November 06, 2024

Silver47 Exploration (TSXV:AGA) is a compelling investment story, well-positioned to capitalize on the increasing global demand for silver, gold, copper, zinc, antimony, tin and graphite driven by its vast industrial applications and investment potential. The company wholly owns a diverse portfolio of silver-polymetallic projects across North America, including Red Mountain VMS (Alaska), Adams Plateau (British Columbia) and Michelle (Yukon).

Focused on rapid resource growth and new discoveries, Silver47 is backed by an experienced technical and management team that brings decades of successful experience in mineral exploration. Silver47 has outlined aggressive drill programs to rapidly advance its projects toward development.

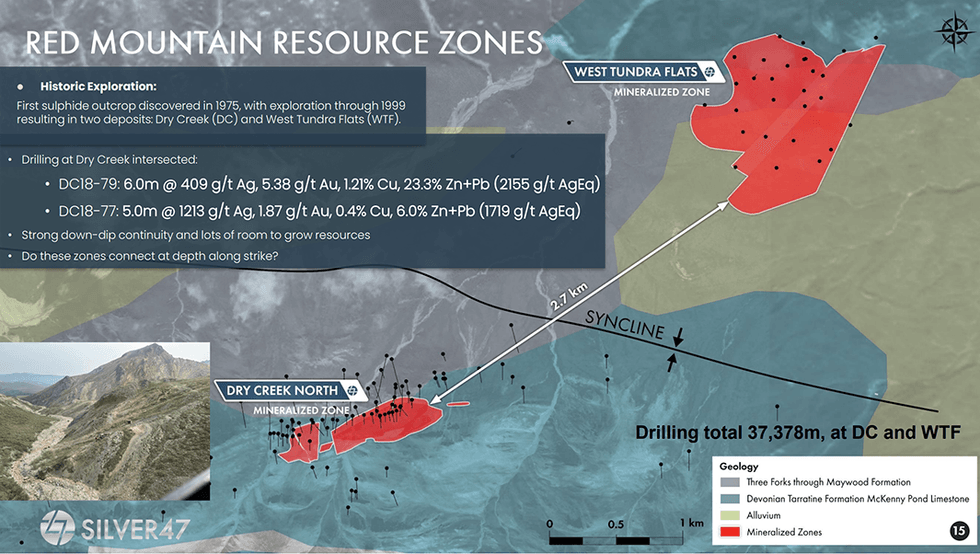

The Red Mountain VMS project is Silver47's flagship asset located about 100 kilometers south of Fairbanks, Alaska. Red Mountain is a polymetallic VMS deposit, rich in silver, gold, zinc, copper, and lead. Red Mountain holds an NI 43-101 inferred resource of 15.6 million tonnes (Mt) at 7 percent zinc equivalent, or 168.6 Moz of silver equivalent at a grade of 335.7 grams per ton (g/t) silver equivalent. The project is located in a mining-friendly jurisdiction on state managed lands with reasonable access to infrastructure.

Company Highlights

- Silver47 Exploration wholly owns a diverse portfolio of silver-polymetallic projects across North America, including Red Mountain VMS (Alaska), Adams Plateau (British Columbia) and Michelle (Yukon).

- In 2022, Silver47 made a significant new silver discovery at the Michelle project with 7.68m of 1,577 g/t Ag, 45 percent Pb, 4 percent Zn within 15m of 907 g/t Ag, 26 percent Pb, 2.7 percent Zn at the Silver Matt Target, Michelle Project.

- The Red Mountain VMS project currently holds an inferred resource of 168.6 million ounces of silver equivalent, with the “Exploration Target” of 500 to 900 Moz silver equivalent through further exploration.

- The Company’s focus on rapid resource growth and new discoveries for silver, copper, and gold is supported by an extensive number of targets identified across its properties.

- Silver47 is poised to capitalize on increasing global demand for silver, driven by its critical role in industrial applications including solar, Ai and AgZn, AgC batteries and investments.

- A projected silver supply deficit of 240 Moz further strengthens the market outlook.

- Backed by an experienced technical and management team, and led by seasoned geologist and company builder Gary R. Thompson, the team brings decades of successful experience in mineral exploration.

- Aggressive drill programs are planned to rapidly advance its projects toward development.

This Silver47 Exploration profile is part of a paid investor education campaign.*

Click here to connect with Silver47 Exploration (TSXV:AGA) to receive an Investor Presentation

AGA:CC

Sign up to get your FREE

Silver47 Exploration Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

15 May

Silver47 Exploration

Advancing a premier high-grade US silver portfolio

Advancing a premier high-grade US silver portfolio Keep Reading...

