November 28, 2022

Trailbreaker Resources Ltd. (TBK.V) (“Trailbreaker” or “the Company”) is pleased to announce the results of the 2022 exploration program at its 100%-owned Atsutla Gold project, located in northwestern British Columbia (BC).

First-pass prospecting on newly staked claims has led to the discovery of high-grade gold mineralization 3.5 km northeast of the Highlands zone, in an area now termed the ‘Snook zone.’ Assays of rock grab samples returned values up to 53.3 g/t gold (Au) from quartz vein talus boulders with galena-bornite-chalcopyrite mineralization.

Twenty-four kilometres east of the Highlands and Snook zones, follow-up prospecting and soil sampling at the Swan zone revealed a new gold-in-soil anomaly. This is located about one kilometre northeast of the 900 m x 700 m multi-element anomaly representing the surface expression of a porphyry centre defined in 2021. This new anomaly is about 559 metres long, with values up to 268 ppb Au. Assays of rock grab samples from the Swan zone yielded values up to 11.7 g/t Au and 212 g/t silver (Ag) (separate samples).

Between the Swan and Snook zones lies a large area of un-explored ground. First-pass prospecting in the Shownektaw Creek area led to the discovery of multiple new gossanous alteration zones within the Christmas Creek Batholith. A grab sample of gossanous talus float returned an assay of 22.1 g/t Au.

The 2022 exploration program also included detailed structural and geological mapping at the four high-grade gold zones discovered and defined in 2021, with a focus on drill target generation. Thirty-one samples were sent for petrographic analysis to aid in determining the nature of the widespread gold mineralization. This independent structural report remains outstanding, and the Company will issue another press release providing the results once received.

Daithi Mac Gearailt, CEO of Trailbreaker, commented, “The Atsutla Gold Project continues to deliver new and exciting discoveries. We have now identified high-grade gold showings across 28 kilometers, spanning multiple lithologies. With these new results and the pending detailed geological report, I am confident that we will have a de-risked drill plan in hand by the end of the year.”

Newly discovered Snook zone

The Snook zone is located 3.5 km northeast of the Highlands zone – a 2021 discovery consisting of multiple high-grade and visible gold showings (>100 g/t Au) across a 750 m x 600 m area (see Map 1 – Atsutla West). A previously identified prominent east-west trending fault (the Snook Fault) defines the southern boundary of the zone and cuts through Snook Lake. At least two generations of quartz veining were identified at the Snook zone. The earlier set comprises steeply dipping sheeted veins which are crosscut by later shallow-dipping veins. Sulphide mineralization consists of variable amounts of pyrite, bornite, chalcopyrite, galena, and arsenopyrite. Galena and arsenopyrite appear to be constrained to the later set of quartz veining. The veining occurs within granodiorite of the early Jurassic Christmas Creek Batholith. Highlights include:

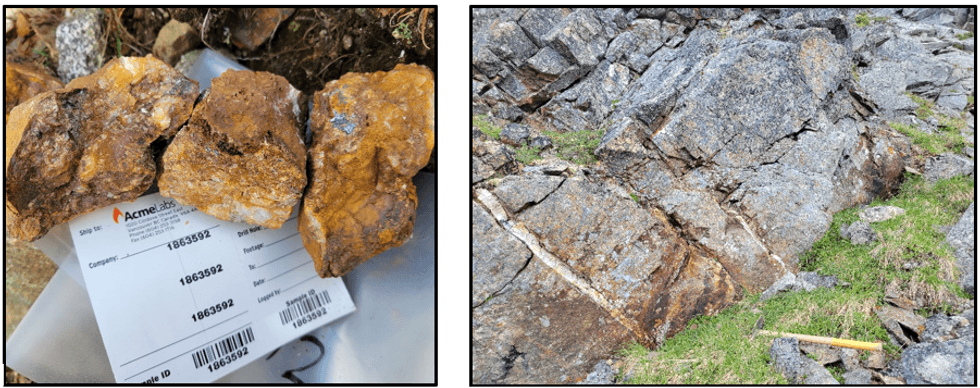

- 53.3 g/t Au from a quartz vein boulder with galena-chalcopyrite mineralization (Photo 1);

- 7.55 g/t Au from an outcrop of sheeted quartz veins typically 5-10 cm wide with chalcopyrite-pyrite mineralization (Photo 2);

- 9.78 g/t Au from a quartz vein boulder with arsenopyrite-pyrite mineralization south of the Snook Fault.

