Vizsla Copper Corp. (TSXV: VCU) (OTCQB: VCUFF) (" Vizsla Copper " or the " Company ") is pleased to announce the appointment of Craig Parry Executive Chairman, to the role of Chief Executive Officer (" CEO "), and further information on the newly acquired Poplar Project ( "Poplar" or the "Project" ). The Poplar Project is home to the Poplar Deposit (the "Deposit" ), a large porphyry-related copper-gold-molybdenum deposit that is one of the most advanced pre-production copper projects in British Columbia .

HIGHLIGHTS:

- CEO. Craig Parry , Executive Chairman, has assumed the role of CEO.

- Large, Gold-Rich Resource Base. The Project hosts a current undiluted indicated mineral resource of 152.3 million tonnes grading 0.32% copper, 0.009% molybdenum, 0.09 g/t gold and 2.58 g/t silver and an undiluted inferred mineral resource of 139.3 million tonnes grading 0.29% copper, 0.005% molybdenum, 0.07 g/t gold and 4.95 g/t silver.

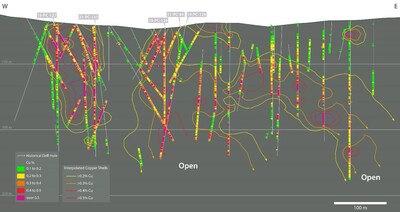

- Development Potential. The Poplar Deposit is a large, near-surface copper deposit that extends to the top of the bedrock and is covered only by a thin veneer (5- 10m thick) of overburden. It possesses a higher-grade core that also extends to the top of the bedrock and may be beneficial to phased mining scenarios.

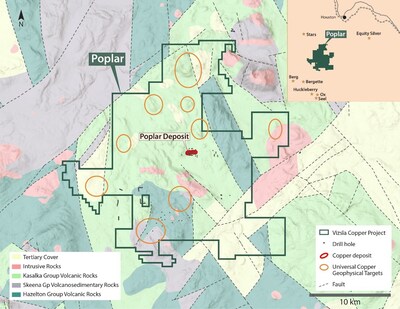

- Exploration Potential. Very little exploration drilling or ground geophysical surveying has been completed outside of the immediate Poplar deposit area, suggesting terrific potential for the discovery of additional porphyry-related mineralization.

" With the completion of the Universal Copper transaction, I look forward to taking a more active role in the Company's day-to-day operations " stated Craig Parry , Executive Chairman of the Company. " Since Vizsla Copper's inception, we've succeeded in adding multiple exciting development and exploration assets, and we're just getting started. Vizsla Copper is in a terrific position with the price of copper approaching $5 per pound and strong tailwinds continuing to dominate the sector."

"Now that we've had a chance to absorb and reflect on the exploration data from the Poplar Project, I'm very impressed by the development potential and exploration opportunity it provides " commented Steve Blower , Vice President, Exploration of the Company. " With a significant precious metal component, large size and location essentially at surface, this deposit is impressive ."

MANAGEMENT CHANGE

With the continuing evolution of the Company, Mr. Craig Parry has assumed the role of CEO and will remain Chair of the Company's Board of Directors. Craig brings a track record of creating shareholder value in previous CEO roles. Most recently, in his role as CEO of IsoEnergy, he turned an early-stage exploration spinout company into a much larger discovery success story in the uranium space. Mr. Chris Donaldson , remaining as a director of the Company, will step down as CEO effective immediately so that he can devote more time to other pursuits. The Company is appreciative of Chris's efforts as the former CEO.

POPLAR PROJECT

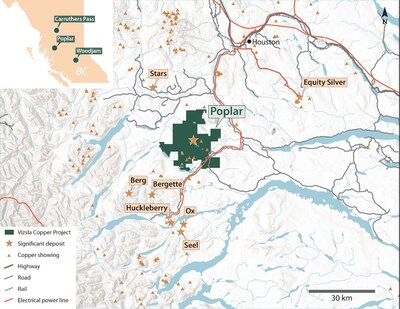

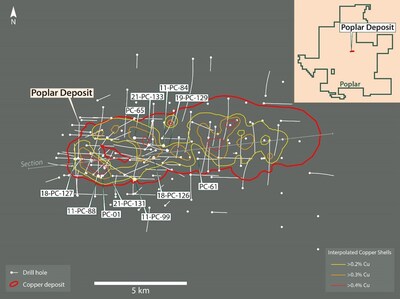

The 39,000-hectare Poplar Project hosts a porphyry-related copper and gold deposit, the Poplar Deposit (Figures 1 and 2). The top 10 historical drill hole intersections (>0.2% Cu) in the Poplar Deposit, ranked by Grade*Length (%Cu*m) are provided in Table 1. The top ranked drill hole was recently completed in 2021 by Universal Copper. Drill hole 21-PC-131 intersected 432.8m @ 0.42% Cu, 0.011% Mo, 0.15 g/t Au and 1.80 g/t Ag (0.58% Cueq 1,2 ) from 2.2m . Figure 3 shows the extent of copper mineralization in plan view at the Poplar deposit and demonstrates, and Figure 4 shows it on a vertical longitudinal section.

