May 01, 2025

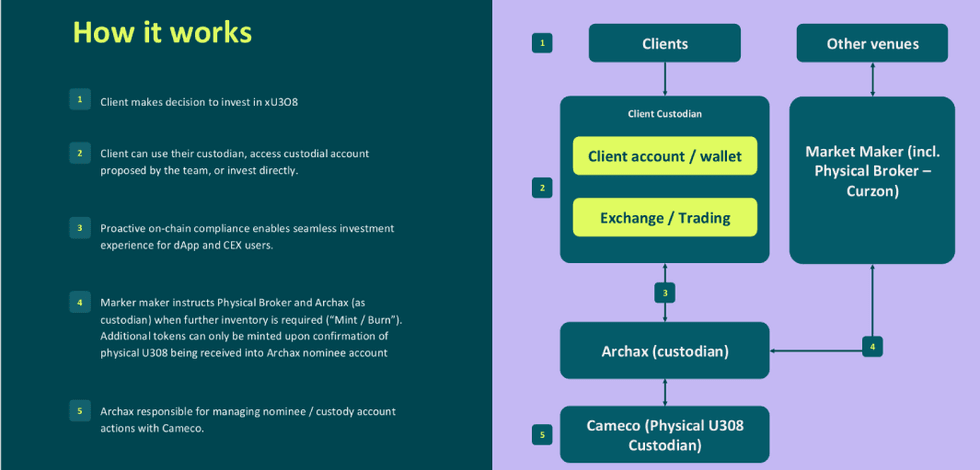

Uranium.io is a next-generation platform transforming access to physical uranium (U₃O₈) through the power of blockchain technology. It empowers both individual and institutional investors to directly own and trade uranium, eliminating many of the traditional barriers, such as high costs, limited transparency, and market inefficiencies. Each xU₃O₈ token is fully backed by physical uranium stored in a secure, regulated facility operated by Cameco. Custodianship is provided by Archax, a UK-regulated digital asset firm, ensuring robust transparency and trust in the asset’s backing.

The platform meets rising investor demand for uranium—a key driver of the global energy transition. As nations pursue net-zero targets, nuclear energy is gaining momentum as a reliable, low-carbon power source. Governments across North America, Europe, and Asia are expanding nuclear capacity by restarting reactors, building new ones, and advancing small modular reactor development.

Uranium.io combines blockchain, digital custody, and real-world uranium supply to deliver secure, transparent access to the uranium market. By bridging traditional commodity trading with Web3, the platform enables users to seamlessly acquire, hold, and trade physical uranium through xU₃O₈ tokens.

Company Highlights

- Uranium.io is a pioneering platform for buying and selling uranium, providing direct ownership of physical uranium via a blockchain-powered token xU3O8.

- Built on Etherlink, powered by Tezos technology, enabling transparency, low fees, energy efficiency and programmable compliance.

- FCA-regulated digital asset custodian, Archax, holds physical uranium in trust on behalf of token holders.

- Physical supply is brokered by Curzon Uranium, a trusted uranium trading and logistics partner with deep industry roots and over $1 billion in uranium trades.

- The uranium bought on the platform is physically stored at a regulated depository owned and operated by Cameco, one of the world’s leading global uranium providers/converters.

- Global 24/7 market access offering fractionalized and direct uranium exposure with real-time settlement and cross-border accessibility.

- Capitalizing on nuclear energy’s role in clean energy transition and the financialization of critical minerals.

This Uranium.io profile is part of a paid investor education campaign.*

Click here to connect with xU3O8 (uranium.io) to receive an Investor Presentation

Sign up to get your FREE

Metro Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

02 March

Metro Mining

Pure-play low-cost producer of high-grade Australian bauxite

Pure-play low-cost producer of high-grade Australian bauxite Keep Reading...

26 February

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

26 February

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

25 February

Uranium American Resources

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern... Keep Reading...

25 February

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten US nuclear expansion plans, according to the leader of Centrus Energy (NYSE:LEU), one of the country’s largest suppliers of enriched uranium.Amir Vexler, president and CEO of Centrus, is warning that rising demand from existing... Keep Reading...

24 February

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

23 February

Basin Energy Hits 1,112 ppm TREO, Fast Tracks 2026 Uranium and REE Strategy at Sybella-Barkly

Basin Energy (ASX:BSN) is moving to accelerate its 2026 exploration efforts following "exciting" results from its maiden drilling program at the Sybella-Barkly project in Queensland. In a recent interview, Managing Director Pete Moorhouse revealed that the company has confirmed a significant... Keep Reading...

Latest News

Sign up to get your FREE

Metro Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00