Copper prices have been having a tough year, and the red metal has fallen sharply this month in particular. Stefan Ioannou of Haywood Securities talks copper prices and what’s in store for the market.

Copper prices have been having a tough year, and the red metal has fallen sharply this month in particular. Since November 1, spot copper prices have dropped roughly 11 percent, closing just above $2 per pound on Monday.

Copper’s fall has been driven in large part by a stronger US dollar, and by worries over slowing demand growth in China. That might not sound like anything new, but it’s been enough to keep the slide going for copper. “Given the downward momentum, prices may well continue lower until some development prompts short-covering,” MarketWatch quotes William Adams of Fastmarkets as stating.

As a result, many base metals investors are now bracing themselves for a fall below $2.

“$2 will definitely, at the very least, be a psychological level for a lot of people,” said Stefan Ioannou of Haywood Securities. However, he did make two positive points regarding copper.

“On an absolute basis, China is still growing,” he said, adding, “maybe not as quickly as people thought, but it’s still growing. It’s not contracting.” That’s important as China is the world’s top consumer of copper, accounting for roughly 40 percent of global demand.

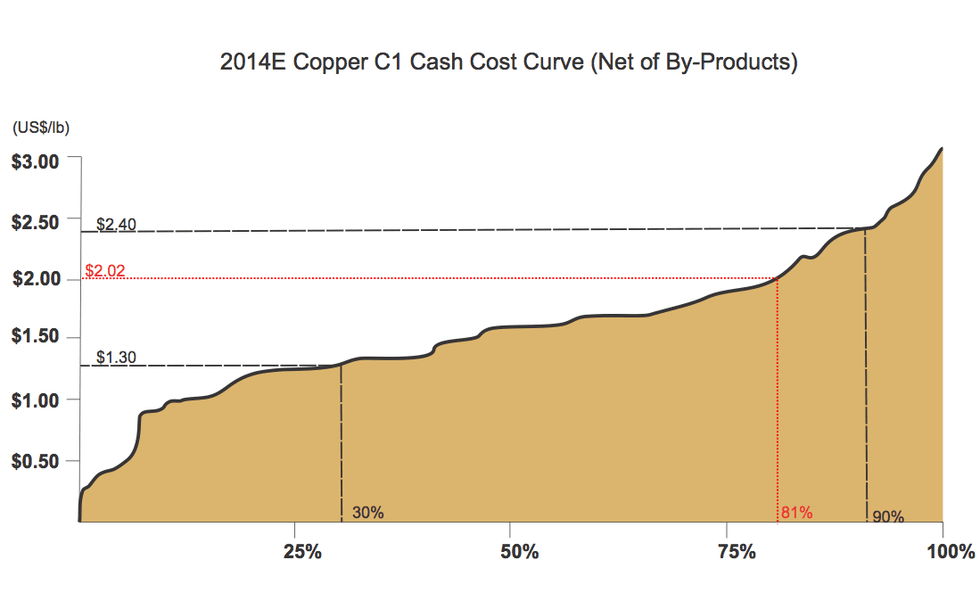

Beyond that, Ioannou suggested that lower copper prices could start to push supply out of the market. “If you look at the copper cash cost curve right now, at $2 copper, we’re quite a ways into it,” he said. “That could definitely could spur on some existing mine shutdowns, which is going to tighten things up more.” Specifically, Ioannou stated that with copper at $2, 20 percent of the world’s producing copper mines will no longer economic.

“That’s the scary thing. It isn’t like it’s just a handful of the most expensive ones — it’s 20 percent,” he said. “And that’s just C1 cash cost. That doesn’t include corporate G&A, sustaining costs, debt obligation costs. You could argue that those additional costs probably add another 20 to 30 cents a pound.” Given those considerations, Ioannou said that the percentage of mines that are not economic at today’s prices could rise to roughly 30 percent.

Cost cutting

However, while a certain percentage of mines are not economic at current copper prices, Ioannou admitted that in reality, Haywood isn’t seeing supply being limited just yet. “There’s a lot of inventory out there that would have to be drawn down before there would be a crunch on the physical supply side,” he said.

Certainly, there have been some not-insignificant production cuts from Glencore (LSE:GLEN) and Freeport-McMoRan (NYSE:FCX) as of late, but that news has failed to bring a material boost in copper prices.

Still, Ioannou suggested that in the coming quarters, more miners could consider putting operations on temporary care and maintenance or even shut them down entirely. He believes that one should never underestimate the ability of miners to continue cutting costs, but suggested that going beyond what has already been done will be increasingly challenging.

“It’s amazing … over the last 12 to 24 months how much has been refocused at the operations level to cut costs,” he said. “Every mine site I was on this year … it was amazing the emphasis on every little thing, every little measure to cut costs, whether it was tires or toilet paper.”

In terms of who has the lowest costs, Ioannou said that’s difficult to pinpoint depending on where one draws the line with copper-gold projects (is it copper or gold that’s being treated as a by-product?); however, overall, he said that about 10 percent of the world’s currently producing copper mines have C1 cash costs of less than $1 per pound.

What does it mean for junior miners?

As Haywood has stated previously, the rout in metals prices has made things tough for junior mining companies in general, and Ioannou said that’s still the case for junior copper companies.

He stated that “the financing window is closed for sure.” For juniors with good projects, that means it will be important to get their projects positioned in cash preservation mode to be ready for when the cycle turns.

“You could have a very good project, but if you’ve got no cash and bills to pay, the mid tiers and bigger players are going to take advantage of that,” he said.

For example, Sunridge Gold (TSXV:SGC) recently sold 60 percent of its Asmara asset to China’s Sichuan Road & Bridge Mining Investment Development, which is certainly a positive development given the current market. However, Ioannou pointed out that there are other factors to consider when selling a project at the bottom of the market — while he believes Sunridge got a good deal relative to its current market cap, he suggested that the price still came in at a big discount to the underlying NAV of the project. “That’s a classic example of timing,” he said.

To be sure, it appears that the tough state of the market for copper is set to continue for some time. However, as mentioned above, there is a light at the end of the tunnel. And for junior miners with projects set to come online a few years from now, that timing might not be so bad.

Securities Disclosure: I, Teresa Matich, hold no direct investment interest in any company mentioned in this article.