15 October

Silver47 Intersects High-Grade Mineralization in Step-Out Holes at Red Mountain, Alaska, and Hughes, Nevada

Assays for Additional Holes Remain Pending Silver47 Exploration Corp. (TSXV: AGA,OTC:AAGAF) (OTCQB: AAGAF) ("Silver47" or the "Company") is pleased to announce high-grade assay results from the first batch of holes from the 2025 drill program at the Company's wholly-owned and flagship Red... Keep Reading...

01 October

Silver47 Completes Successful Red Mountain Drill Program and Intersects Massive Sulfides in Multiple Holes

The Red Mountain Deposit Remains Open to Expansion in Multiple Directions with Assays PendingSilver47 Exploration Corp. (TSXV: AGA,OTC:AAGAF) (OTCQB: AAGAF) ("Silver47" or the "Company") is pleased to announce the completion of its summer 2025 drill program at its wholly-owned Red Mountain... Keep Reading...

22 September

Silver47 Announces Grant of Stock Options and Restricted Share Units

Silver47 Exploration Corp. (TSXV: AGA,OTC:AAGAF) (OTCQB: AAGAF) ("Silver47" or the "Company") announces that it has granted an aggregate of 5,300,000 incentive stock options (the "Options") and 180,000 Restricted Share Units ("RSUs") to certain directors, officers and consultants of the Company... Keep Reading...

17 September

Silver47 Exploration - OTC Markets Request

Silver47 Exploration Corp. (TSXV: AGA,OTC:AAGAF) (OTCQB: AAGAF) ("Silver47" or the "Company") confirms that, as previously announced on September 4, 2025, it has engaged Sideways Frequency LLC ("SFLLC") as an arms-length, third party firm contractually retained by the Company in accordance with... Keep Reading...

16 September

Silver47 Announces Closing of $23 Million Brokered LIFE Financing, Including Full Exercise of the Over-Allotment Option

Silver47 Exploration Corp. (TSXV: AGA,OTC:AAGAF) (OTCQB: AAGAF) ("Silver47" or the "Company") is pleased to announce the closing of its previously announced brokered private placement (the "Offering") of units (each, a "Unit") at a price of $0.70 per Unit for aggregate gross proceeds of... Keep Reading...

24 October

Ed Steer: Silver Rally Now Unstoppable, Price to Hit Triple Digits

Ed Steer of Ed Steer's Gold and Silver Digest shares his thoughts on silver's run past US$50 per ounce, saying that in his view the bull market is just getting started. "One way or another we're going to run into a supply/demand brick wall, and when that day happens we could see triple-digit... Keep Reading...

22 October

Gianni Kovacevic: Silver, Oil to Break US$100, but This is the Real Speculation

Investor and author Gianni Kovacevic discusses silver's price pullback, saying that in the long term he sees the white metal reaching triple digits. He expects oil prices to reach that level too, but emphasized that he sees lithium as the truly contrarian play for the rest of 2025 and into next... Keep Reading...

21 October

BP Silver Finalizes Targets for Upcoming Drill Program at its Cosuño Silver Project, Bolivia

BP Silver Corp. (TSXV: BPAG) ("BP Silver" or the "Company") announces that it has finalized targets for initial drill testing and has selected Maldonado Exploraciones, a premier Bolivian drilling contractor, to carry out the upcoming drill program at its Cosuño Silver Project ("Cosuño") in... Keep Reading...

21 October

Silver Hammer Enters into Option Agreement to Acquire 100% Interest in a Strategic and Prospective Silver Project in the Silver Valley of Idaho

Silver Hammer Mining Corp. (CSE: HAMR) (the "Company" or "Silver Hammer") is pleased to announce it has entered into an option agreement (the "Option Agreement") on October 20, 2025 with Fahey Group Mines, Inc. ("Fahey"), pursuant to which the Company has been granted the right (the "Option") to... Keep Reading...

20 October

Top 5 Canadian Silver Stocks of 2025

Silver's strong performance in 2025 is drawing attention to silver-mining companies.During Q3, the silver price closed in on all-time highs, reaching a quarterly high of US$46.92 per ounce on September 29. It has continued to soar since then, breaking US$50 and setting a new all-time high of... Keep Reading...

Latest News

Sign up to get your FREE

Silver47 Exploration Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00