- WORLD EDITIONAustraliaNorth AmericaWorld

August 01, 2024

Proceeds will be applied to fund exploration and development activities on Brightstar’s portfolio and a fast-tracked drill out of the sandstone project being acquired by Brightstar

Brightstar Resources Ltd (ASX: BTR) (Brightstar) is pleased to announce it has received firm commitments to raise approximately $24 million (before costs) in a two-tranche share placement (Placement) to professional and sophisticated investors at $0.015 per share (New Shares). This represents a discount of:

- nil discount to the last close price as at 30 July 2024;

- 2.1% discount to the 5-day VWAP up to and including 30 July 2024; and

- 5.7% discount to the 10-day VWAP up to and including 30 July 2024.

The Placement received very strong support from a range of new and existing institutional investors, including a number of specialist gold and natural resource funds, with overall demand received for new shares strongly in excess of the $24 million Placement size.

The Placement follows:

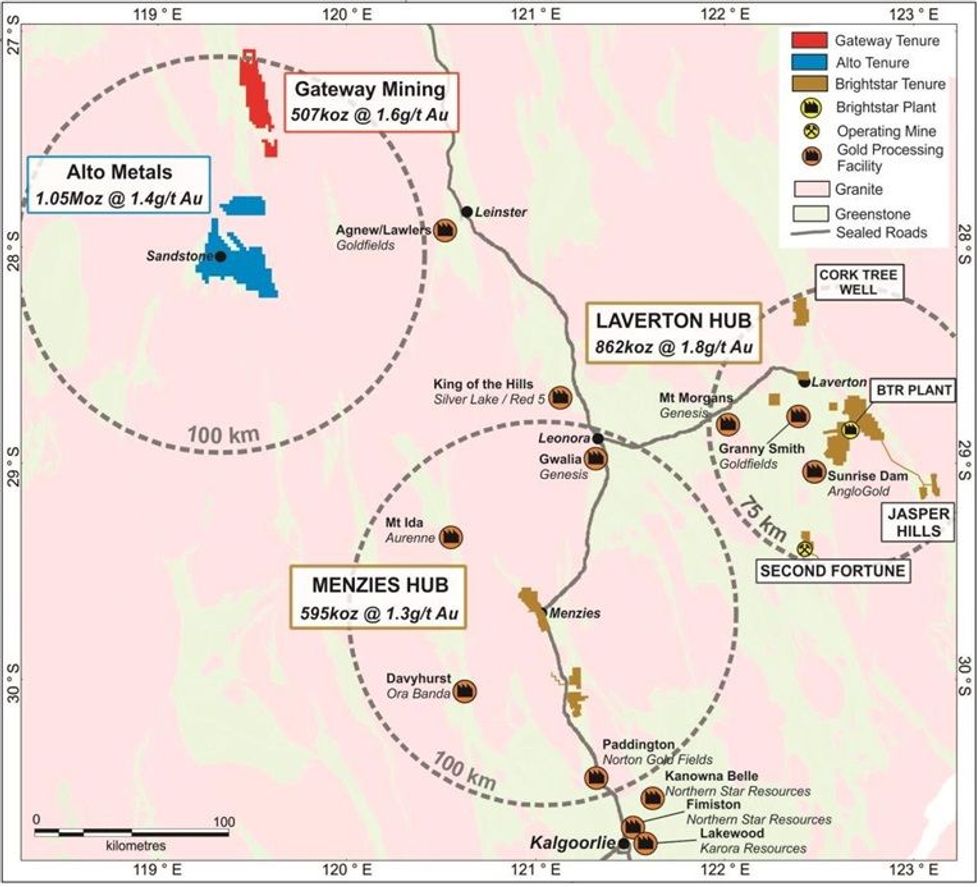

entry into a Scheme Implementation Deed with Alto Metals Ltd (ASX:AME) (Alto), pursuant to which Brightstar proposed to acquire 100% of the shares in Alto (Scheme); and Brightstar, via a newly incorporated wholly owned SPV ‘Montague Gold Project Pty Ltd’ (MGP), agreeing to acquire 100% of the gold mineral rights in the Montague East Gold Project from Gateway Mining Limited (ASX:GML) and its wholly owned subsidiary Gateway Projects Pty Ltd (GPWA) and Gateway and GPWA’s interests held in certain mining tenure in respect of the Montague East Gold Project (Montague Acquisition).

The Scheme and Montague Acquisition will consolidate highly prospective exploration ground in the Sandstone region (Sandstone Project) which will complement Brightstar’s existing production, development and exploration asset portfolio.

Brightstar’s Managing Director, Alex Rovira, said:

“This is a significant and transformational transaction for Brightstar, with the Alto Scheme and acquisition of Gateway’s Montague East Gold Project adding significant mineral endowment into our portfolio. Importantly, it adds a third development hub to Brightstar that also delivers the critical mass of gold resources that underpin a fast-tracked exploration and development phase of work to move the Sandstone hub towards monetisation. We are extremely excited to get rigs spinning at Sandstone to aggressively grow the currently defined mineral resources.

