September 20, 2022

Valor Resources Limited (Valor) or (the Company) (ASX:VAL) is pleased to advise that it has completed the interpretation of airborne gravity gradiometry survey data at the Hook Lake Uranium Project situated on the eastern flank of the Athabasca Basin (see Figure 2).

HIGHLIGHTS

- Eleven new targets identified from the recently completed airborne gravity gradiometry (AGG) survey:

- On-ground field checking of gravity targets completed in August.

- Follow up field program proposed including radon and geochemical surveys over new gravity targets.

- Final assay results received for Hook Lake diamond drilling from earlier in the year.

- Anomalous results in three of the six holes drilled at the S-Zone prospect.

- Cluff Lake drilling permits have been received

- Surprise Creek ground-based program to recommence this month, with assays pending from previous work this quarter. Significant uranium occurrences were identified and follow up work is about to commence.

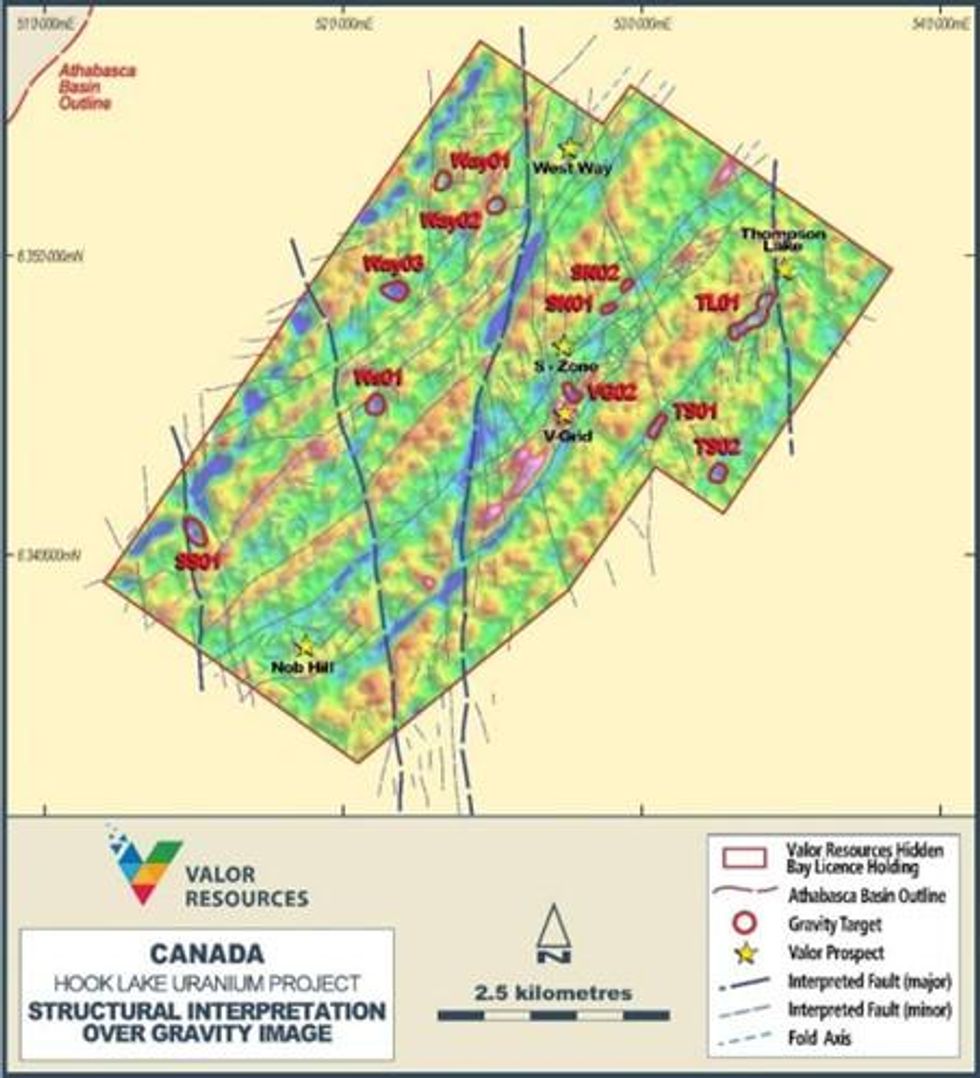

Figure 1: Hook Lake Gravity Targets identified through airborne gravity survey

The Company completed an airborne gravity gradiometry survey in May-June this year and following an interpretation of the data, eleven new targets have been defined (see Figure 1). The airborne gravity survey was designed to identify gravity lows. The hydrothermally clay altered host rocks associated with unconformity uranium deposits will have a lower density than the surrounding rocks and will present as gravity lows.

A site visit has also been completed to review the airborne gravity survey targets and assess the local geology. Follow-up work in the form of radon surveys and lake sediment sampling are currently being planned over the highest-priority targets.

Final assay results have now been received from the diamond drilling program completed earlier this year, details of which were released in the ASX announcement dated 11 April 2022 and titled “Initial Drill program hits elevated radioactivity and associated alteration at Hook Lake Uranium Project”. The assay results are within expectations based on the handheld scintillometer readings and downhole gamma survey results which were reported in the announcement dated 11 April 2022. The best result returned was in DDHL22-002 with 2.5m from 105.5m @ 160ppm U3O8.

Executive Chairman George Bauk commented “The assay results of the Hook Lake drilling program are within the boundaries expected and highlight uranium mineralisation at depth. These results coupled with the exciting new 11 targets developed using the recently flown airborne gravity survey provides the company with potential drill targets at the Hook Lake project. This area has had limited exploration with particular reference to modern exploration techniques and we will follow up with on ground exploration activities to assist with the ranking of these targets for drilling in the near future.”

