(TheNewswire)

July 26, 2022 TheNewswire - R enforth Resources Inc. (CSE:RFR) (OTC:RFHRF) (FSE:9RR) ("Renforth" or the "Company") is pleased to inform shareholders that summer 2022 prospecting at Surimeau has successfully concluded with, amongst other findings, the extension of the known Lalonde surface battery metals mineralization to a strike length of 9 kms. on Renforth's wholly owned 330 sq km. property located south of Cadillac, Quebec and contiguous to the Canadian Malartic Mine. In the summer 2022 program Renforth continued to work to define the extent of surfacesub-surface polymetallic mineralization on the Surimeau District Property as evidenced by outcrop, drill results and geophysics. To date this has resulted in the definition of the Victoria mineralized structure at ~20km in length and the Lalonde mineralized structure now measuring ~9km in length. A significant amount of ground remains untested, in part because Renforth has, to date, only used existing lumber roads and trails for access within the property.

"We are very happy with the visual results from our second prospecting program at Surimeau this year, this time it seems Lalonde yielded the best-looking samples and each trench intersected mineralization. The extension of Lalonde's strike to 9km adds to the overall battery metals picture at Surimeau, at the same time we have not yet fully prospected the entire Lalonde magnetic trend. Our Surimeau property just continues to get more and more interesting, while our work is at an early stage it is clear we are dealing with two mineralized systems offering significant strike length of mineralization on surface, justifying our continued efforts to determine how big Surimeau actually is" states Nicole Brewster, President and CEO of Renforth.

Summer 2022 Program

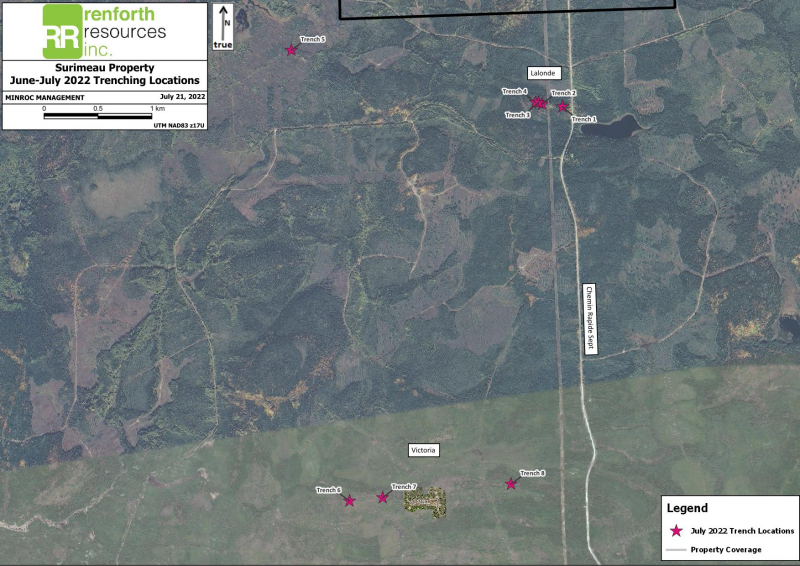

During this program Renforth's field crew, along with prospecting various targets, dug 8 different trenches between the Lalonde and Victoria polymetallic mineralized systems. In each trench some amount of mineralization was exposed, with the best mineralization (confirmed visually and with XRF) coming from Lalonde. Interestingly, each trench exposed different portions of each mineralized system, helping to define the orientation of the mineralization, and in some cases making clear that the trench should be extended to capture the entire cross section of the mineralization. Renforth has discovered that at Victoria there is a second horizon of mineralization sitting to the north of the mineralized horizon uncovered during the Fall 2021 stripping at Victoria, the northern crosscut ended ~40m short of where it would have intersected the northern mineralization. Each trench is described below and shown on the location map. Channels were cut in each trench and samples sent for assay; results will be released once available. Due to the success of this program Renforth is now planning additional stripping to cross-cut strike at Victoria in addition to a series of larger cross-cutting stripped trenches along strike at Lalonde in order to further define the extent of mineralization. At Victoria the cross-cutting trenches, which will start at the south and north side of the currently stripped area, will extend well into the sediments, hopefully capturing any additional mineralized horizons.