The strong support in the capital raising from well credentialled, dedicated long-only gold and natural resources- focused institutional investors is a testament to the quality of the package of assets and development plan at Brightstar, against the backdrop of a rising AUD gold price environment.”

Proceeds from the Placement will be applied to fund a fast-tracked drill out of the Sandstone Project and for general exploration and development activities on Brightstar’s portfolio.

The New Shares are expected to settle on Wednesday, 7 August 2024 and be issued and commence trading on the ASX on a normal basis on Thursday, 8 August 2024. New Shares issued under the Placement will rank equally with existing shares on issue.

Tranche One of the Placement to raise approximately $17.5m (before costs) will be conducted within Brightstar’s available placement capacity pursuant to ASX Listing Rules 7.1 and 7.1A (Tranche One) and Tranche Two, to raise approximately $6.5m (before costs), will be subject to shareholder approval to be sought at an Extraordinary General Meeting (EGM) expected to be held in mid-September 2024 (Tranche Two).

In Tranche One, a total of 1,166,666,667 New Shares will be issued. 700,000,000 of these New Shares will be issued pursuant the Company’s placement capacity under ASX Listing Rule 7.1 and a total of 466,666,667 New Shares will be issued pursuant the Company’s placement capacity under ASX Listing Rule 7.1A.

Under Tranche Two, which is conditional on the receipt of prior shareholder approval pursuant to ASX Listing Rule 7.1, the remaining 433,333,334 New Shares are proposed to be issued.

Click here for the full ASX Release

This article includes content from Brightstar Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BTR:AU

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

08 January

Brightstar Resources

Emerging gold producer and district-scale resource developer in Western Australia

Emerging gold producer and district-scale resource developer in Western Australia Keep Reading...

01 February

Strategic $180M capital raising funds Goldfields development

Brightstar Resources (BTR:AU) has announced Strategic $180M capital raising funds Goldfields developmentDownload the PDF here. Keep Reading...

30 January

Quarterly Activities/Appendix 5B Cash Flow Report

Brightstar Resources (BTR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Updated Goldfields Feasibility Study

Brightstar Resources (BTR:AU) has announced Updated Goldfields Feasibility StudyDownload the PDF here. Keep Reading...

29 January

Updated Goldfields DFS Presentation

Brightstar Resources (BTR:AU) has announced Updated Goldfields DFS PresentationDownload the PDF here. Keep Reading...

28 January

Trading Halt

Brightstar Resources (BTR:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

2h

Gold-Copper Consolidation Continues as Eldorado Moves to Acquire Foran

Eldorado Gold Corporation (NYSE:EGO,TSX:ELD) and Foran Mining (TSX:FOM,OTCQX:FMCXF) have agreed to combine in a share-based transaction that would create a larger, diversified gold and copper producer with two major development projects set to enter production in 2026Under the deal, Eldorado... Keep Reading...

3h

Stellar AfricaGold Intersects Multiple Gold-Bearing Zones and Confirms Structural Controls at Tichka Est, Morocco - Drilling Resumed on January 30, 2026

(TheNewswire) Vancouver, BC TheNewswire - February 3rd, 2026 Stellar AfricaGold Inc. ("Stellar" or the "Company") (TSX-V: SPX | FSE: 6YP | TGAT: 6YP) is pleased to report additional assay results and an updated interpretation from its ongoing diamond drilling program at the Tichka Est Gold... Keep Reading...

18h

Gold and Silver Prices Take a U-Turn on Trump's Fed Chair Nomination

Gold and silver prices have experienced one of their most savage corrections in decades. After hitting a record high of close to US$5,600 per ounce in the last week of January, the price of gold took a dramatic U-turn on January 30, dropping as low as US$4,400 in early morning trading on Monday... Keep Reading...

19h

Bold Ventures Kicks Off 2026 with Diamond Drilling Program at Burchell Base and Precious Metals Project

Bold Ventures (TSXV:BOL) has launched a diamond drilling program at its Burchell base and precious metals property in Ontario, President and COO Bruce MacLachlan told the Investing News Network.“We just started drilling a couple of weeks ago, and we’ll be drilling for a while,” MacLachlan said,... Keep Reading...

19h

Providence Gold Mines CEO Highlights Growth Catalysts at La Dama de Oro Gold Property

In an interview during the Vancouver Resource Investment Conference, Providence Gold Mines (TSXV:PHD,OTCPL:PRRVF) President, CEO and Director Ron Coombes said 2026 will be a pivotal year for the company. Providence Gold Mines is entering a key growth phase as funding, permitting and technical... Keep Reading...

02 February

Randy Smallwood: The Case for Gold Streaming in Today's Price Environment

Gold streaming took center stage at the Vancouver Resource Investment Conference last week as Randy Smallwood, president and CEO of Wheaton Precious Metals (TSX:WPM,NYSE:WPM), laid out why the model is drawing renewed investor attention amid today's high gold and silver prices.Speaking during a... Keep Reading...

Latest News

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00