The Poplar Deposit has a historical indicated mineral resource of 152.3 million tonnes grading 0.32% copper, 0.009% molybdenum, 0.09 g/t gold and 2.58 g/t silver and a historical inferred mineral resource of 139.3 million tonnes grading 0.29% copper, 0.005% molybdenum, 0.07 g/t gold and 4.95 g/t silver (above a cut-off grade of 0.20% copper). The historical mineral resource estimate was prepared for Universal Copper in September, 2021. It is not being treated as a current Mineral Resource Estimate, as the Company has not yet had it verified by an Independent Qualified Person. However, the recent date of the Universal estimate and the lack of drilling completed since that date suggests that the historical estimate is relevant. Readers are cautioned that mineral resources, which are not mineral reserves, do not have demonstrated economic viability.

The Poplar Project is located in mining country, 35km from the Huckleberry Copper Mine. The road accessible property is bisected by a 138 Kva hydroelectric line and lies 88km from the rail head at Houston and 400km from the deep-water port at Prince Rupert by rail.

Table 1 – Top 10 Poplar Deposit Drill Hole Intersections (>0.2% Cu) Ranked by Cu%*m

| Rank | Hole ID | From (m) | To (m) | Length (m) | Cu % | Mo % | Au g/t | Ag g/t | CuEq % | Cu*L (%*m) |

| 1 | 21-PC-131 | 2.20 | 435.00 | 432.80 | 0.42 | 0.011 | 0.15 | 1.80 | 0.58 | 183.32 |

| | incl. | 156.00 | 192.00 | 36.00 | 0.66 | 0.012 | 0.28 | 1.23 | 0.90 | |

| | incl. | 242.00 | 270.00 | 28.00 | 0.67 | 0.012 | 0.27 | 3.41 | 0.92 | |

| 2 | 21-PC-133 | 21.25 | 423.50 | 402.25 | 0.43 | 0.014 | 0.13 | 3.07 | 0.60 | 174.12 |

| | incl. | 253.25 | 294.50 | 41.25 | 0.94 | 0.018 | 0.23 | 4.06 | 1.19 | |

| 3 | 19-PC-129 | 149.00 | 527.65 | 378.65 | 0.42 | 0.014 | 0.13 | 2.22 | 0.58 | 160.78 |

| | incl. | 397.00 | 452.82 | 55.82 | 0.54 | 0.019 | 0.14 | 2.18 | 0.72 | |

| | incl. | 286.00 | 312.56 | 26.56 | 0.57 | 0.006 | 0.18 | 3.40 | 0.74 | |

| 4 | 11-PC-88 | 11.79 | 361.00 | 349.21 | 0.41 | 0.020 | 0.12 | 2.62 | 0.59 | 143.92 |

| | incl. | 232.98 | 280.98 | 48.00 | 0.62 | 0.011 | 0.18 | 2.35 | 0.79 | |

| | incl. | 166.98 | 187.98 | 21.00 | 0.55 | 0.018 | 0.15 | 1.21 | 0.73 | |

| 5 | 18-PC-126 | 23.50 | 404.47 | 380.97 | 0.36 | 0.015 | 0.10 | 2.30 | 0.51 | 138.57 |

| 6 | 11-PC-84 | 24.99 | 402.88 | 377.89 | 0.36 | 0.012 | 0.10 | 1.74 | 0.48 | 134.85 |

| 7 | 11-PC-99 | 53.60 | 420.59 | 366.99 | 0.37 | 0.022 | 0.12 | 2.30 | 0.55 | 134.45 |

| | incl. | 340.57 | 379.57 | 39.00 | 0.69 | 0.036 | 0.31 | 0.89 | 1.03 | |

| 8 | PC-65 | 24.40 | 315.00 | 290.60 | 0.39 | 0.015 | 0.00 | 0.53 | 0.45 | 113.32 |

| | incl. | 36.00 | 78.00 | 42.00 | 0.58 | 0.005 | 0.01 | 0.76 | 0.61 | |

| 9 | PC-01 | 0.61 | 300.84 | 300.23 | 0.37 | 0.022 | 0.02 | 0.30 | 0.47 | 112.47 |

| 10 | 18-PC-127 | 8.50 | 270.36 | 261.86 | 0.42 | 0.013 | 0.11 | 2.66 | 0.56 | 110.97 |

| | incl. | 51.00 | 78.00 | 27.00 | 0.64 | 0.030 | 0.15 | 2.63 | 0.87 | |

| Notes: | |

| 1. | Composite intervals are calculated above 0.2% Cu (above 0.5% Cu for the included sub-intervals) and may include a maximum of 10m of internal waste, |

| 2. | Copper equivalent values are based on metal prices of $4.00/lb Cu, $1,800/oz Au, $22/oz Ag and $15/lb Mo and an assumed 100% recovery. |

