November 24, 2022

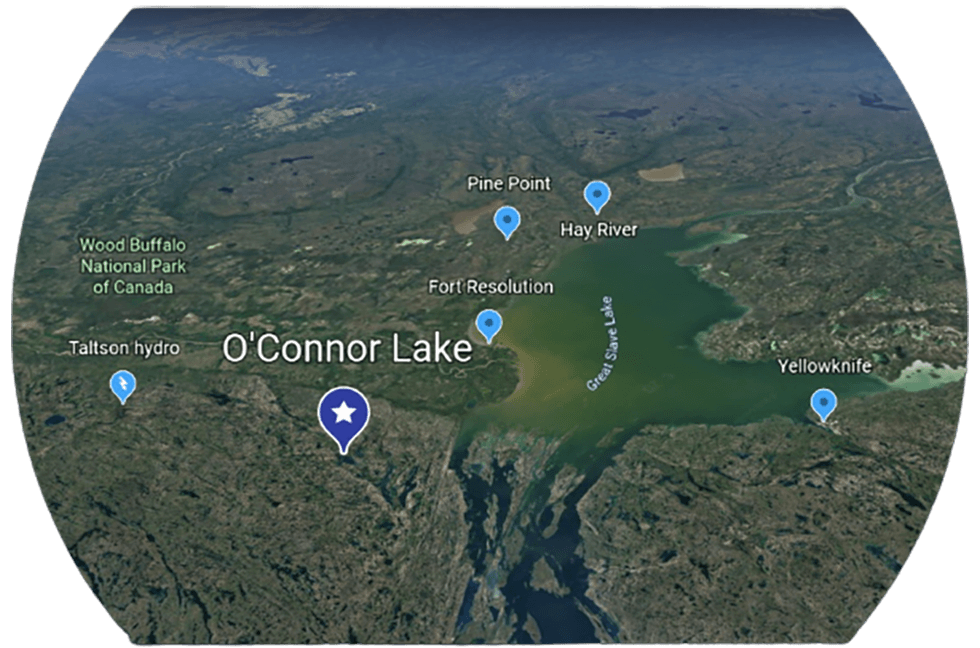

Slave Lake Zinc (CSE:SLZ) recognizes the importance of a sound partnership with Indigenous communities. The company’s flagship O’Connor Lake zinc project, in the under-explored South Slave Region of the Northwest Territories, is located on Indigenous land owned by the Métis Nation. Slave Lake has worked closely with the Métis Nation to establish collaborative agreements designed to benefit both parties to advance the project area by providing economic and employment opportunities to the Métis Nation.

The O’Connor Lake project was initially discovered in 1948 and indicated high-grade deposits of zinc, lead, copper and precious metals. This discovery led to additional exploratory efforts up to 1952, before it was deemed uneconomical to continue based on market conditions at the time.

The O’Connor Lake project covers 76.25 square kilometers and is approximately 185 kilometers from Yellowknife by air. Historical results indicate the presence of high-grade zinc, lead, copper and precious metals, yet the asset has not received any exploration with modern technologies and techniques. The current expanded land package is more than 15 times the original claim, as Slave Lake is aware of nearby showings that have only been mapped from the shore. The company has worked closely with First Nations communities to create mutually beneficial agreements.

This Slave Lake Zinc profile is part of a paid investor education campaign.*

Click here to connect with Slave Lake Zinc (CSE:SLZ) to receive an Investor Presentation

SLC:ZZ

The Conversation (0)

31 December 2025

Zinc Stocks: 5 Biggest Canadian Companies in 2025

Zinc companies saw support in 2025 as prices for the base metal rebounded during the second half of the year. By the end of December, zinc had crossed above the US$3,000 per metric ton (MT) level. However, zinc still faces headwinds — its biggest demand driver is its use in the production of... Keep Reading...

30 December 2025

Electric Royalties Announces Interest Conversion Under Convertible Credit Facility

VANCOUVER, BC / ACCESS Newswire / December 30, 2025 / Electric Royalties Ltd. (TSXV:ELEC,OTC:ELECF)(OTCQB:ELECF) ("Electric Royalties" or the "Company") announces that Gleason & Sons LLC (the "Lender") has elected to convert C$420,000.00 of accrued interest on the principal amount of the... Keep Reading...

16 December 2025

Korea Zinc Unveils US$7.4 Billion Plan for First US Zinc Smelter in Decades

Korea Zinc (KRX:010130) plans to invest US$7.4 billion to build a zinc smelter and critical minerals processing facility in the US, marking the first new US-based zinc smelter since the 1970s.The world’s largest zinc smelter said the facility will be built in Tennessee and will produce... Keep Reading...

08 December 2025

Electric Royalties Provides Update on Critical Metals Royalty Portfolio

VANCOUVER, BC / ACCESS Newswire / December 8, 2025 / Electric Royalties Ltd. (TSXV:ELEC,OTC:ELECF)(OTCQB:ELECF) ("Electric Royalties" or the "Company") is pleased to provide an update on key royalties in its portfolio, adding to the December 2, 2025 announcement of royalty revenues and other... Keep Reading...

02 December 2025

Electric Royalties: Several Copper Royalties Make Strides and Copper Royalty Revenues Rise

VANCOUVER, BC / ACCESS Newswire / December 2, 2025 / Electric Royalties Ltd. (TSXV:ELEC,OTC:ELECF)(OTCQB:ELECF) ("Electric Royalties" or the "Company") is pleased to provide an update on growing revenues and progress within its copper royalty portfolio.Electric Royalties CEO Brendan Yurik... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00