Summer 2022 Trenches

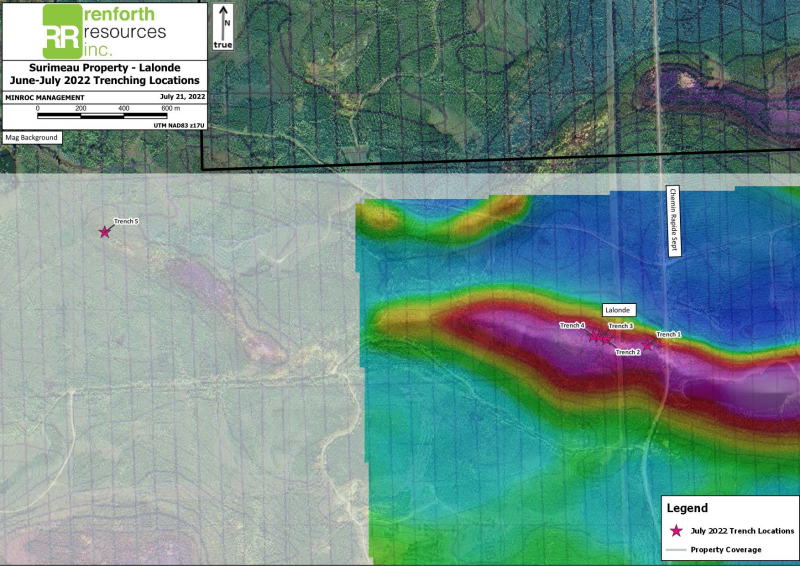

Lalonde Trenches

Trenches 1 through 5 were dug at Lalonde, ~3.7km north of the Victoria stripped area. Trench 5 represents an extension to the west of ~2km for the Lalonde mineralization.

Trench 1 The first trench exposes about 5 meters of Pontiac sediments at the north end with occasional narrow beds of graphitic mudstone, mineralized with traces of chalcopyrite and pyrite stringers. Ultramafics are found immediately south of the sediments with a narrow band of ab-shearing between the two units (approximately 50-60cm). The ultramafics have bands of calc-silicate alteration as well as bands of moderate to strong albitization with around 15-20% sulfide overall. South of the ultramafics is strongly amphibolized mafic volcanics (picrites).

Trench 2 As expected, the second trench exposes the same general lithological sequence as the first. The south end of the trench exposes very well mineralized calc-silicate altered ultramafics, followed by serpentinized ultramafics and another band of albitized and calc-silicate altered ultramafics. The first ~2m of the channel (at the south end) are extremely well mineralized with 5-25% sulfide disseminations and clots of pyrite, pyrrhotite and traces of sphalerite, pentlandite, chalcopyrite and bornite. There is a narrow band of Pontiac sediments in the rough center of the trench, followed by another band of well mineralized calc-silicate and albitized ultramafics that is about 3m wide. The last 2 meters of the trench exposes Pontiac sediments.

Trench 3 From south to n orth this trench exposes ultramafics with varying degrees albitization and up to 5-7% sulfide mineralization (pyrite-pyrrhotite), locally up to 15% sulfide, with traces of chalcopyrite, followed by Pontiac sediments to the end of the trench/channel, including occasional narrow beds of graphitic sediments.

Trench 4 This trench is 12 meters in length and trench exposes serpentinized ultramafics at the south end, with occasional bands of very strong biotitization to about 7m, followed by 2 meters of calc-silicate altered ultramafics with 10-15% sulfide. Sediments follow the ultramafics for about 3 meters to the end of the trench.

Trench 5 This trench is about 22 meters in length and exposes serpentinized ultramafics at the very southern end, followed by 3 meters of graphitic mudstones and sediments with occasional narrow bands of albitized ultramafics, containing traces of chalcopyrite and up to 2% disseminated pyrite-pyrrhotite in the ultramafics. A 3 meter wide albitized shear zone follows with 5-7% sulfide mineralization overall, with locally up to 30% sulfides, primarily sphalerite, pyrite and pyrrhotite. The next 6 meters (approx.) is albitized ultramafics with up to 2% disseminated pyrite-pyrrhotite, followed by serpentinized ultramafics at the north end of the trench.