DEVELOPMENT STRATEGY

The Company will be updating the Mineral Resource Estimate for the Poplar Deposit to bring it up to current status. This will provide important inputs to planned internal scoping level trade-off studies which will be used to rank and prioritize development scenarios amongst the various projects and deposits within the Company. The results of the internal scoping studies will determine the path forward for a Preliminary Economic Analysis.

Figure 1 – Poplar Project Location Map

Figure 2 – Poplar Project Map

Figure 3 – Poplar Deposit Level Plan (700masl) (Drill hole traces projected in their entirety)

Figure 4 – Poplar Deposit Vertical Longitudinal Section (Section Line on Figure 3)

STOCK OPTIONS AND AMENDED STOCK OPTION PLAN

The Company's board of directors have approved amendments to its current 10% Rolling Stock Option Plan (the " Plan "), originally adopted on September 20, 2021 to comply with the recent changes to the TSX Venture Exchange (the " TSXV ") Policy 4.4 – Security Based Compensation. The amendments have been conditionally approved by the TSXV and are subject to shareholder ratification at the Company's next annual general meeting later this year.

The Company has granted a total of 7,500,000 stock options (the " Options ") to directors, officers, employees and consultants of the Company. The Options will have an exercise price of $0.09 , expire five years from the date of grant and shall vest over two years. The Options were granted pursuant to the Plan and are subject to regulatory approval.

QUALIFIED PERSON

The disclosure of technical or scientific information in this press release has been reviewed and approved by Ian Borg , P.Geo., Senior Geologist for Vizsla Copper. Mr. Borg is a Qualified Person as defined under the terms of National Instrument 43-101.

ABOUT Vizsla Copper

Vizsla Copper is a Cu-Au-Mo focused mineral exploration and development company headquartered in Vancouver, Canada . The Company is primarily focused on its flagship Woodjam project, located within the prolific Quesnel Terrane, 55 kilometers east of the community of Williams Lake, British Columbia . It has three additional copper exploration properties: Copperview, Redgold and Carruthers Pass , all well situated amongst significant infrastructure in British Columbia . Following closing of the Arrangement, Vizsla Copper will control a fifth project, the Poplar Project. The Company's growth strategy is focused on the exploration and development of its copper properties within its portfolio in addition to value accretive acquisitions. Vizsla Copper's vision is to be a responsible copper explorer and developer in the stable mining jurisdiction of British Columbia, Canada and it is committed to socially responsible exploration and development, working safely, ethically and with integrity.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

FORWARD LOOKING STATEMENTS

This news release contains forward-looking statements or forward-looking information relating to the future operations of the Company and other statements that are not historical facts. Forward-looking statements in this news release include but are not limited to: obtaining the necessary approvals required for the Arrangement; completion of the Arrangement and the timing thereof; the benefits of the Arrangement; exploration activities; and Vizsla Copper's growth and business strategies.

Forward-looking statements are based on the reasonable assumptions, estimates, analyses and opinions of management made in light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances at the date that such statements are made, but which may prove to be incorrect. Management believes that the assumptions and expectations reflected in such forward-looking statements are reasonable. Assumptions have been made regarding, among other things: the Company's ability to carry on exploration and development activities; the timely receipt of required approvals; the price of copper and other metals; and the Company's ability to obtain financing as and when required and on reasonable terms. Readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions which may have been used.

Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause actual results to be materially different from those expressed or implied by such forward-looking statements. Such risks, uncertainties and other factors include but are not limited to: the Company's early stage of development and lack of history as a stand-alone entity; the fluctuation of the price of copper and other metals; the availability of additional funding as and when required; the speculative nature of mineral exploration and development; the timing and ability to maintain and, where necessary, obtain necessary permits and licenses; the uncertainty in geologic, hydrological, metallurgical and geotechnical studies and opinions; infrastructure risks, including access to water and power; environmental risks and hazards; risks associated with negative operating cash flow; and risks associated with dilution. For a further discussion of risks relevant to the Company, see the Company's other public disclosure documents.

Although management has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There is no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such forward-looking statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company does not undertake to update any forward-looking statements, except as, and to the extent required by, applicable securities laws.

SOURCE Vizsla Copper Corp.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/May2024/16/c9267.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/May2024/16/c9267.html