“This part of the Athabasca Basin is the focus of a significant amount of uranium exploration activity at the moment. Most recently we have seen a new IPO with a project to the north of Hook Lake about to hit the ASX, and both 92 Energy and Baselode Energy completing significant drilling campaigns at their new Gemini/ACKIO discovery about 30km north of our S-Zone prospect.”

“We have an exciting portfolio of assets located around key existing and historical mining centres of the Basin. Hook Lake and Hidden Bay are close to the McArthur River, Cigar Lake and the Rabbit Lake mines, our Cluff Lake project is next to the historic Cluff Lake deposit and Surprise Creek is near the Beaverlodge uranium district. Our efforts in 2022 have been significant, comprising extensive data reviews of historical exploration, conducting a number of field programs, several large airborne surveys and a drill program at Hook Lake. What we have uncovered is a significant number of uranium targets on our properties that ultimately require drilling. With the abundance of new targets we have generated, we now need to prioritise them, which is difficult when they are of such high quality.”

Click here for the full ASX Release

This article includes content from Valor Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

VAL:AU

The Conversation (0)

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 January

Basin Energy Eyes Uranium Growth in Europe After Sweden Policy Shift

Basin Energy (ASX:BSN) is positioning for growth following Sweden’s significant shift in uranium policy, a move the company’s managing director, Pete Moorhouse, says has major implications not only for the company, but also for Europe’s broader energy strategy. In an interview with the Investing... Keep Reading...

27 January

American Uranium Exec Outlines Lo Herma ISR Progress, Resource Update

American Uranium (ASX:AMU,OTCID:AMUIF) Executive Director Bruce Lane says recent test work at the company’s Lo Herma uranium project in Wyoming has delivered an important proof of concept for its in situ recovery (ISR) development plans. The testing focused on validating aquifer performance, a... Keep Reading...

27 January

Standard Uranium CEO Outlines Athabasca Exploration Plans and Uranium Market Outlook

Standard Uranium (TSXV:STND,OTCQB:STTDF) is advancing an ambitious exploration strategy in Saskatchewan’s Athabasca Basin, according to CEO and Chairman Jon Bey, who spoke with the Investing News Network at the 2026 Vancouver Resource Investment Conference.The company is preparing for a... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00