- WORLD EDITIONAustraliaNorth AmericaWorld

August 06, 2023

Blackstone Minerals Limited (“Blackstone” or the “Company”) is pleased to announce that our Ta Khoa Project (“TKP”) was included in the Vietnamese National Mineral Master Plan which was recently approved by the Vietnamese Deputy Prime Minister, Tran Hong Ha.

The National Mineral Master Plan details Vietnam’s mineral development strategy up until 2030 with a vision to 2050. The Master Plan is a key document and reference point in the approval of major mineral projects in Vietnam. The Master Plan aims to closely manage, exploit and process mineral resources with the objective to value add in country as much as possible to ensure Vietnam maximises the value generated from their natural resources. The Master Plan focuses on environmental protection and climate change adaptation to move Vietnam towards the goal of achieving carbon neutrality.

The Ta Khoa Project aligns with Vietnam’s objective for maximising value creation from their natural resources and Blackstone is pleased that both Ta Khoa Nickel (“TKN”) and Ta Khoa Refinery (“TKR”) projects were included in the approved National Mineral Master Plan, demonstrating that these projects are considered as ‘significant value’ for Vietnam.

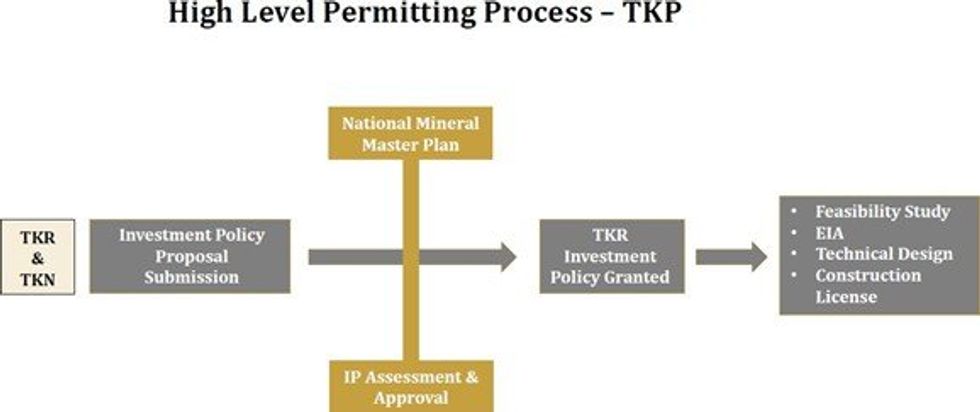

The inclusion of the projects in the Master Plan was an important step in the permitting and licensing of our projects. For the Provincial Government to advance the approval and issuing of the Investment Policies (“IP”) for both TKR and TKN our projects needed to be in the National Mineral Master Plan.

For Blackstone, the master plan included;

- TKN: allowance for the construction of a new concentrator, a new mine development and inclusion of new exploration opportunities around the Ban Phuc Nickel Mine;

- TKR: allowance for a Nickel Refinery with a production capacity of up to 150,000 tonnes per annum of Nickel:Cobalt:Manganese (NCM) precursor cathode active material (pCAM) or up to 420,000 tonnes per annum of Nickel Sulphate or any combination of these products.

A key step in the permitting of the Ta Khoa Project is the approval of an Investment Policy for each of TKR and TKN. The Investment Policy which is converted to an Investment Certificate is Vietnam’s approval for developers to proceed with acquiring the necessary licenses to start construction and operations. In order for an Investment Policy for a mineral development project to be approved it must be in the National Mineral Master Plan to allow it to be assessed and ultimately approved.

As announced on the 26th July 2023, Blackstone has entered into a MOU with Vietnam Rare Earths JSC (“VTRE”) and Australian Strategic Materials (“ASM”) to cooperate on opportunities to develop a fully integrated rare earths mine to metals value chain in Vietnam. The company is happy to announce that the target concessions in the Dong Pao region have also been included in the National Master Mineral Plan. A number of other highly prospective Rare Earth concessions were also included which will also be investigated by the Company.

Blackstone Minerals’ Managing Director, Scott Williamson, commented:

“Congratulations to Vietnam on finalising and approving this important Master Plan which will help facilitate the development of mineral projects throughout Vietnam. Blackstone is very pleased to have our Ta Khoa Project included in the Master Plan and are honoured that Vietnam are supportive of our strategy to develop a vertically integrated nickel mining and refining business. This was a critical step in the permitting of our projects and we look forward to making significant progress in this area”

Click here for the full ASX Release

This article includes content from Blackstone Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BSX:AU

Sign up to get your FREE

Blackstone Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

25 July 2025

Blackstone Minerals

A diversified developer of battery-grade nickel and copper-gold assets in Southeast Asia

A diversified developer of battery-grade nickel and copper-gold assets in Southeast Asia Keep Reading...

27 January

Quarterly Activities/Appendix 5B Cash Flow Report

Blackstone Minerals (BSX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

28 December 2025

Managing Director Resignation and Board Changes

Blackstone Minerals (BSX:AU) has announced Managing Director Resignation and Board ChangesDownload the PDF here. Keep Reading...

24 October 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Blackstone Minerals (BSX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 August 2025

BSX Secures JV Partner & Funding for Ta Khoa Nickel Project

Blackstone Minerals (BSX:AU) has announced BSX Secures JV Partner & Funding for Ta Khoa Nickel ProjectDownload the PDF here. Keep Reading...

25 August 2025

Trading Halt

Blackstone Minerals (BSX:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

16 January

Top 5 Canadian Mining Stocks This Week: Homeland Nickel Gains 132 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.The Ontario government said Tuesday (January 13) that it is accelerating permitting and... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

Latest News

Sign up to get your FREE

Blackstone Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Trading Halt

10h

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00