- WORLD EDITIONAustraliaNorth AmericaWorld

July 20, 2022

GALENA MINING LTD. (“Galena” or the “Company”) (ASX: G1A) is pleased to provide initial production guidance for its 60% owned Abra Base Metals Mine (“Abra” or the “Project”) having achieved the construction milestone of 75% complete. The guidance for the CY2023 ramp-up year and future life of mine averages are based on the most recently updated mine plan incorporating updated mine designs and the latest cost information.

HIGHLIGHTS

- Abra Project construction is now 75% complete – Galena confirms first concentrate production remains on-target for Q1 2023 and provides initial production targets based on latest mine plan

- CY2023 mill throughput expected to be 0.8-1.0Mtpa resulting in ramp-up year lead production of 53-68kt

- Following ramp-up, life of mine average annual production expected to average 93,000 tonnes of lead and 553,000 ounces of silver, with lead ‘C1’ direct cash cost of US$0.50/lb

- Plant processing throughput and mine plan increased to 1.3Mtpa in the current mine plan (vs. 1.2Mtpa in 2019 Feasibility Study)1

Managing Director, Tony James commented, “With first concentrate production on target for the March 2023 quarter, we provide this update on near-term and life of mine plan and targets. During the construction period of the project, we have worked very closely with our partner Toho Zinc and our key service providers to reach the 75% build mark. For the remainder of 2022 we plan to safely complete the mine construction and commission Abra as a world-class lead-silver mine.”

The guidance provided today is based on the knowledge and confidence gained from additional drilling, Mineral Resource estimation, and advancing construction at Abra, and preparation for commissioning ahead of a planned safe and efficient start-up.

Grade control drilling commenced in June 2022 and ongoing drilling and evaluation over the next 3 months will likely offer further opportunity for additional optimisation of the mine plan.

The forecast life of mine production now averages 93,000tpa lead metal production and 553,000ozpa silver. An 8% increase in mine and mill production is offset by a 6% reduction in lead grade to produce slightly less metal in direct comparison to the 2019 Feasibility Study (“FS”)1. A suitable ramp up profile has been adopted for the CY2023 prior to reaching steady state production which is anticipated to occur in the December quarter 2023.

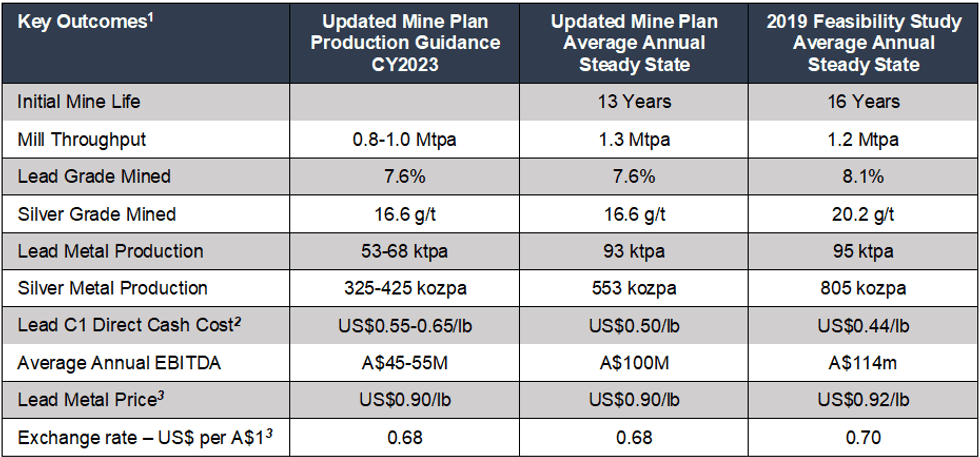

Table 1 below outlines the current expected production forecast for CY2023 and the Updated Life of Mine outcomes in direct comparison the FS completed in 2019.

Table Notes

1. Key outcomes and metrics shown reference 100% of Project. Abra Project is owned 60% by Galena & 40% by Toho Zinc.

2. Includes a by-product credit for net silver revenue of US$0.04/lb (A$0.06/lb).

3. Current lead metal price and exchange rate.

Table 1 - Updated Abra key operating and financial metrics.

The Abra mine construction is progressing as planned. Progress reached 73% complete as of 30 June 2022 and has since past 75% complete. Processing plant construction activities reached 79% complete with concrete civils passing 95% complete and structural steel passing 42% complete. During June and early July several key equipment items arrived on site and the only remaining items coming from overseas are the flotation cells and the regrind mill. These items are currently in shipping with the flotation cells expected to arrive on 12 August and the regrind mill expected to arrive on 1 September. Figures 1 to 4 included in this announcement provide additional photographs of the Abra work completed to date.

Click here for the full ASX Release

This article includes content from GALENA MINING LTD., licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

G1A:AU

The Conversation (0)

12 September 2022

Galena Mining

Galena Mining CEO Tony James said, “People have been just sitting and watching how we would perform this year, a perceived difficult construction period. But we've done a great job."

Galena Mining CEO Tony James said, “People have been just sitting and watching how we would perform this year, a perceived difficult construction period. But we've done a great job." Keep Reading...

3h

Stefan Gleason: Silver Wakeup in the West — What's Happening, What's Next

Stefan Gleason, CEO of Money Metals, breaks down recent silver and gold dynamics, discussing trends in the US retail market, as well as backups at refineries. While the situation has begun to normalize, he sees potential for further disruptions in the future. Don't forget to follow us... Keep Reading...

19 February

Mercado Minerals Provides Exploration Update on Copalito; Reveals New Vein Discoveries

Mercado Minerals Ltd. (CSE: MERC) ("Mercado" or the "Company") is pleased to report continued progress from ongoing exploration activities at its flagship Copalito Project ("Copalito" or the "Project"). The Company's technical team in Mexico has been actively mapping, sampling, and advancing... Keep Reading...

16 February

How Rick Rule Reinvested His Silver Gains: 5 Silver Stocks He Owns

Over the past year, the spot price of silver has surged past a 40 year record and into triple-digit territory, reaching a high of US$121 per ounce this past January.For silver investors who bought into the physical market when the price was low, this first leg of the silver bull market has... Keep Reading...

16 February

Silver Institute: Market Heading for Sixth Straight Deficit in 2026

Silver surged past US$100 per ounce for the first time in January before retreating below the US$80 level, marking a volatile start to 2026 as the precious metal faces renewed investor appeal.In its latest annual outlook, published on February 10, the Silver Institute notes that the rally comes... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00