April 10, 2023

Blue Star Helium Limited (ASX:BNL, OTCQB:BSNLF) (Blue Star or the Company) provides an update on progress on its maiden Voyager helium development in Las Animas County, Colorado.

Highlights

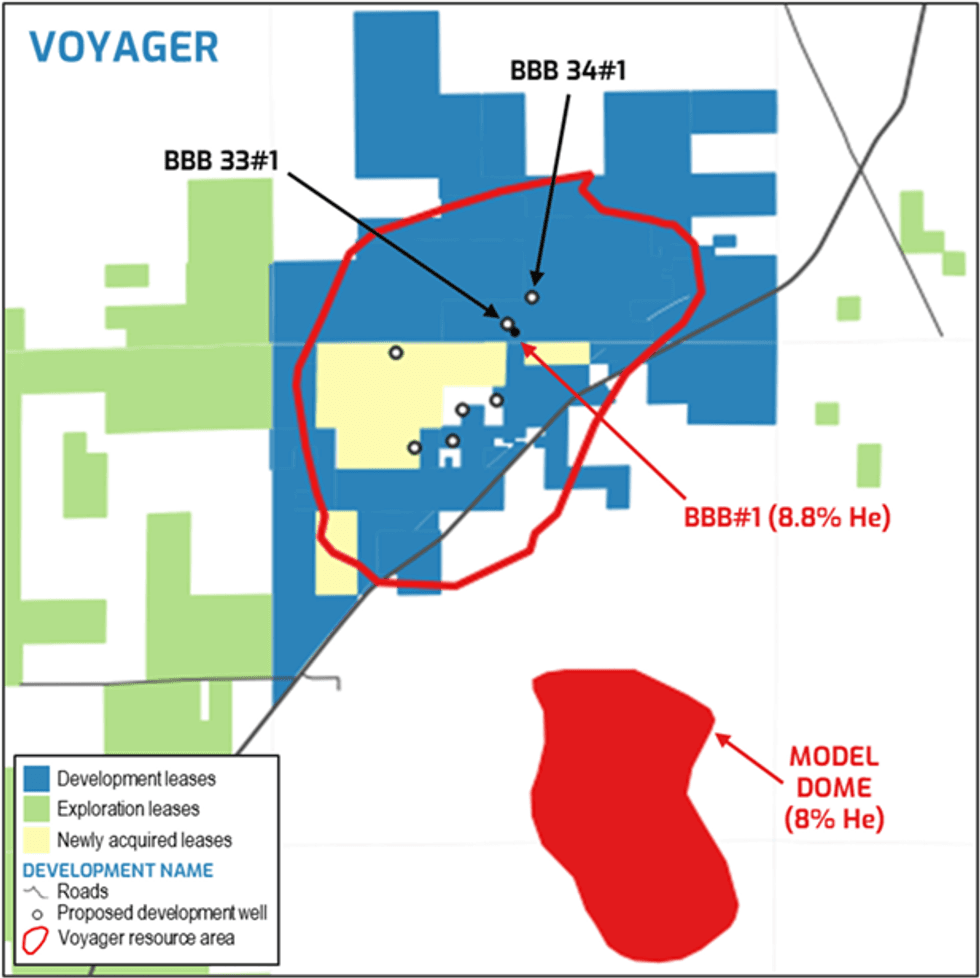

- Final approval to drill the first two helium development wells (BBB 33#1 and 34#1) at the high-grade Voyager helium development expected this month.

- These two wells offset the BBB#1 helium discovery and are planned to be production wells.

- Drilling of the first well is expected to commence in late Q2 or Q3 and is set to include flow and pressure testing.

- Newly acquired strategic crestal mineral leases and surface access agreements expected to increase Voyager contingent resources and enable optimised siting of helium processing facility.

- Commercial discussions for provision of leased helium facility at Voyager highly advanced and expected to conclude in execution of a facilities agreement in coming weeks.

- Additional five-well OGDP for Voyager to be submitted to COGCC; together with the BBB 33#1 and 34#1 locations, delivers robust inventory from which the initial 3-4 production well locations at Voyager will be selected.

- Blue Star targeting first helium production and sales from Voyager during H2 CY2023.

Blue Star Managing Director and CEO, Trent Spry commented:

“We are very pleased to have now secured the majority of the Voyager helium resource area with these new crestal leases. While infill leasing will continue in the background, these leases are expected to significantly add to our net contingent resource and have allowed inclusion of highly regarded well locations in the upcoming OGDP submission. It will also allow for additional crestal locations to be added to the inventory going forward. The new surface access allows for optimal placing of the helium facility and a more efficient gathering gas system.

