July 25, 2024

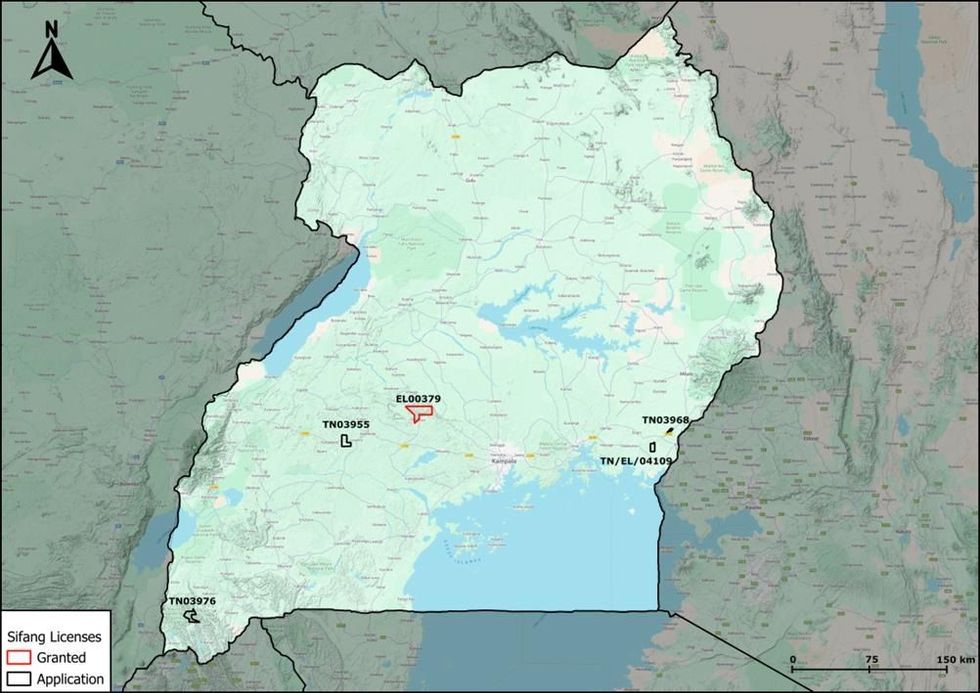

The Directors of eMetals Limited (ASX:EMT)(eMetals)(Company) are pleased advise it has entered into a binding terms sheet (Agreement) with Sifang Mineral Resources Limited (Sifang), a Ugandan incorporated company, and its shareholders (Sifang Shareholders) to acquire an interest in a granted exploration licence (EL00379) located in central Uganda (the Mubende Gold Project) through the purchase 80% of the ordinary shares in Sifang. Sifang is the 100% legal and beneficial owner of the Mubende Gold Project and four exploration license applications located in central Uganda (the Applications).

HIGHLIGHTS

- The granted exploration license EL00379 covers 202 square kilometres in the Mubende region west of Kampala and includes the highly prospective Bukuya prospect.

- The Bukuya prospect is currently being mined by 60-80 artisanal workers over 600 metres of prospective strike and remains open along strike and at depth.

- Rock chip samples taken from a recent site visit to the Bukuya prospect by consultant geologists returned numerous specimens containing visible gold in both ferro-manganese and quartz veins.

- Experienced in-country technical team appointed including Mr Dylan le Roux and Mr Allan Agumya to manage exploration activities.

- Field activities scheduled to commence 05 August 2024.

Commenting on the acquisition Managing Director Mr Mathew Walker stated, “We are delighted to have secured a significant land holding that has prospectivity confirmed by a strong presence of artisanal mining activity. Uganda has a well established gold mining industry and regulatory protocols that add to the appeal of the acquisition. We look forward to the commencement of field activities in the immediate term.”

MUBENDE GOLD PROJECT

The Mubende Gold Project is an extensive landholding of 202 square kilometers that covers a series of metasediments, predominantly characterized by meta-wacke’s and phyllitic slates, with occasional interbedded quartzite units and mafic volcanics. Late-stage granites have intruded the metasediments, mainly in the southern part of the license.

At the Bukuya prospect, wall rock consists of metapelitic units with vertical foliation trending NW in most shafts, turning EW in the northern artisanal shafts. Mineralization appears confined to a deformation zone within the metapelites and hosts three subsets of veins exploited by artisanal workers. The first subset includes quartz veins with hematite mineralization, iron-oxide staining, and goethite/limonite-filled vugs, seen in southern shafts with NW trending foliation. The second subset comprises metallic veins of blueish-grey and black ferro-manganese mineralisation with botryoidal textures and specular hematite, found in northern shafts with EW trending foliation. The third set comprises massive milky white quartz veins.

These veins are described in more detail below.

Type 1 (Iron-rich quartz veins): These are quartz veins that show varying degrees of ferro(-manganese) mineralisation. Mineralisation occurs as hematite (red), specular hematite (dark silver/black), and a lesser degree of manganese (botryoidal, blue-grey to black). Vugs filled with limonitic material is often seen in these veins and is interpreted to represent leached out sulphides. These veins are seen in the SE of the Bukuya site. They are typically decimetre to metre scale and are foliation concordant (vertical to subvertical with dominantly NW trend).

Click here for the full ASX Release

This article includes content from eMetals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EMT:AU

The Conversation (0)

25 February 2021

eMetals Limited

Building a strong pipeline of mineral projects to drive shareholder value.

Building a strong pipeline of mineral projects to drive shareholder value. Keep Reading...

10h

Byron King: Gold, Silver, Oil/Gas — Stock Ideas and Strategy Now

Byron King, editor at Paradigm Press, shares his approach to the gold and silver sectors as tensions in the Middle East intensify, also touching on oil and gas. Overall he sees hard assets becoming increasingly key as global uncertainty escalates."Own gold, own silver — physically own the metal... Keep Reading...

10h

Jaime Carrasco: Gold Going "Much Higher," Silver Force Majeure Inevitable

Jaime Carrasco, senior portfolio manager and senior financial advisor at Harbourfront Wealth Management, shares his outlook for gold and silver, saying prices must rise much higher. He also talks about how to build a strong precious metals portfolio. "We're moving from a credit-based economy, a... Keep Reading...

10h

Garrett Goggin: Gold, Silver in New Era, My Stock Strategy Now

Garrett Goggin, founder of Golden Portfolio, says although gold and silver haven't gone mainstream yet, the metals — and the mining sector overall — have entered a new era. "It's a real mind shift — it's a new era in mining right here," he said.Don't forget to follow us @INN_Resource for... Keep Reading...

20h

Nicola Mining Provides Update on NASDAQ Listing

Nicola Mining Inc. (TSXV: NIM,OTC:HUSIF) (OTCQB: HUSIF) (FSE: HLIA) (the "Company" or "Nicola") is pleased to provide an update on its proposed NASDAQ listing, which it originally disclosed in its news release of October 27, 2025. There are approximately 220 Canadian companies trading via cross... Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00