Tudor Gold Corp. (TSXV: TUD) (FSE: H56) (the "Company" or "Tudor") reports that it has filed a Notice of Work permit application with the BC Ministry of Energy, Mines and Low Carbon Innovation (EMLI) for the underground exploration of the Treaty Creek Project located in northwest British Columbia.

The permit application provides for the development of an underground ramp to access the high-grade gold SC-1 Zone and to also access the other zones. Once the ramp is completed, underground drill stations will be excavated to support definition drilling for mine-planning purposes and provide for more efficient expansion drilling. Underground drilling is expected to reduce the time and cost of delineating the high-grade gold SC-1 Zone and allow for year-round drilling by Tudor.

The high-grade gold SC-1 Zone was first identified by Tudor in early 2024 based on 2022 and 2023 drilling with the discovery hole (GS-22-134) intersecting 25.5 meters grading 9.66 g/t gold, 1.23 g/t silver and 0.24% copper (see news release dated February 1, 2024).

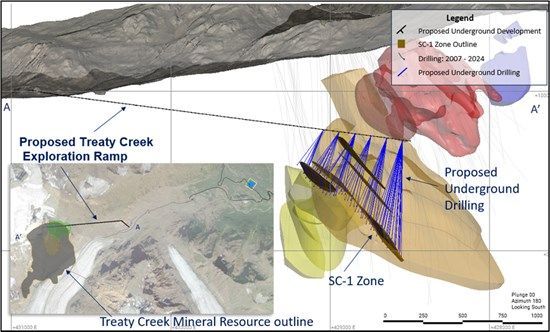

See Figure 1 below for a plan and section view of the proposed underground development and initial drilling of the SC-1 Zone at Treaty Creek.

Figure 1: Treaty Creek Project proposed underground development and SC-1 Zone drilling

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4494/262604_5ff9196b942a4b49_002full.jpg

American Creek Acquisition

American Creek Resources Ltd. ("American Creek") has set August 28, 2025 as the date for its annual general and special meeting of shareholders to, among other things, approve a statutory plan of arrangement under which the Company will acquire all of the issue and outstanding shares of American Creek (the "Transaction"). (See the Company's news releases of June 9, 2025 and June 26, 2025.)

In addition to American Creek shareholder approval and court approval, the Transaction is subject to applicable regulatory approvals including, but not limited to, TSX Venture Exchange (the "Exchange") approval and the satisfaction of certain other closing conditions customary in a transaction of this nature. The Transaction is anticipated to be completed in early September 2025.

Currently, American Creek holds a 20% carried interest, and Tudor a 60% interest, in the Treaty Creek Project. On completion of the Transaction, Tudor will hold an 80% interest in the Treaty Creek Project. The Treaty Creek Project hosts an Indicated Mineral Resource of 21.66 million ounces of gold grading 0.92 g/t, 2.87 billion pounds of copper grading 0.18% and 128.73 million ounces of silver grading 5.48 g/t and an Inferred Mineral Resource of 4.88 million ounces of gold grading 1.01 g/t, 503.2 million pounds of copper grading 0.15% and 28.97 million ounces of silver grading 6.02 g/t.

Quality Assurance and Control

Ken Konkin, P.Geo, Senior Vice-President of Exploration for Tudor Gold, is the Qualified Person, as defined by National Instrument 43-101, responsible for the Treaty Creek Project. Mr. Konkin has reviewed, verified, and approved the scientific and technical information in this news release.

About Tudor Gold

Tudor Gold Corp. is a precious and base metals exploration and development company with claims in the Golden Triangle of British Columbia (Canada), an area that hosts producing and past-producing mines and several large deposits that are approaching potential development. The 17,913-hectare Treaty Creek Project borders Seabridge Gold Inc.'s KSM property to the southwest and Newmont Corporation's Brucejack Mine property to the southeast.

For further information, please visit the Company's website at www.tudor-gold.com or contact:

| Joseph Ovsenek President & CEO (778) 731-1055 Tudor Gold Corp. Suite 789, 999 West Hastings Street Vancouver, BC V6C 2W2 info@tudorgoldcorp.com (SEDAR+ filings: Tudor Gold Corp.) | Chris Curran Vice President of Investor Relations and Corporate Development (604) 559 8092 chris.curran@tudor-gold.com |

Neither the Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements Regarding Forward-Looking Information

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. "Forward-looking information" includes, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future, including the completion and anticipated results of planned exploration activities. Generally, but not always, forward-looking information and statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" or the negative connotation thereof.

Such forward-looking information and statements are based on numerous assumptions, including among others, that the Company's planned exploration activities will be completed in a timely manner. Although the assumptions made by the Company in providing forward-looking information or making forward-looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate.

There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's plans or expectations include risks relating to the actual results of current exploration activities, fluctuating gold prices, possibility of equipment breakdowns and delays, exploration cost overruns, availability of capital and financing, general economic, market or business conditions, regulatory changes, timeliness of government or regulatory approvals and other risks detailed herein and from time to time in the filings made by the Company with securities regulators.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information.

The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise except as otherwise required by applicable securities legislation

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/262604