December 02, 2024

Blackstone Minerals Limited (ASX: BSX) (“Blackstone” or the “Company”) advises that the Company has completed its Accelerated Non-Renounceable Entitlement Offer as per the terms of the Prospectus dated 4 November 2024 (“Entitlement Offer”). As announced on 6 November 2024, the institutional component of the Entitlement Offer was completed raising approximately $550k from Nanjia Capital Limited and its controlled entities.

Under the Entitlement Offer, eligible shareholders were invited to subscribe for one (1) New Share for every four (4) existing Shares held at an offer price of $0.03 per share.

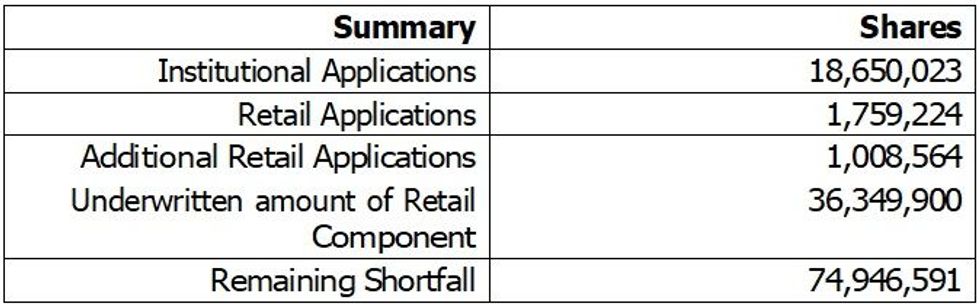

The Company has now closed the retail component of the Entitlement Offer with applications totalling 2,767,788 shares including additional acceptances to be issued at $0.03 on top of the 18,650,023 shares issued under the institutional component of the Entitlement Offer on 15 November 2024. In accordance with the timetable, the New Shares will be issued on or before 4 December 2024.

The retail component of the Entitlement Offer is partially underwritten by Nanjia Capital Limited “(Nanjia”) for the amount of approximately $1.09m. Accordingly, Nanjia will now subscribe for 36,349,900 New Shares in accordance with the underwriting arrangements summarised in section 7.4(b) of the Prospectus and the Company expects to finalise this process within the next week.

Shortfall Share Placement

A total of 74,946,591 New Shares were not taken up under the Entitlement Offer by eligible securityholders or issued to Nanjia as underwriter (“Shortfall Shares’”) The directors will work with the lead manager to the Entitlement Offer and the major shareholders to place the shortfall within three (3) months of the closing date, subject to requirements of the ASX Listing Rules and Corporations Act 20021 (Cth) continuing to be met. Please refer to the Prospectus dated 4 November 2024 for further details on the issue of the shortfall.

Click here for the full ASX Release

This article includes content from Blackstone Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BSX:AU

Sign up to get your FREE

Blackstone Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

25 July 2025

Blackstone Minerals

A diversified developer of battery-grade nickel and copper-gold assets in Southeast Asia

A diversified developer of battery-grade nickel and copper-gold assets in Southeast Asia Keep Reading...

27 January

Quarterly Activities/Appendix 5B Cash Flow Report

Blackstone Minerals (BSX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

28 December 2025

Managing Director Resignation and Board Changes

Blackstone Minerals (BSX:AU) has announced Managing Director Resignation and Board ChangesDownload the PDF here. Keep Reading...

24 October 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Blackstone Minerals (BSX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 August 2025

BSX Secures JV Partner & Funding for Ta Khoa Nickel Project

Blackstone Minerals (BSX:AU) has announced BSX Secures JV Partner & Funding for Ta Khoa Nickel ProjectDownload the PDF here. Keep Reading...

25 August 2025

Trading Halt

Blackstone Minerals (BSX:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

22 December 2025

Nickel Price Forecast: Top Trends for Nickel in 2026

Nickel prices were stagnant in 2025, trading around US$15,000 per metric ton (MT) for much of the year.Weighing heavily on the metal was persistent oversupply from Indonesian operations. Meanwhile, sentiment remained weak amid soft demand growth from the construction and manufacturing sectors,... Keep Reading...

Latest News

Sign up to get your FREE

Blackstone Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00