June 11, 2024

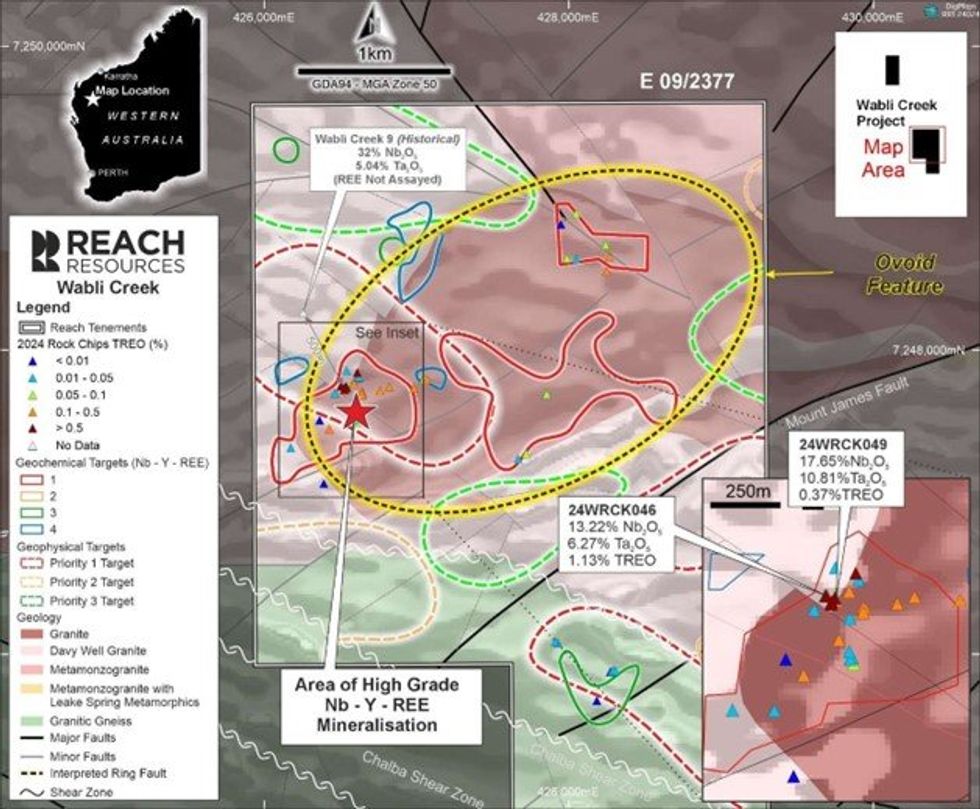

Reach Resources Limited (ASX: RR1 & RR1O) (“Reach” or “the Company”) is pleased to advise that assay results from the latest field program at Wabli Creek have identified a primary source of high grade Nb/REE mineralisation previously only found in surface eluvial samples on site (Figure 2).

HIGHLIGHTS

- In-situ or bedrock source of high-grade Niobium (Nb) and Rare Earth Elements (REE) has been discovered during the latest program of rock chip sampling at Wabli Creek, Gascoyne, W.A.

- The recently identified ovoid late-stage intrusive feature (ASX Announcement 28 May 2024) is considered the likely parental source of the Nb-Y-Ta-Ti-REE enriched pegmatites at Wabli Creek. Further, geochemistry indicates that a carbonatite association cannot be ruled out in addition to the pegmatites.

- This ovoid intrusive feature is younger than the surrounding country rock, with a diameter in excess of 3km’s and a circumference greater than 8km’s.

- Granitic pegmatite is now confirmed as a primary source of mineralisation with in-situ assay results including:

- 17.65% Nb2O5, 0.15% Y2O3, 10.81% Ta2O5, 31.39% TiO2, 0.37% TREO (24WRCK049)

- 13.22% Nb2O5, 0.13% Y2O3, 6.27% Ta2O5, 18.97% TiO2, 1.13% TREO (24WRCK046)

- These outstanding results have been chipped straight off bedrock (in-situ) and hold similar concentrations to the previously reported high grade weathered surface material (eluvial samples previously reported 32% Nb2O5 and 2.57% TREO -ASX Announcement 21 December 2023). Importantly, the in-situ assay results taken straight from the bedrock were taken approximately 0.5km from the historically reported 32% Nb2O5.

