October 14, 2024

African Gold Ltd (African Gold or the Company) (ASX: A1G) is very pleased to announce the results from the recently completed DDD049 diamond drillhole, second out of six drilled on the Blaffo Guetto prospect, on the Company’s Didievi Gold Project in Cote d’Ivoire (Figure 1). The drilling program was designed to test possible extension of the gold lodes and to infill previous drilling on gold controlling structures of the prospect with a view to increasing the scale and categorisation of the existing Inferred Resource.

HIGHLIGHTS

- Assay results from the recently completed diamond drilling program on the Didievi Project returns a spectacular, wide, high-grade intercept of:

- 65.0m at 5.6 g/t of gold from 177m (DDD049)

- The drillhole also included shallow intercepts of:

- 9.0m at 1.7 g/t of gold from 23m

- 28m at 1.1 g/t of gold from 77m

- The deeper intercept (65.0m at 5.6 g/t of gold) has confirmed that the gold mineralisation extends outside of the existing resource envelope and remains open at depth

- Drillhole DDD049 was drilled to test a predicted extension of the gold mineralisation using the new geological model, hosted by the shear zone and gently plunging in a south-westerly direction

- The new drilling results will allow a positive update to the existing Didievi Project Maiden Inferred Resource of 4.93Mt for 452koz of gold at 2.9 g/t Au (1.0 g/t Au cut off)

- Previous high-grade drilling results from the Didievi Project include:

- 10.0m at 123.7 g/t of gold from 66m including 2m at 613.1 g/t of gold

- 83.3m at 3.3 g/t of gold from 166.9m including 18.0m at 12 g/t of gold

- 17.4m at 17.0 g/t of gold from 244m including 1.0m at 216.0 g/t of gold

- 80.0m at 3.0 g/t of gold from 0m including 23.0m at 9.5 g/t of gold

- 43.0m at 4.3 g/t of gold from 57 m including 17.0m at 9.5 g/t of gold

- 69.0m at 2.9 g/t of gold from 31m including 37.0m at 4.9 g/t of gold

- 37.0m at 7.7 g/t of gold from 42m including 24m at 11.0 g/t of gol

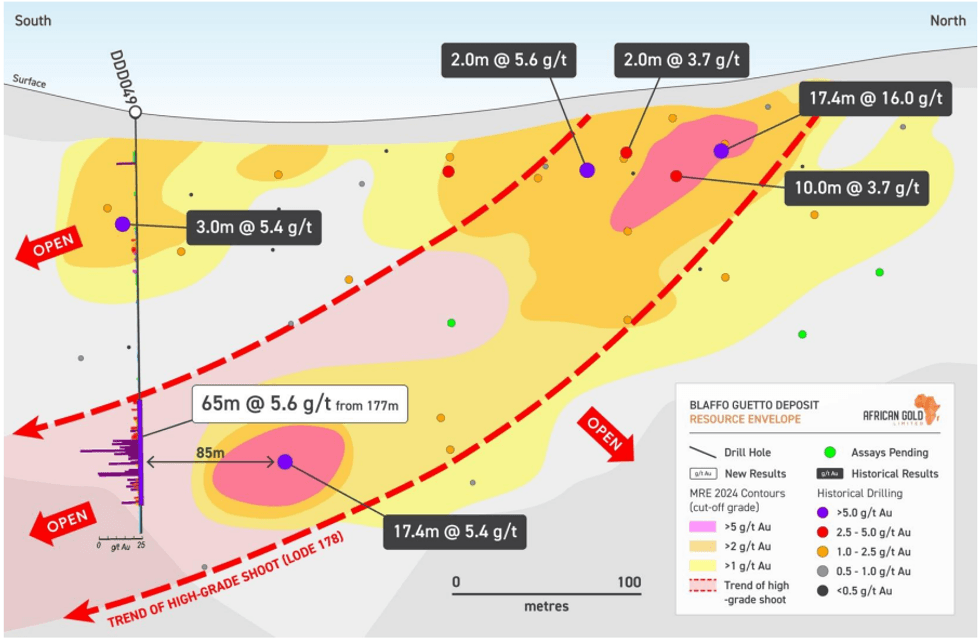

Figure 1: Long section of lode 178 showing the location of drillhole DDD049, the contours of the Mineral Resource (MRE 2024 data, ASX release dated 30 July 2024) and the interpreted south-westerly plunging high-grade shoot

The second hole of the program, DDD049, was drilled to test an extension of the gold mineralisation controlled by the north-northeast striking shear zone where high grade mineralisation gently plunging in the south�westerly direction (Figure 1).

The assay results from DDD049 have returned a spectacular, thick, high-grade gold intersection of 65.0m at 5.6 g/t of gold from 177m, confirming distribution of the gold mineralisation an additional 85m along the south�westerly plunging high-grade gold trend. The mineralisation (lode 178) remains open at depth.

Click here for the full ASX Release

This article includes content from African Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

A1G:AU

The Conversation (0)

10 February

Flow Metals to Acquire the Monster IOCG Project in Yukon

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to report that it has entered into an option agreement dated February 9, 2026 (the "Option Agreement") with Go Metals Corp. ("Go Metals") to acquire the Monster IOCG project (the "Monster Project"), located approximately 90... Keep Reading...

09 February

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

09 February

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

09 February

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

09 February

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

09 February

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00