October 14, 2024

African Gold Ltd (African Gold or the Company) (ASX: A1G) is very pleased to announce the results from the recently completed DDD049 diamond drillhole, second out of six drilled on the Blaffo Guetto prospect, on the Company’s Didievi Gold Project in Cote d’Ivoire (Figure 1). The drilling program was designed to test possible extension of the gold lodes and to infill previous drilling on gold controlling structures of the prospect with a view to increasing the scale and categorisation of the existing Inferred Resource.

HIGHLIGHTS

- Assay results from the recently completed diamond drilling program on the Didievi Project returns a spectacular, wide, high-grade intercept of:

- 65.0m at 5.6 g/t of gold from 177m (DDD049)

- The drillhole also included shallow intercepts of:

- 9.0m at 1.7 g/t of gold from 23m

- 28m at 1.1 g/t of gold from 77m

- The deeper intercept (65.0m at 5.6 g/t of gold) has confirmed that the gold mineralisation extends outside of the existing resource envelope and remains open at depth

- Drillhole DDD049 was drilled to test a predicted extension of the gold mineralisation using the new geological model, hosted by the shear zone and gently plunging in a south-westerly direction

- The new drilling results will allow a positive update to the existing Didievi Project Maiden Inferred Resource of 4.93Mt for 452koz of gold at 2.9 g/t Au (1.0 g/t Au cut off)

- Previous high-grade drilling results from the Didievi Project include:

- 10.0m at 123.7 g/t of gold from 66m including 2m at 613.1 g/t of gold

- 83.3m at 3.3 g/t of gold from 166.9m including 18.0m at 12 g/t of gold

- 17.4m at 17.0 g/t of gold from 244m including 1.0m at 216.0 g/t of gold

- 80.0m at 3.0 g/t of gold from 0m including 23.0m at 9.5 g/t of gold

- 43.0m at 4.3 g/t of gold from 57 m including 17.0m at 9.5 g/t of gold

- 69.0m at 2.9 g/t of gold from 31m including 37.0m at 4.9 g/t of gold

- 37.0m at 7.7 g/t of gold from 42m including 24m at 11.0 g/t of gol

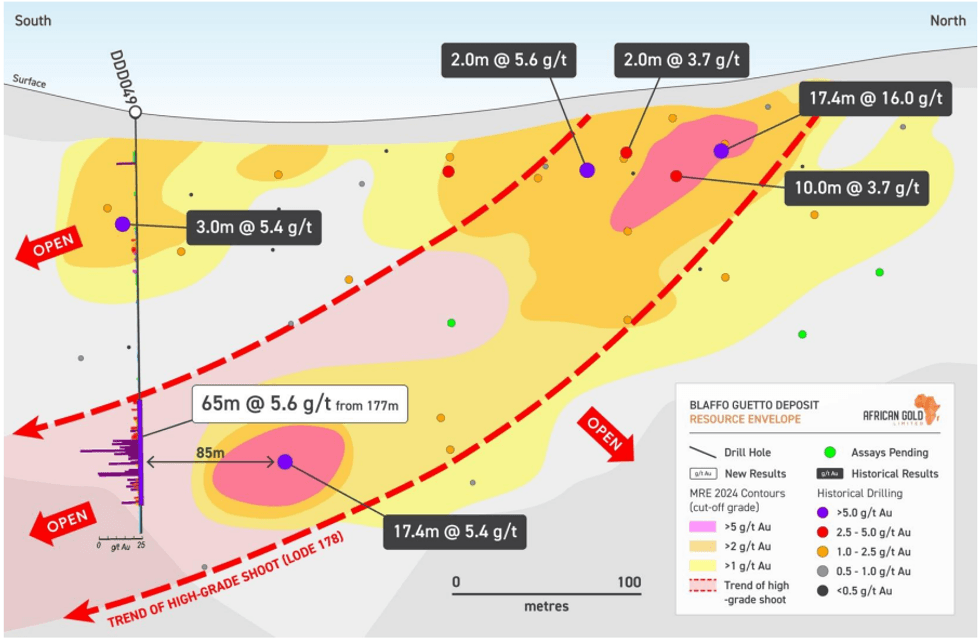

Figure 1: Long section of lode 178 showing the location of drillhole DDD049, the contours of the Mineral Resource (MRE 2024 data, ASX release dated 30 July 2024) and the interpreted south-westerly plunging high-grade shoot

The second hole of the program, DDD049, was drilled to test an extension of the gold mineralisation controlled by the north-northeast striking shear zone where high grade mineralisation gently plunging in the south�westerly direction (Figure 1).

The assay results from DDD049 have returned a spectacular, thick, high-grade gold intersection of 65.0m at 5.6 g/t of gold from 177m, confirming distribution of the gold mineralisation an additional 85m along the south�westerly plunging high-grade gold trend. The mineralisation (lode 178) remains open at depth.

Click here for the full ASX Release

This article includes content from African Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

A1G:AU

The Conversation (0)

17h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

18h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

22h

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00