- The majority of the ovoid intrusive feature most prospective for Nb-Y-Ti-REE mineralisation (the margin zone), is poorly exposed and remains under-explored.

- Detailed airborne magnetic and radiometric surveys recently acquired are currently being interpreted by Southern Geoscience to identify and refine key priority targets for further exploration.

- The Company is actively progressing its heritage discussions with the Native Title custodians of the land and will return to site for additional sampling in the short term.

Most importantly, these latest high-grade assay results (17.65% Nb2O5 and 13.22% Nb2O5) confirm that the hard rock source material holds the same or similar high-grade concentrations as the weathered surface material (eluvial material), previously reported by the Company (32% Nb2O5 and 2.57% TREO - ASX Announcement 21 December 2023). Further, the in-situ samples have been chipped straight off the bedrock (in-situ) approximately 0.5km from the previously reported sample returning 32% Nb2O5.

Located in the highly prospective Gascoyne Province of Western Australia, approximately 150km north of Gascoyne Junction, the Wabli Creek project has previously reported high grade niobium and TREO eluvial results up to 32% Nb2O5 and 2.57% TREO (ASX Announcement 21 December 2023).

These latest in-situ results, in addition to the large ovoid intrusive feature (ASX Announcement 28 May 2024), provide a fundamental change in the prospectivity at Wabli Creek.

During the Company’s current program, a total of 49 rock chip samples were taken from Wabli Creek (E09/2377), during May 2024. Sampling was focused on the Priority 1 geochemical targets outlined by Sugden Geoscience (ASX Announcement 21 December 2023).

Click here for the full ASX Release

This article includes content from Reach Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

RR1:AU

The Conversation (0)

03 May 2022

Reach Resources Limited

Sourcing the Critical Minerals of the Future

Sourcing the Critical Minerals of the Future Keep Reading...

13 May 2025

Murchison South Increases to 67koz Gold Across Two Pits

Reach Resources Limited (ASX: RR1 & RR1O) (“Reach” or “the Company”) is pleased to announce the completion of a new Mineral Resource Estimate (MRE) for the Pansy Pit deposit at its Murchison South Gold Project. The estimate, prepared by independent consultants Mining Plus, reported above a... Keep Reading...

28 July 2023

Quarterly Activities/Appendix 5B Cash Flow Report

Reach Resources Limited (ASX: RR1) (“Reach” or “the Company”) provides its activities report for the quarter ended 30 June 2023. HIGHLIGHTS High-Grade Lithium Results at Yinnetharra (15 May 2023) Lithium mineralisation confirmed with rock chip samples reporting highly encouraging assays of up to... Keep Reading...

18 May 2023

Outcropping Copper Gossan Delivers 33% Cu Assays At Morrissey Hill Project, Yinnetharra

Reach Resources Limited (ASX: RR1 & RR1O) (“Reach” or “the Company”) is pleased to announce that it has received high grade copper, gold and silver results up to 33% copper, 0.2g/t gold and 142g/t silver from its recently completed rock chip sampling program at the Company’s Morrissey Hill... Keep Reading...

14 May 2023

Reach Resources’ Strategic Position Between Two of WA’s Mining Heavyweights

Reach Resources’ (ASX:RR1) strategic position with its Morrissey Hill project has placed the critical mineral explorer on the radar of two of Western Australia’s mining giants Delta Lithium (ASX:DLI) and Minerals 260 (ASX:MI6), according to an article published in The West Australian.“While... Keep Reading...

17h

Laguna Verde CEOL Terms Agreed with Chilean Government

CleanTech Lithium (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is delighted to announce that the Company and the Mining Ministry in Chile have formally agreed the contractual terms on which the Special Lithium Operating... Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00