Photos 1 and 2: Snook zone quartz-galena-chalcopyrite boulder assaying 53.3 g/t Au (left) and sheeted quartz-chalcopyrite-pyrite veins assaying 7.55 g/t Au.

An Option Agreement has been signed with Mr. Torrey Fredlund (the “Vendor”) for Trailbreaker to obtain a 100% interest in his ‘Golden Echelon’ claim block located between the Snook and Highland zones. The block consists of one claim covering 132 hectares. Prior to the 2022 exploration program, an agreement was made allowing for Trailbreaker to explore and evaluate the claim block before finalizing an option agreement.

Pursuant to the terms of the Option Agreement and subject to receipt of all regulatory approvals, Trailbreaker can earn a 100% interest in the Property by making staged share issuances totaling 80,000 common shares over three years and a making a one-time cash payment of $25,000 as follows:

- 10,000 common shares on receipt of TSX Venture Exchange approval;

- 10,000 common shares on or before November 16, 2023;

- 10,000 common shares on or before November 16, 2024; and

- 50,000 common shares and $25,000 cash payment on or before November 16, 2025.

The Vendor will retain a 1% Net Smelter Royalty and Trailbreaker has the right to buy back the 1% NSR within a two-year period from the exercise of the option for a cash payment of $50,000 and issuance of 100,000 common shares.

Swan zone follow-up and reconnaissance sampling

The 2022 work program included follow-up and reconnaissance exploration at the Swan zone (see Map 2 – Swan). The Swan zone area was initially staked by Trailbreaker to cover a historical molybdenum-copper porphyry prospect that was discovered in the late 1960s and explored periodically since then. Despite the collection of more than 500 soil and surface rock samples, and the completion of almost 1,000 metres of shallow diamond drilling, no geochemical analysis for gold was done before Trailbreaker staked the area.

In 2021, Trailbreaker identified a 900 m x 700 m gold (Au) – arsenic (As) – silver (Ag) – antimony (Sb) – copper (Cu) – molybdenum (Mo) – lead (Pb) soil anomaly, with multiple gold and silver showings in bedrock. The core of the soil anomaly is located ~1.2 km east of the historical drilling.

Exploration in 2022 led to the discovery of additional gold mineralization within the soil anomaly, whereby assaying of rock grab samples returned values up to 11.7 g/t Au, 212 g/t Ag, and 0.12% Cu. Gold is associated primarily with disseminated and massive arsenopyrite mineralization within a porphyritic leucogranite unit of the Upper Cretaceous Glundebery Batholith.

A reconnaissance soil sample line identified a new 550-metre-long gold anomaly located 1 km east of the main Swan zone anomaly. Assaying of soil samples yielded values up to 268 ppb Au within this new anomaly.

First-pass prospecting was conducted on a ridge 2 km west of the Swan zone, across the valley from where the historic diamond drilling was conducted. Multiple new quartz-arsenopyrite showings were identified, and assays returned values up to 0.79 g/t Au.

About the Atsutla Gold Project

Trailbreaker’s 100%-owned Atsutla Gold project is located 70 km south of the Yukon-British Columbia border and 130 km northwest of the community of Dease Lake, BC. The project covers 40,057 hectares of ground with very limited historic exploration. The project represents a district-scale discovery in an under-explored area of British Columbia.

To date, Trailbreaker has identified five gold zones at Atsutla: The Highlands, Christmas Creek, Snook, Willie Jack, and Swan zones, which span a distance of 28 kilometres. The highest grades occur at the Highlands zone, where grab samples have returned values up to 630 g/t (18.38 oz/ton) gold and 1,894 g/t (55.25 oz/ton) silver. High-grade, vein- and wallrock-hosted copper mineralization has also been discovered in the Highlands, Christmas Creek, and Willie Jack zones, with grab sample assays up to 1.7% copper. For more information and detailed maps, see the Atsutla Gold Project section on Trailbreaker’s website.

Message from the President

“The Atsutla Gold project is district-scale discovery with not only the gold-bearing copper porphyry model at Swan but also a large robust high-grade gold system at the Highlands, Christmas Creek, and Snook zones. We own it 100%, it’s brand-new and begging to be drilled!”