“While in Denver recently we met with the mid-stream company that will provide and operate the initial facility at Voyager with discussions now highly advanced and final document signing expected in the coming weeks.”

Voyager helium development wells

The Colorado Oil and Gas Conservation Commission (COGCC) has advised that it expects to issue the final Form 2 approvals for the BBB 33#1 and 34#1 helium wells this month. These wells relate to the “BBB 2860” Oil and Gas Development Plan (OGDP) located within the Company’s high-grade Voyager helium development.

These two wells offset the BBB#1 helium discovery and are intended to produce into the initial Voyager facility (see BNL announcement dated 19 December 2022). Drilling of the first of these wells is expected to commence in late Q2 or Q3 and is planned to include subsequent flow and pressure testing evaluation.

Following the acquisition of strategic mineral leases and surface access agreements, the next planned OGDP submission at Voyager has been expanded to five wells and is set to be submitted within the next four weeks after expiry of mandatory pre-submission notices to the County. Coupled with BBB 33#1 and 34#1, approval of these further locations is expected to deliver a robust inventory of permitted wells from which to select the initial 3-4 production well locations at Voyager.

Previously this OGDP included the three eastern wells on the map below (on existing leases shown in blue). Submission of the OGDP was paused to add the two highly regarded well locations associated with the newly acquired strategic minerals leases (shown in yellow). This approach follows COGCC guidance.

COGCC advised at the operator meeting on 14 March 2023 that it is implementing a revised permitting process which is designed to shorten the time between submission and hearing to 4.5 months. COGCC says that the current process takes on average 7 months.

Additional leases and surface access acquired

Blue Star has agreed to acquire further strategic mineral leases in the Voyager area and has agreed additional highly favourable surface access. The leases comprise a total of 2987 gross acres (1382 net acres), are located high on the Voyager structure as currently mapped and are therefore expected to increase the contingent resource base at Voyager.

The additional surface access allows optimisation of the planned siting of the helium processing facility at Voyager and a more efficient gas gathering system layout.

Click here for the full ASX Release

This article includes content from Blue Star Helium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BNL:AU

The Conversation (0)

28 November 2022

Blue Star Helium

Developing High-Grade Helium Assets in Colorado

Developing High-Grade Helium Assets in Colorado Keep Reading...

27 February

US-Iran Tensions Put Europe’s Gas Storage Plans at Risk

Escalating tensions between the United States and Iran are reviving a risk energy markets have long feared: a potential closure of the Strait of Hormuz, the narrow Gulf passage that carries roughly 20 percent of global LNG trade and 25 percent of seaborne oil.New modelling from energy analytics... Keep Reading...

25 February

QIMC Intersects Major Subsurface Fault Corridor with Elevated H2 Readings at 142m Depth

Pressurized Formation Water and Visible Gas Bubbling Confirm Active Structural System in First of Five-Hole Systematic Drill Program

Quebec Innovative Materials Corp. (CSE: QIMC) (OTCQB: QIMCF) (FSE: 7FJ) ("QIMC" or the "Company") is pleased to report significant initial results from the first 300 metres of its planned 650-metre diamond drill hole DDH-26-01 at its West Advocate Eatonville Project, Nova Scotia. Drilling... Keep Reading...

24 February

Angkor Resources Commences Trenching Program At CZ Gold Prospect, Ratanakiri Province, Cambodia

(TheNewswire) GRANDE PRAIRIE, ALBERTA (February 24, 2026) TheNewswire - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") announces the completion of a trenching and sampling program at the CZ Gold Prospect in Ratanakiri Province, Cambodia. As previously announced (see... Keep Reading...

23 February

PEP 11 Update - Federal Court Proceedings

MEC Resources (MMR:AU) has announced PEP 11 Update - Federal Court ProceedingsDownload the PDF here. Keep Reading...

23 February

Kinetiko Energy Poised to Address South Africa’s Gas Supply Gap: MST Access Report

Description:A research report by MST Access highlights Kinetiko Energy (ASX:KKO) as an emerging participant in South Africa’s domestic gas sector, supported by a base-case valuation of AU$0.49 per share. The company’s project covers 5,366 sq km, located 200 km southeast of Johannesburg within an... Keep Reading...

18 February

Half Yearly Report and Accounts

MEC Resources (MMR:AU) has announced Half Yearly Report and AccountsDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00