(This image includes the detail mag flown by Renforth overlaid on the available government mag)

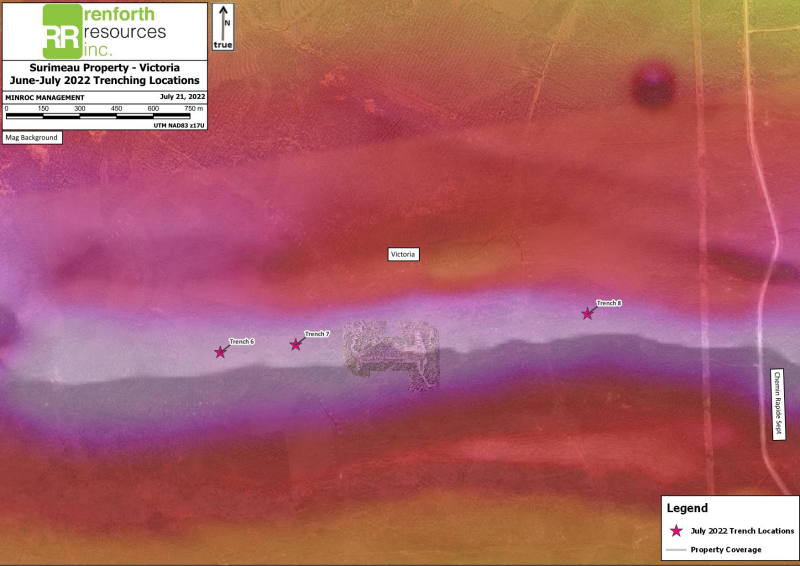

Surimeau Victoria North Trenches

Trenches 6-8 were dug at Victoria to expose the newly discovered northern band of mineralization at Victoria. In the Fall 2021 Victoria stripping program, a length of 275m was stripped, exposing surface polymetallic mineralization, between fences of holes drilled in Spring 2021. Subsequently, the exposed mineralization was undercut with drilling in December 2021. Prior to this program the exploration at Victoria had been targeting the magnetic high, all the drilling and the stripped north crosscuts missed intersecting the northern mineralized band which was discovered during prospecting in Spring 2022 by Renforth's field crew. Renforth is currently planning additional stripping at Victoria which will consist of a wide trench starting on the north and south sides of the stripped area, and driven to the north and the south, long enough to be well into what is assumed to be only host rock in an effort to not miss mineralization in future drilling. Little is known about what occurs between Victoria and Lalonde.

Trench 6 This trench exposes ultramafics at the south end, with occasional bands of moderate albitization and around 2-3% sulfide (pyrite-pyrrhotite) in the albitized zones. Following this is approximately 3m of calc-silicate alteration with 3-5% sulfide overall and traces of Cr-diopside. Very strongly albitized graphitic sediments follow the calc-silicates. There is a wide band (about 5m) of graphitic mudstone in the center of the trench with sphalerite nodules and pyrite rims, 1-2% chalcopyrite blebs and stringers and pyrite-pyrrhotite closer to the ultramafic contact. The north end of the trench exposes weakly foliated serpentinized ultramafics.

Trench 7 This trench exposes ultramafics at the south end, followed by Pontiac sediments that are possibly albitized, as well as a narrow bed of graphitic mudstone at the north end of the trench. It is thought that this trench was dug a bit too far north.

Trench 8 This trench exposes serpentinized ultramafics at the south end, followed by a few bands of albitized ultramafics / calc silicate altered ultramafics. These were narrow but well mineralized with up to 7% disseminated and clotty sulfides. There is a bed of graphitic sediments followed by a narrow bed of Pontiac sediments and then a wide band, approximately 7m, of albitized to strongly albitized ultramafics to the end of the trench. There is a 1m band of calc-silicate altered ultramafics near the north end of the trench which is also well mineralized.

(This image includes the detail mag flown by Renforth overlaid on the available government mag)

In addition, a channel was cut in the main Lalonde pit on the powerline. This channel consists of the albitized shear zone to the north and deeply weathered but strongly altered ultramafics to the south of the channel. Overall sulfides in the samples ranged from 5-7% disseminated and clots of pyrite-pyrrhotite and sphalerite. Renforth previously prospected this pit in an initial 2020 prospecting campaign which yielded the following results;

| Sample | UTM E | UTM N | Year | Simple Description | Ni ppm | Cu ppm | Zn ppm |

| 2343 | 698523 | 5331852 | 2020 | Pyroxenite, coarse pyroxene | 98.6 | 5.17 | 176.5 |

| 2344 | 698523 | 5331852 | 2020 | mineralized rhyolite, coarse stringers of sph + py + ~10% disseminated sph. Heavily oxidized, weathered, weakly siliceous. Old trench on powerline, appears blasted, oriented 346 deg. | 143.5 | 565 | 5630 |

| 2345 | 698524 | 5331854 | 2020 | mineralized rhyolite, med stringers of sph + py + ~10-15% disseminated sph. Heavily oxidized, weathered, weakly siliceous. Same trench as sample 2344. | 103 | 776 | 460 |

| 2346 | 698533 | 5331844 | 2020 | rhyolite + komatiite (in contact with each other). Coarse grained, dark greenish, bt-alt? med py stringers + ~5% diss sulfide, fol 276/70N | 570 | 439 | 432 |

| 2347 | 698536 | 5331848 | 2020 | coarse grained dark greenish komatiite? Trace py | 1445 | 177 | 392 |

| 2348 | 698600 | 5331843 | 2020 | old trench oriented about 200 deg, 10 m long, exposes coarse patchy sil sed with bands of graphite, tr-1% fine diss py. Verging on quartzite? Weak-mod patchy sil. | 7.07 | 86.4 | 31.4 |