ON BEHALF OF THE BOARD

Daithi Mac Gearailt

President and Chief Executive Officer

Carl Schulze, P. Geo., Consulting Geologist with Aurora Geosciences Ltd, is a qualified person as defined by National Instrument 43-101 for Trailbreaker's BC and Yukon exploration projects, and has reviewed and approved the technical information in this release.

For new information about the Company’s projects, please visit Trailbreaker’s website at TrailbreakerResources.com and sign up to receive news. For further information, follow Trailbreaker’s tweets at Twitter.com/TrailbreakerLtd, use the ‘Contact’ section of our website, or contact us at (604) 681-1820 or at info@trailbreakerresources.com.

TRAILBREAKER RESOURCES LTD.

650 W. Georgia Street, #2110

Vancouver, British Columbia

Canada, V6B 4N9

Telephone: 604 681 1820

Facsimile: 604 681 1864

https://www.TrailbreakerResources.com

https://twitter.com/TrailbreakerLtd

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

Statements contained in this news release that are not historical facts are "forward-looking information" or "forward-looking statements" (collectively, "Forward-Looking Information") within the meaning of applicable Canadian securities legislation and the United States Private Securities Litigation Reform Act of 1995. Forward-Looking Information includes, but is not limited to, disclosure regarding possible events, conditions or financial performance that is based on assumptions about future economic conditions and courses of action; expectations regarding future exploration and drilling programs and receipt of related permitting. In certain cases, Forward-Looking Information can be identified by the use of words and phrases such as "anticipates", "expects", "understanding", "has agreed to" or variations of such words and phrases or statements that certain actions, events or results "would", "occur" or "be achieved". Although Trailbreaker has attempted to identify important factors that could affect Trailbreaker and may cause actual actions, events or results to differ materially from those described in Forward-Looking Information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. In making the forward-looking statements in this news release, if any, Trailbreaker has applied several material assumptions, including the assumption that general business and economic conditions will not change in a materially adverse manner. There can be no assurance that Forward-Looking Information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on Forward-Looking Information. Except as required by law, Trailbreaker does not assume any obligation to release publicly any revisions to Forward-Looking Information contained in this news release to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

The Conversation (0)

23 March 2023

Trailbreaker Resources

Grassroots Exploration with Blue-Sky Potential

Grassroots Exploration with Blue-Sky Potential Keep Reading...

1h

Mike Maloney: Gold, Silver Bull Run in Final Phase, I Expect "Spectacular" Prices

Mike Maloney, founder of GoldSilver.com, explains why this time really is different for gold and silver, pointing to factors including growing mainstream adoption. "This to me signals the beginning of the third and final phase of the bull market — and that is where you have the greatest amount... Keep Reading...

1h

Dana Samuelson: Gold, Silver in Global Bank Run, Prices on Hair Trigger

Dana Samuelson, president of American Gold Exchange, discusses this year's unusual market dynamics for gold and silver, saying there have been three big moves of physical metal. "To me, this is literally a run on the bank of gold globally — it's global, it's widespread and it's deep, and I don't... Keep Reading...

7h

Canadian Gold Resources to Expand Maiden Diamond Drill Program & Provides Update on Bulk Sampling Program at Lac Arsenault, LIFE Offering Update; Disclosure Corrections

Canadian Gold Resources Ltd. (TSXV: CAN) ("Canadian Gold" or the "Company") provides an operational update regarding its maiden diamond drill program and the planned 5,000-tonne bulk sampling program at the 100%-owned Lac Arsenault Project in Québec's Gaspé Peninsula, as well as recent changes... Keep Reading...

9h

China’s Gold Market Enters Turbulent Transition as New VAT Rules Take Effect

China’s gold industry is entering a period of rapid adjustment after Beijing implemented a major overhaul of value-added tax (VAT) rules on physical gold. The reform, which took effect on the first of November run through December 31, 2027, ending the long-standing practice of allowing full tax... Keep Reading...

13 November

Top 5 Australian Mining Stocks This Week: Nova Minerals Rides on Growing Antimony Interest

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Antimony-focused gold company Nova Minerals takes the lead in this week's list, alongside mining stocks focused on gold, lithium and... Keep Reading...

13 November

Gold Price Rallies "Like a Meme Stock," Breaks US$4,200 Again

As its record-setting year continues, gold is on its way to posting its strongest annual performance since 1979, up an impressive 58 percent year-to-date as of Wednesday (November 12). The yellow metal once again broke past US$4,200 per ounce this week, moving closer to its all-time high of... Keep Reading...

Latest News

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00