- WORLD EDITIONAustraliaNorth AmericaWorld

March 05, 2024

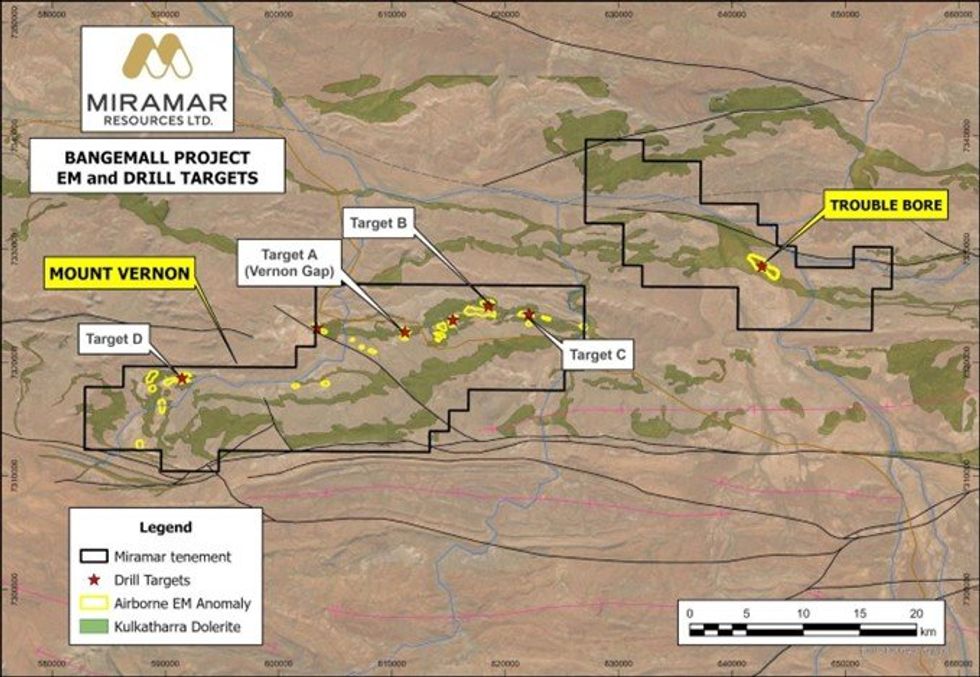

Miramar Resources Limited (ASX:M2R, “Miramar” or “the Company”) in pleased to advise that ground electromagnetic (EM) surveys have identified additional conductors at the Company’s large 100%-owned Mount Vernon Project in the Gascoyne region of Western Australia.

- Ground EM survey identifies more strong conductors at Mount Vernon

- Bangemall Projects share regional, project and target-scale similarities to Norilsk

Miramar is exploring for intrusion-hosted nickel, copper and platinum group element (Ni-Cu-PGE) mineralisation related to 1070Ma aged Kulkatharra Dolerite sills, part of the Warakurna Large Igneous Province and the same age as the large Nebo-Babel Ni-Cu deposits in the West Musgraves.

Miramar’s Executive Chairman, Mr Allan Kelly, said the Company was excited about the potential district- scale opportunity at Bangemall and looked forward to progressing towards a maiden drilling campaign.

“At Mount Vernon and Trouble Bore, we are seeing all the ingredients needed for the formation of a large- scale mafic intrusion hosted Ni-Cu-PGE deposit such as Nova or Nebo-Babel,” he said.

“These types of deposits can be large and very valuable due to the mix of metals present which makes them mostly immune to short-term fluctuations in the nickel price,” he added.

Mount Vernon – Target C

Geophysical surveying contractor, Wireline Services Group, has now completed the Fixed Loop EM (FLTEM) survey over Target C, within the Mount Vernon Project, which shows a strong late-time EM anomaly where two dolerite sills are crosscut by several northeast trending faults (Figure 2).

Modelling of the data (Figure 3) indicates:

- a large, strongly conductive (~1600S), shallow (<100m) plate dipping towards the SSE; and

- a poorly-defined secondary anomaly located north of the main response

The Target C anomaly is covered by recent sediments and is the strongest EM conductor seen at Mount Vernon to date.

There is no previous drilling or geochemical sampling in the vicinity of this target.

The geophysical crew have now moved to Target D, the final airborne EM anomaly to be tested as part of this initial programme.

Following completion of the EM survey, Miramar plans to conduct systematic rock chip sampling and mapping at Mount Vernon, including field checking of the various airborne and ground EM anomalies.

Following this, the Company will plan for the maiden drill programme at Mount Vernon and Trouble Bore.

Click here for the full ASX Release

This article includes content from Miramar Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

copper stocksasx:m2rresource stocksasx stocksgold explorationgold stocksnickel stockscopper investingcopper explorationnickel exploration

M2R:AU

The Conversation (0)

06 February 2024

Miramar Resources

Aiming to create shareholder value through the discovery of world-class mineral deposits

Aiming to create shareholder value through the discovery of world-class mineral deposits Keep Reading...

04 March

Teck VP Highlights China's Major Role in Evolving Copper Markets

Copper prices have surged since the middle of 2025, as tariffs, rising demand and supply disruptions came together to create the perfect storm for metals traders.These factors are helping raise awareness of the challenges copper producers will face in the coming years, as supply deficits are... Keep Reading...

04 March

BHP: Targeted AI Platforms Boost Efficiency, Safety and More

Modern society has a metals problem. The demands of modern consumer culture, the energy transition and the emergence of artificial intelligence (AI) and robotics have created a dilemma.As demand rises, the supply of many metals is at a bottleneck brought about by a number of factors, from... Keep Reading...

04 March

VIDEO - BTV Visits Atlas Salt, Graphene Manufacturing, Telescope Innovations, Nevada Organic Phosphate, Maple Gold, Intrepid Metals and Nine Mile Metals

Watch on BNN Bloomberg nationalWednesday, March 4 at 7:30 PM EST & Saturday, March 7 at 8 PM EST Tune into BTV and Discover Investment Opportunities. As the resource cycle accelerates, BTV Business Television highlights companies turning exploration, innovation and strategic growth into... Keep Reading...

03 March

Hudbay to Acquire Arizona Sonoran, Creating North America’s Third Largest Copper District

Hudbay Minerals (TSX:HBM,NYSE:HBM) is doubling down on Arizona, striking a deal to acquire Arizona Sonoran Copper Company in a transaction that would create North America’s third-largest copper district.The deal gives Hudbay 100 percent ownership of the Cactus project in southern Arizona, adding... Keep Reading...

03 March

Top 10 Copper Producers by Country

In 2025, supply disruptions highlighted a growing concern as copper mines in the top copper-producing countries were aging without new mines to replace them.Additionally, copper demand from electrification is expected to rise significantly in the coming years.The competing forces of the global... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00