Samples taken in the pit in 2020 were grab samples of weathered rock. A grab sample is not representative of the entirety of the mineralization and weathering can affect the presence of mineralization as well as mineralization can leach out during weathering. Since our crew was working in the area of the old pit a channel was cut in order to get a more representative picture of the mineralization. The grab samples referred to above were bagged and tagged in the field and processed at ALS Laboratories in Val d'Or where they were tested by "PGM-MS23L" Low Level PGM – FA ICPMS, "ME-MS61L" Super Trace Lowest DL 4A by ICPMS and "ME-OG62" Ore Grade Elements – Four Acid.

Technical disclosure in this press release has been reviewed and approved by Francis R. Newton P.Geo (OGQ#2129), a "qualified person" pursuant to NI 43-101.

For further information please contact:

Nicole Brewster

President and Chief Executive Officer

C:416-818-1393

E: nicole@renforthresources.com

#Unit 1B – 955 Brock Road, Pickering ON L1W 2X9

Follow Renforth on Facebook, LinkedIn and Instagram!

About Renforth

Renforth is focused on Quebec's newest battery metals district, our wholly owned ~330 km 2 Surimeau District Property, which hosts several known areas of polymetallic "battery metals" mineralization, each with various levels of exploration, as well as a significant amount of unexplored ground. Victoria West has been drilled over a strike length of 2.2km, within a 5km long mineralized structure, proving nickel, copper, zinc and cobalt mineralization, in the western end of a 20km magnetic anomaly. The Huston target, during initial reconnaissance, resulted in a grab sample grading 1.9% Ni, 1.38% Cu, 1170 ppm Co and 4 g/t Ag. Additionally, the Lalonde, Surimeau and Colonie Targets are all polymetallic mineralized occurrences which, along with various gold showings, comprise the areas of potential of this NSR free property.

In addition to the Surimeau District battery metals property Renforth wholly owns the Parbec Gold deposit, a surface gold deposit contiguous to the Canadian Malartic Mine property in Malartic, Quebec. In 2020/21 Renforth completed 15,569m of drilling which successfully twinned certain historic holes, filled in gaps in the resource model with newly discovered gold mineralization and extended mineralization deeper. Based upon the success of this significant drill program the Company considers the spring 2020 MRE, with a resource estimate of 104,000 indicated ounces of gold at a grade of 1.78 g/t Au and 177,000 inferred ounces of gold at a grade of 1.78 g/t Au to be out of date. With the new data gained Renforth will undertake to complete the first ever structural study of the mineralization at Parbec, as well as additional total metallic assay work in order to better contextualize the nugget effect on the gold mineralization.

Renforth also holds the Malartic West property, the site of a copper/silver discovery, and Nixon-Bartleman, west of Timmins Ontario, with gold present on surface over a strike length of ~500m.

No securities regulatory authority has approved or disapproved of the contents of this news release.

Forward Looking Statements

This news release contains forward-looking statements and information under applicable securities laws. All statements, other than statements of historical fact, are forward looking. Forward-looking statements are frequently identified by such words as ‘may', ‘will', ‘plan', ‘expect', ‘believe', ‘anticipate', ‘estimate', ‘intend' and similar words referring to future events and results. Such statements and information are based on the current opinions and expectations of management. All forward-looking information is inherently uncertain and subject to a variety of assumptions, risks and uncertainties, including the speculative nature of mineral exploration and development, fluctuating commodity prices, the risks of obtaining necessary approvals, licenses and permits and the availability of financing, as described in more detail in the Company's securities filings available at www.sedar.com. Actual events or results may differ materially from those projected in the forward-looking statements and the reader is cautioned against placing undue reliance thereon. Forward-looking information speaks only as of the date on which it is provided and the Company assumes no obligation to revise or update these forward-looking statements except as required by applicable law.

Copyright (c) 2022 TheNewswire - All rights reserved.