a strong presence of artisanal mining activity. Uganda has a well established gold mining industry and regulatory protocols that add to the appeal of the acquisition. We look forward to the commencement of field activities in the immediate term.”

MUBENDE GOLD PROJECT

The Mubende Gold Project is an extensive landholding of 202 square kilometers that covers a series of metasediments, predominantly characterized by meta-wacke’s and phyllitic slates, with occasional interbedded quartzite units and mafic volcanics. Late-stage granites have intruded the metasediments, mainly in the southern part of the license.

At the Bukuya prospect, wall rock consists of metapelitic units with vertical foliation trending NW in most shafts, turning EW in the northern artisanal shafts. Mineralization appears confined to a deformation zone within the metapelites and hosts three subsets of veins exploited by artisanal workers. The first subset includes quartz veins with hematite mineralization, iron-oxide staining, and goethite/limonite-filled vugs, seen in southern shafts with NW trending foliation. The second subset comprises metallic veins of blueish-grey and black ferro-manganese mineralisation with botryoidal textures and specular hematite, found in northern shafts with EW trending foliation. The third set comprises massive milky white quartz veins.

These veins are described in more detail below.

Type 1 (Iron-rich quartz veins): These are quartz veins that show varying degrees of ferro(-manganese) mineralisation. Mineralisation occurs as hematite (red), specular hematite (dark silver/black), and a lesser degree of manganese (botryoidal, blue-grey to black). Vugs filled with limonitic material is often seen in these veins and is interpreted to represent leached out sulphides. These veins are seen in the SE of the Bukuya site. They are typically decimetre to metre scale and are foliation concordant (vertical to subvertical with dominantly NW trend).

Click here for the full ASX Release

This article includes content from eMetals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EMT:AU

The Conversation (0)

25 February 2021

eMetals Limited

Building a strong pipeline of mineral projects to drive shareholder value.

Building a strong pipeline of mineral projects to drive shareholder value. Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Obonga Project: Wishbone VMS Update

27 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00